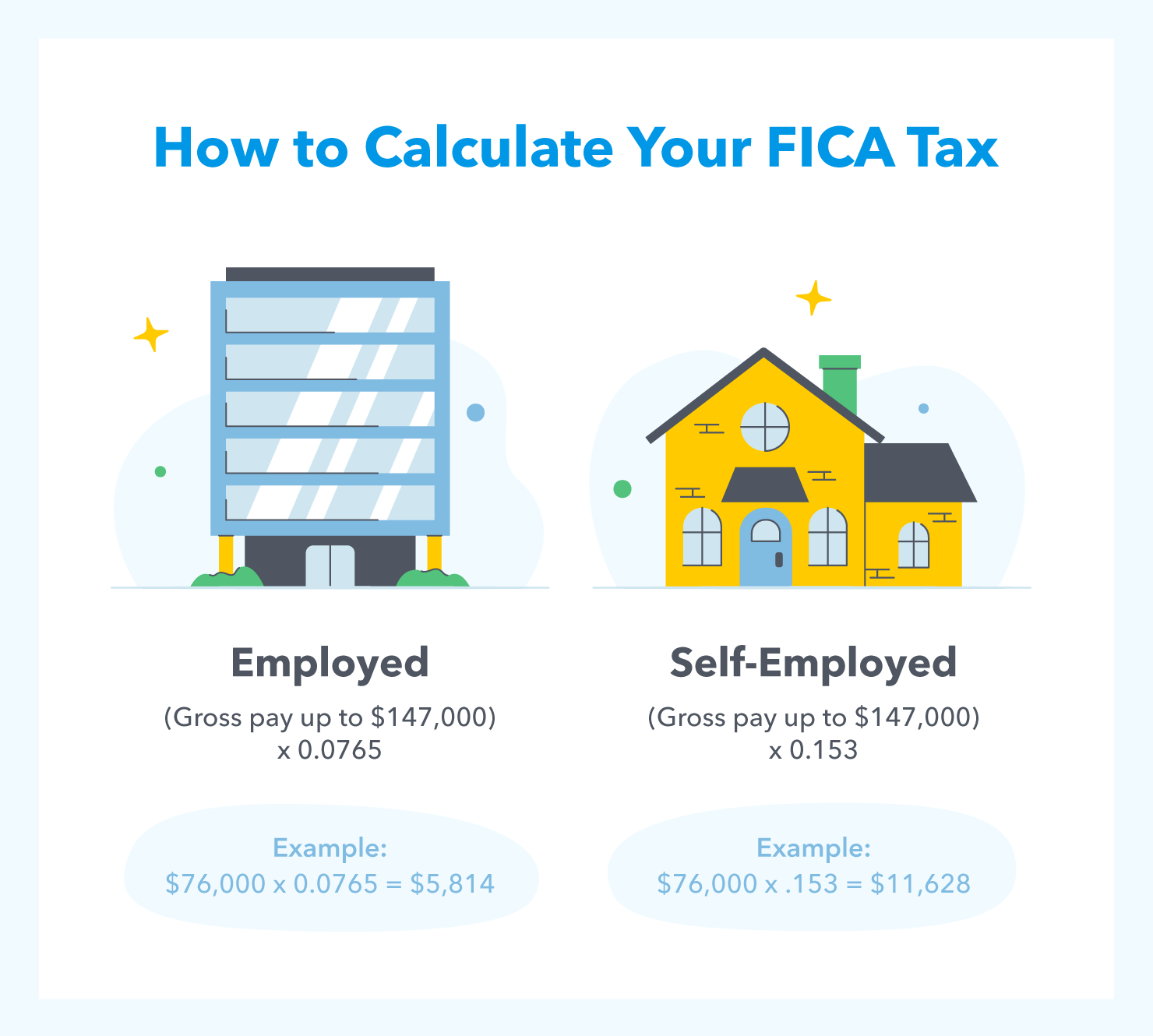

2021 FICA Tax Rates

Por um escritor misterioso

Last updated 15 abril 2025

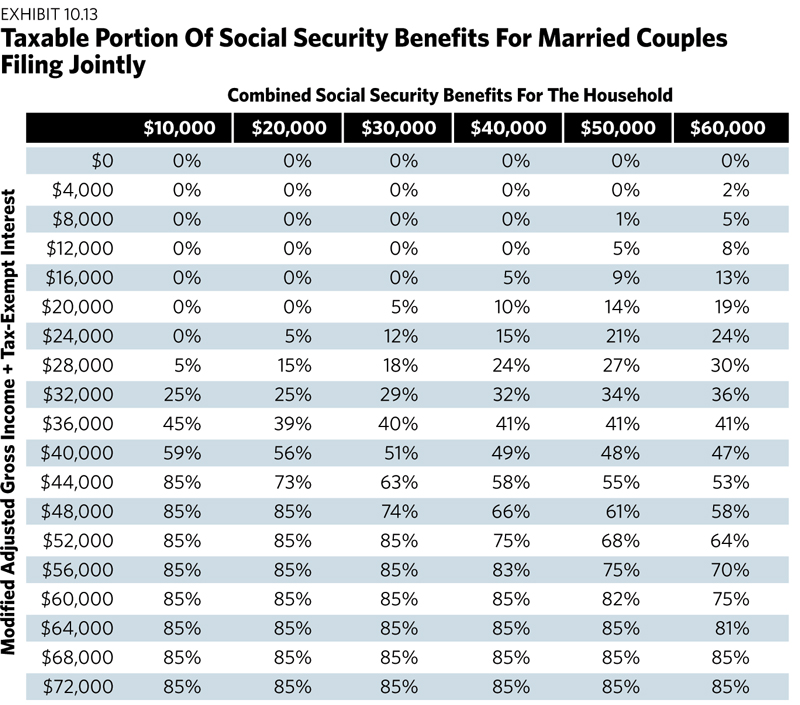

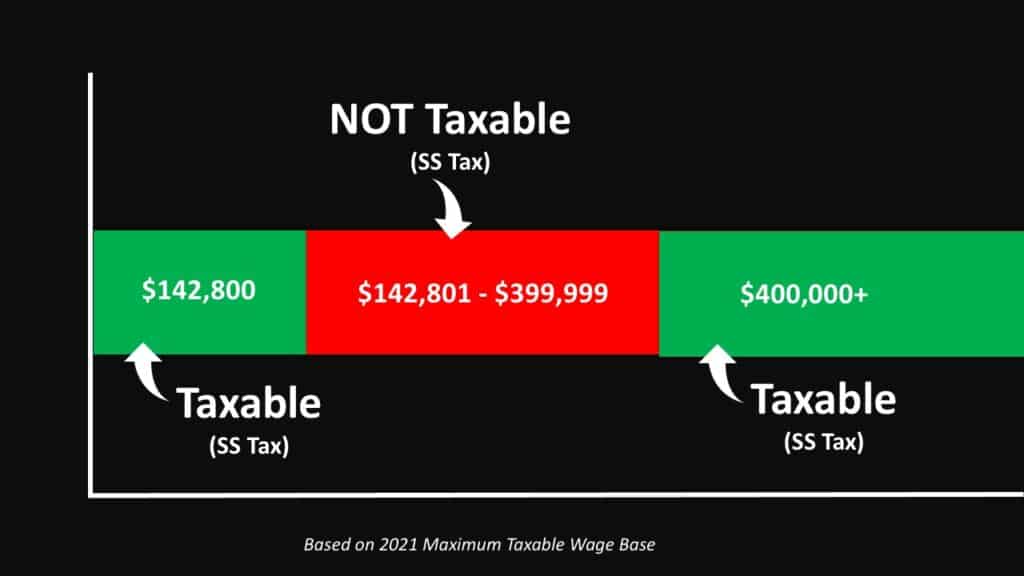

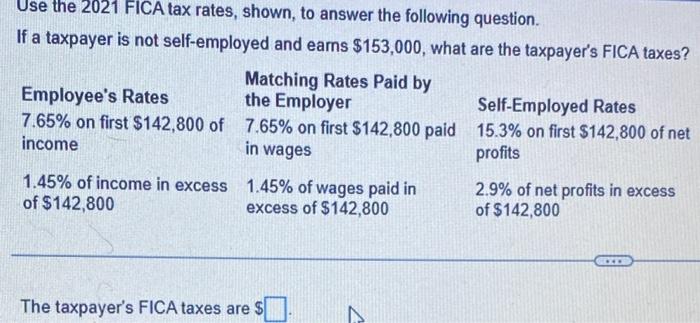

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Avoiding The Social Security Tax Torpedo

Withholding FICA Tax on Nonresident employees and Foreign Workers

Social Security Administration Announces 2022 Payroll Tax Increase

Research: Income Taxes on Social Security Benefits

The Myth of Fixing Social Security Through Raising Taxes – Social Security Intelligence

How to calculate payroll taxes 2021

Solved Use the 2021 FICA tax rates, shown, to answer the

Federal Insurance Contributions Act - Wikipedia

Social Security Announces 2020 Taxable Wage Base - HRWatchdog

Payroll tax - Wikipedia

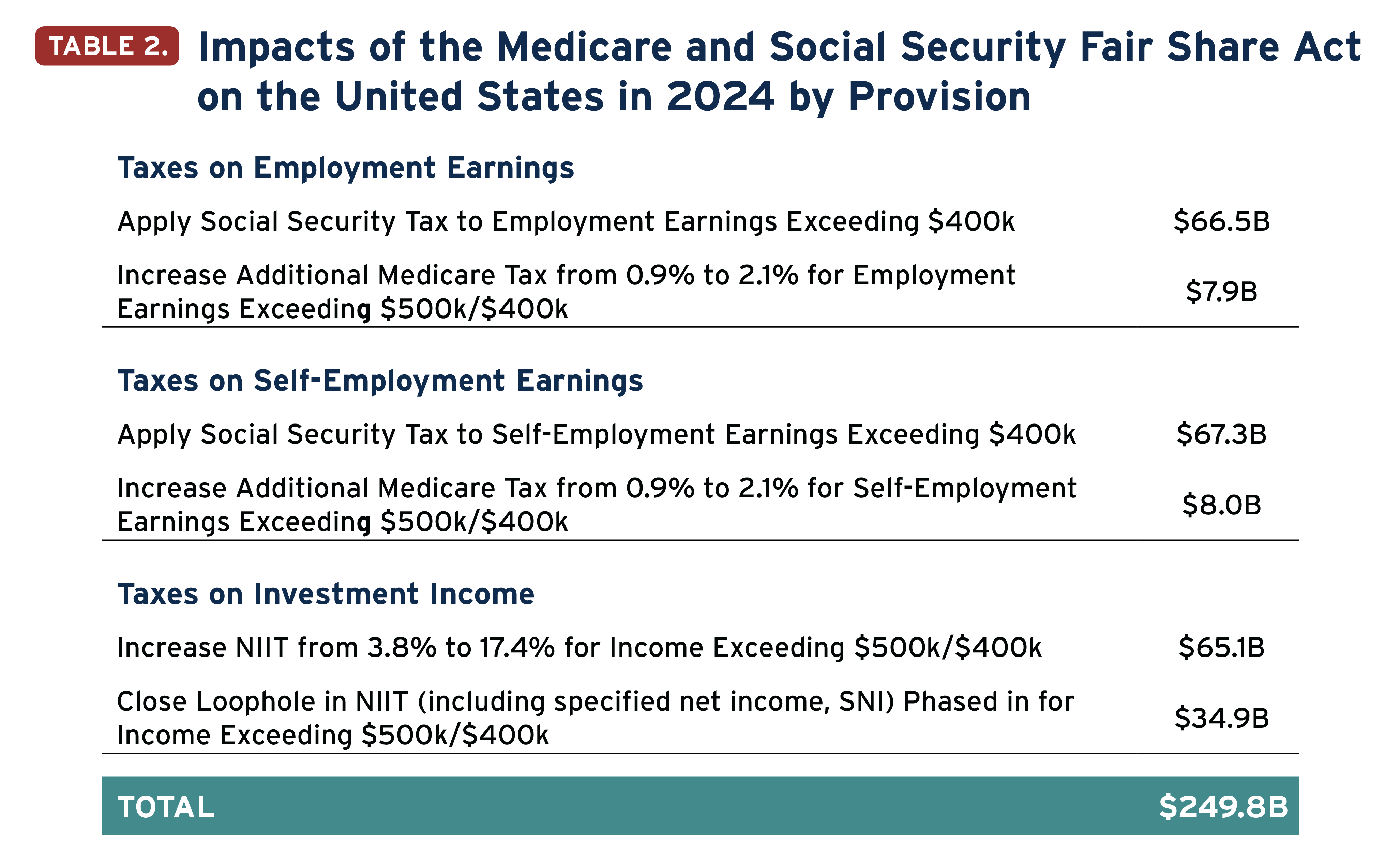

Fair Share Act' Would Strengthen Medicare and Social Security Taxes – ITEP

What are the major federal payroll taxes, and how much money do they raise?

Reliance on Social Insurance Tax Revenue in Europe

Financial Considerations for Moonlighting Physicians

How to calculate fica taxes - The Tech Edvocate

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog15 abril 2025

-

What is FICA15 abril 2025

What is FICA15 abril 2025 -

What is Fica Tax?, What is Fica on My Paycheck15 abril 2025

What is Fica Tax?, What is Fica on My Paycheck15 abril 2025 -

What is FICA Tax? - Optima Tax Relief15 abril 2025

What is FICA Tax? - Optima Tax Relief15 abril 2025 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?15 abril 2025

FICA Tax Rate: What is the percentage of this tax and how you can calculated?15 abril 2025 -

FICA Tax Exemption for Nonresident Aliens Explained15 abril 2025

FICA Tax Exemption for Nonresident Aliens Explained15 abril 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand15 abril 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand15 abril 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.15 abril 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.15 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example15 abril 2025

What Is Social Security Tax? Definition, Exemptions, and Example15 abril 2025 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —15 abril 2025

Students on an F1 Visa Don't Have to Pay FICA Taxes —15 abril 2025

você pode gostar

-

The Elder Scrolls Online Gameplay Footage Leaks15 abril 2025

The Elder Scrolls Online Gameplay Footage Leaks15 abril 2025 -

LEGO AVENGERS AGE OF ULTRON TRAILER15 abril 2025

LEGO AVENGERS AGE OF ULTRON TRAILER15 abril 2025 -

Speed draw doodles (If you see this in the roblox piggy tag then15 abril 2025

Speed draw doodles (If you see this in the roblox piggy tag then15 abril 2025 -

8 lugares imperdíveis que você precisa conhecer no Ceará15 abril 2025

8 lugares imperdíveis que você precisa conhecer no Ceará15 abril 2025 -

BRAND NEW* DOMINUS?? ROBLOX FREE DOMINUS ITEM COMING15 abril 2025

BRAND NEW* DOMINUS?? ROBLOX FREE DOMINUS ITEM COMING15 abril 2025 -

Marvel Wastelanders: Old Man Star-Lord (Podcast Series 2021) - IMDb15 abril 2025

Marvel Wastelanders: Old Man Star-Lord (Podcast Series 2021) - IMDb15 abril 2025 -

Bright Eyes - Baltimore Soundstage15 abril 2025

Bright Eyes - Baltimore Soundstage15 abril 2025 -

Resource Search - IPMI15 abril 2025

Resource Search - IPMI15 abril 2025 -

Fogo na água imagem de stock. Imagem de chama, nave, incandescer15 abril 2025

Fogo na água imagem de stock. Imagem de chama, nave, incandescer15 abril 2025 -

Minecraft 1.19 Trailer Ender Update15 abril 2025

Minecraft 1.19 Trailer Ender Update15 abril 2025