Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 13 abril 2025

Publication 970 - Introductory Material Future Developments What's New Reminders

Tax Information Seattle Pacific University

Publication 970 (2022), Tax Benefits for Education

American Opportunity Tax Credit

Educator expense tax deduction increases for 2022 returns

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Maximum 2023 Educator Expenditure Deduction is $300

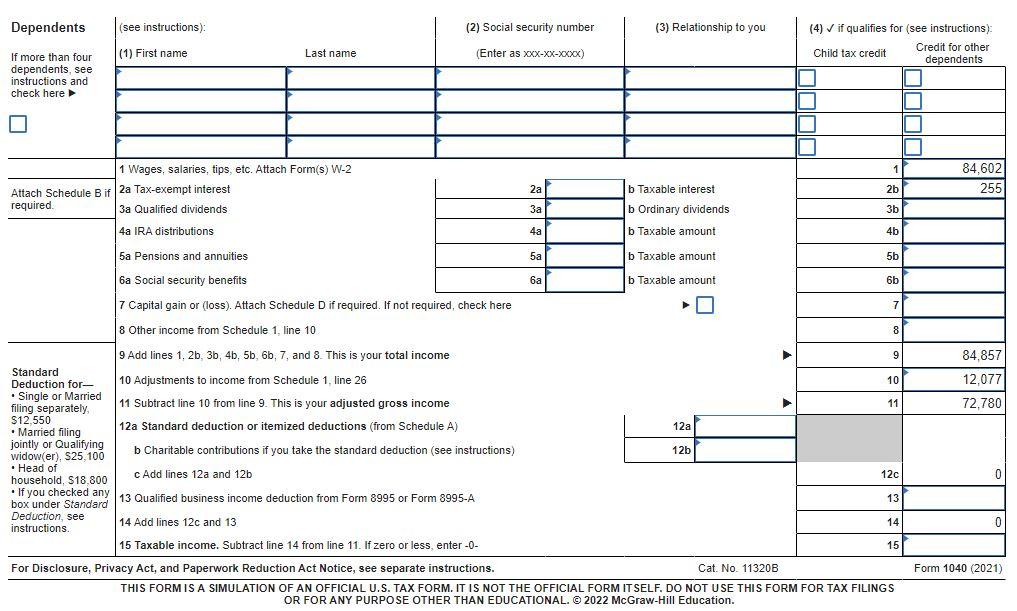

Solved Assume the taxpayer does NOT wish to contribute to

An Unconventional Tax Saving Strategy for Parents of College Students - The CPA Journal

Tax Credits for Education Waubonsee Community College

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

Other Tax Forms and Taxable Income

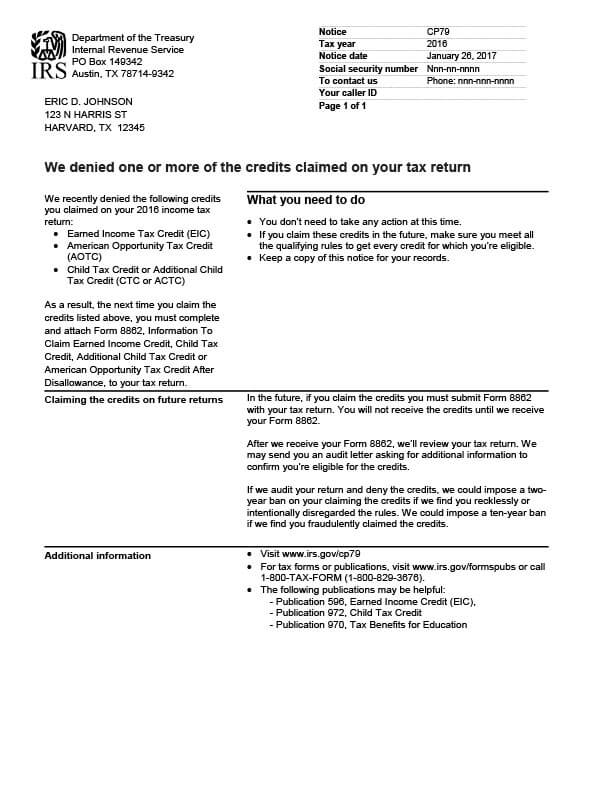

IRS Notice CP79 - Tax Defense Network

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

TAS Tax Tip: Tax resources for individuals filing a federal income tax return for the first time - TAS

Recomendado para você

-

Putnam County R-I Schools - New Year, New Chapter! Welcome back PCR-I students and staff!13 abril 2025

Putnam County R-I Schools - New Year, New Chapter! Welcome back PCR-I students and staff!13 abril 2025 -

Chapter 1: From Jim Crow to Affirmative Action and Back Again: A Critical Race Discussion of Racialized Rationales and Access to Higher Education - Tara J. Yosso, Laurence Parker, Daniel G. Solórzano13 abril 2025

-

Chapter 1 - Introduction: Why This Resource with Community Tools?, Community Tools to Improve Transportation Options for Veterans, Military Service Members, and Their Families13 abril 2025

Chapter 1 - Introduction: Why This Resource with Community Tools?, Community Tools to Improve Transportation Options for Veterans, Military Service Members, and Their Families13 abril 2025 -

NCERT Solutions Class 4 EVS Chapter 1 Going To School - Free Download13 abril 2025

NCERT Solutions Class 4 EVS Chapter 1 Going To School - Free Download13 abril 2025 -

Tim Te Maro and the Subterranean Heartsick Blues13 abril 2025

Tim Te Maro and the Subterranean Heartsick Blues13 abril 2025 -

The Truth about Bats (The Magic School Bus by Moore, Eva13 abril 2025

The Truth about Bats (The Magic School Bus by Moore, Eva13 abril 2025 -

Chapter 1: Old School Me. Back where it all started. #GXVE coming soon. Link in bio ❤️gx13 abril 2025

-

All photos about Back to School: All Grown Up page 273 - Mangago13 abril 2025

All photos about Back to School: All Grown Up page 273 - Mangago13 abril 2025 -

Navigating the Classroom with Confidence: Back to School with T1D - Northern Florida Chapter13 abril 2025

Navigating the Classroom with Confidence: Back to School with T1D - Northern Florida Chapter13 abril 2025 -

Watch The OA Netflix Official Site13 abril 2025

Watch The OA Netflix Official Site13 abril 2025

você pode gostar

-

TESTE DOS GAMES PRENSADOS DE SATURN DA OLDSCHOOL RETROART E DA OLDGAME13 abril 2025

TESTE DOS GAMES PRENSADOS DE SATURN DA OLDSCHOOL RETROART E DA OLDGAME13 abril 2025 -

Lane Brody - Over You13 abril 2025

Lane Brody - Over You13 abril 2025 -

Lies of P - Unlock the BEST Boss Weapons Early - 10 BIG Upgrades, Secrets & OP Items You Can't Miss!13 abril 2025

Lies of P - Unlock the BEST Boss Weapons Early - 10 BIG Upgrades, Secrets & OP Items You Can't Miss!13 abril 2025 -

Omega Games Room - Picture of Sunset Beach Club, Benalmadena13 abril 2025

Omega Games Room - Picture of Sunset Beach Club, Benalmadena13 abril 2025 -

Jenny Wakeman's new body by Ata12345 on DeviantArt13 abril 2025

Jenny Wakeman's new body by Ata12345 on DeviantArt13 abril 2025 -

.jpg) 24 - The Game (En,Fr,Es) ROM (ISO) Download for Sony Playstation 213 abril 2025

24 - The Game (En,Fr,Es) ROM (ISO) Download for Sony Playstation 213 abril 2025 -

63 Nature Quotes That Will Remind You of Earth's Beauty13 abril 2025

63 Nature Quotes That Will Remind You of Earth's Beauty13 abril 2025 -

Roblox Baller Gif - IceGif13 abril 2025

Roblox Baller Gif - IceGif13 abril 2025 -

Funny Dance Dancing GIF - Funny Dance Dancing - Discover & Share GIFs13 abril 2025

Funny Dance Dancing GIF - Funny Dance Dancing - Discover & Share GIFs13 abril 2025 -

Faceless hacker at work with ROOTKIT VIRUS inscription, Computer13 abril 2025

Faceless hacker at work with ROOTKIT VIRUS inscription, Computer13 abril 2025