Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 14 abril 2025

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

Are Gifts to Employees Taxable or Deductible?

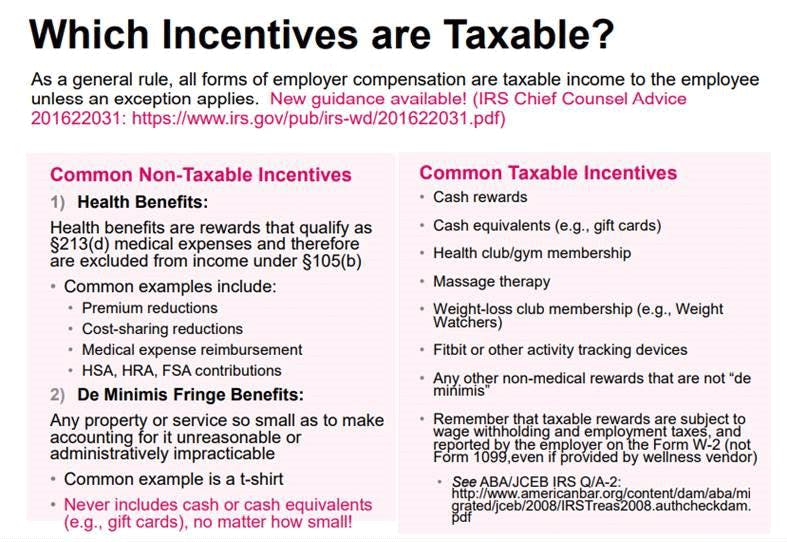

Taxation of Wellness Program Gift Cards

Employee Gift Cards, Best in 2023

Employee Benefits Advisory: Gift cards and other employee incentives are counted as taxable income - MUS Law

What employers need to know about employee gifts

Taxable & Non-Taxable Benefits: Definition & Examples - Video & Lesson Transcript

Our Top 24 Gift Cards for Employee Appreciation Presents

Tax Implications of Giving Gifts to Employees l Small Business Guide for Employee Gift l SwagMagic

Turkey Corporate Gift Certificates

Are Gift Cards Taxable to Employees?

Is There Tax On Gift Cards - Are Gift Cards Taxable?

What Counts as Taxable and Non-Taxable Income for 2023

FAQ: Are Gift Cards for Employees a Tax Deduction?

Recomendado para você

-

Best Beauty Gifts14 abril 2025

-

The Ultimate IGN Holiday Gift Guide for 2023 - IGN14 abril 2025

The Ultimate IGN Holiday Gift Guide for 2023 - IGN14 abril 2025 -

Gift Guides 2023: The Best Gift Ideas For Every Occassion14 abril 2025

Gift Guides 2023: The Best Gift Ideas For Every Occassion14 abril 2025 -

Gift Card14 abril 2025

Gift Card14 abril 2025 -

Why Warren Buffet Believes Feedback Is A Gift and You Should Too14 abril 2025

Why Warren Buffet Believes Feedback Is A Gift and You Should Too14 abril 2025 -

33 Best Gift Cards to Give for the Holidays 202314 abril 2025

33 Best Gift Cards to Give for the Holidays 202314 abril 2025 -

43 best gifts for husbands in 2023 that are thoughtful14 abril 2025

43 best gifts for husbands in 2023 that are thoughtful14 abril 2025 -

Receiving gifts warms my heart – The Mirror14 abril 2025

Receiving gifts warms my heart – The Mirror14 abril 2025 -

Quarantine Gift Guide14 abril 2025

Quarantine Gift Guide14 abril 2025 -

Gift - Wikipedia14 abril 2025

Gift - Wikipedia14 abril 2025

você pode gostar

-

Player Reached the Top. LitRPG Series. Book VIII eBook14 abril 2025

Player Reached the Top. LitRPG Series. Book VIII eBook14 abril 2025 -

NWT Nick Foles #9 Philadelphia Eagles 2018 Super Bowl LII 52 Game14 abril 2025

NWT Nick Foles #9 Philadelphia Eagles 2018 Super Bowl LII 52 Game14 abril 2025 -

ilustração de cachorro fofo cachorro kawaii chibi estilo de14 abril 2025

ilustração de cachorro fofo cachorro kawaii chibi estilo de14 abril 2025 -

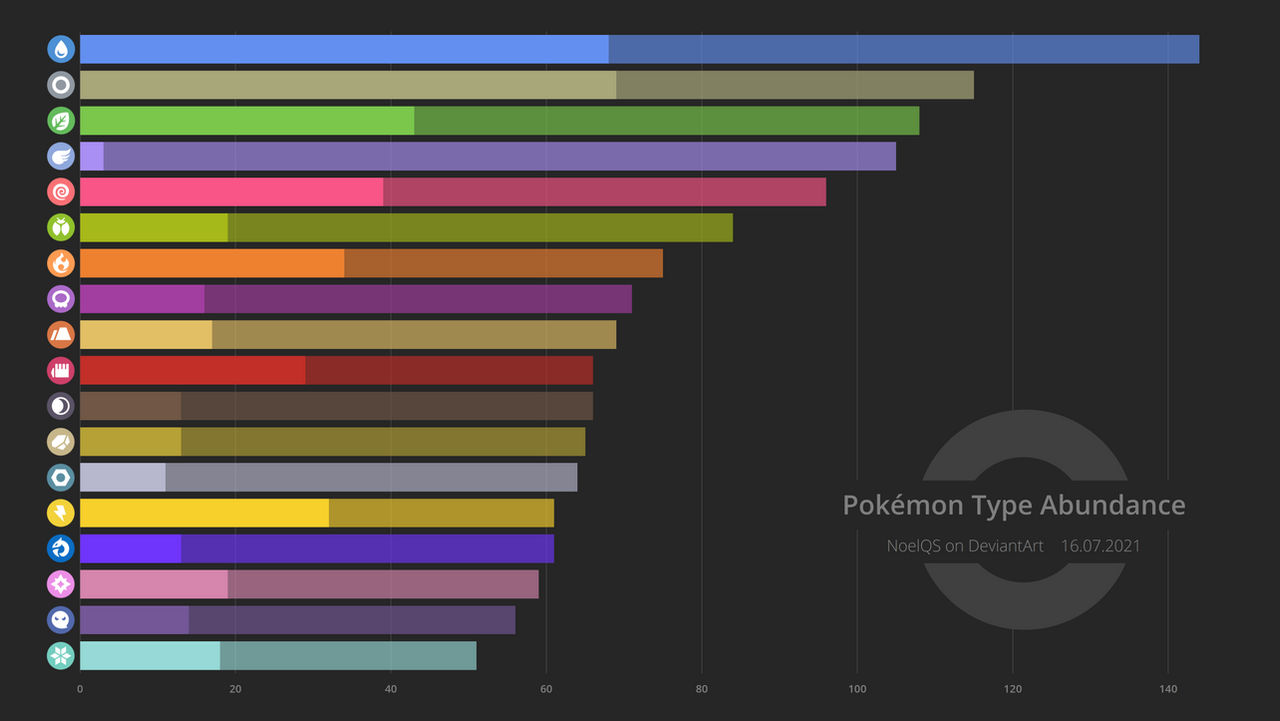

NoelQS - Pokemon Type Abundance by NoelQS on DeviantArt14 abril 2025

NoelQS - Pokemon Type Abundance by NoelQS on DeviantArt14 abril 2025 -

![Stream [ Oregairu ] Yanagi Nagi - Harumodoki (EO Remix) by EO](https://i1.sndcdn.com/artworks-000123286057-uuhe3k-t500x500.jpg) Stream [ Oregairu ] Yanagi Nagi - Harumodoki (EO Remix) by EO14 abril 2025

Stream [ Oregairu ] Yanagi Nagi - Harumodoki (EO Remix) by EO14 abril 2025 -

Gears Tactics already tops Steam charts, gains positive reviews14 abril 2025

Gears Tactics already tops Steam charts, gains positive reviews14 abril 2025 -

Topper de bolo Minnie Mouse rosa c/ 6 unidades Regina Festas14 abril 2025

Topper de bolo Minnie Mouse rosa c/ 6 unidades Regina Festas14 abril 2025 -

Gears - VEX Robotics14 abril 2025

Gears - VEX Robotics14 abril 2025 -

Will You Press The Button?: Image Gallery (List View)14 abril 2025

Will You Press The Button?: Image Gallery (List View)14 abril 2025 -

Carlos Henrique Aquino - Membro da Comissão Especial de Logística14 abril 2025