European Banking Authority (EBA) rejects mobile device biometrics

Por um escritor misterioso

Last updated 07 abril 2025

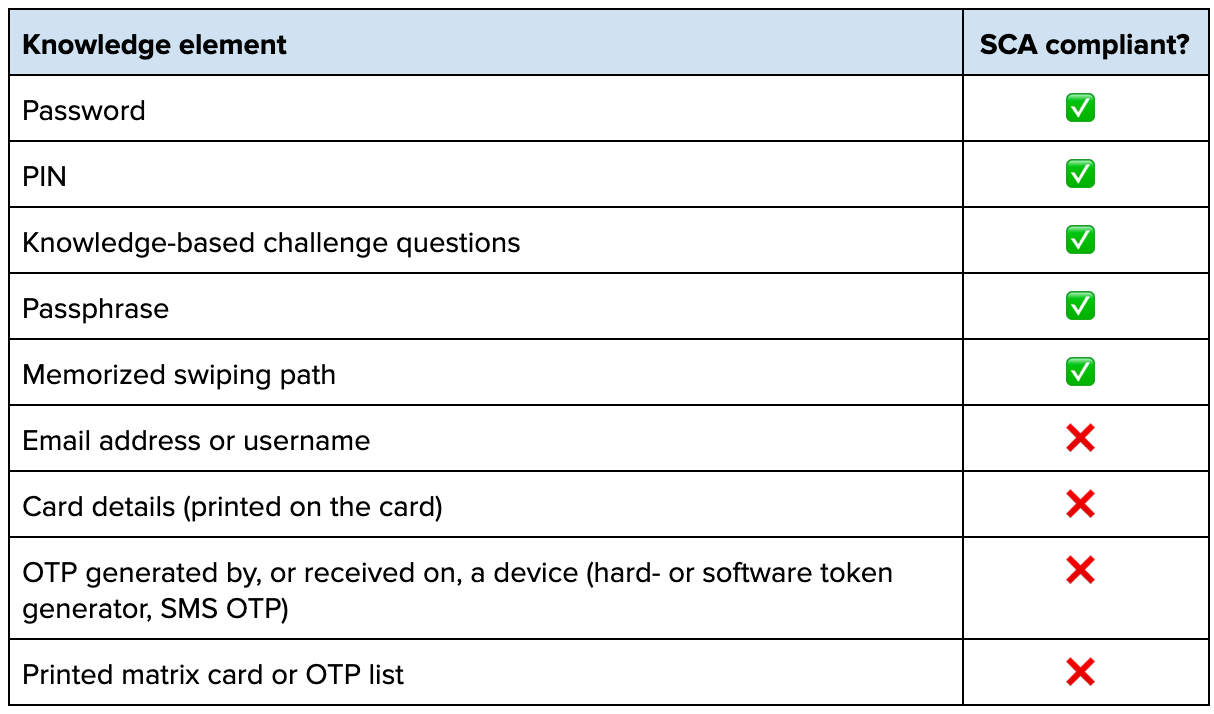

The European Banking Authority (EBA) requires strong customer authentication (SCA) for electronic payments to improve security. However, on-device biometrics are no longer considered a valid method to be used as a second authentication factor, the EBA ruled on January 31, 2023.

PSD2, Strong Customer Authentication and 3D Secure

The European Banking Authority favours arbitrary box-ticking over data innovation - FinTech Futures

What is PSD2? Biometric recognition in online payments - Mobbeel

From PSD2 to PSD3 regulation: What you need to know

PDF) Prospects for the application of biometrics in the Polish banking sector

PSD2 in 2022: A Comprehensive Guide

The EU Regulation Causing Your Finance Apps To Drive You Mad (Part 2)

EBA: new guidelines on Digital Onboarding solutions - Mobbeel

Strengthening Cybersecurity Using Advance Biometrics Solutions

Why Mobile Banking and Payment Apps Need Strong Authentication

Recomendado para você

-

EBA Atlassian07 abril 2025

EBA Atlassian07 abril 2025 -

EBA INTERNATIONAL: Our world is the ian Nut - EBA INTERNATIONAL07 abril 2025

EBA INTERNATIONAL: Our world is the ian Nut - EBA INTERNATIONAL07 abril 2025 -

Taşındık07 abril 2025

Taşındık07 abril 2025 -

File:EBA logo.png - Wikipedia07 abril 2025

File:EBA logo.png - Wikipedia07 abril 2025 -

EBA Engineering, Inc.07 abril 2025

-

Meu Eba on the App Store07 abril 2025

Meu Eba on the App Store07 abril 2025 -

Eba News07 abril 2025

-

About EBA - European Blood Alliance07 abril 2025

About EBA - European Blood Alliance07 abril 2025 -

2011-2021: 10 years of the EBA07 abril 2025

2011-2021: 10 years of the EBA07 abril 2025 -

SuperEBA® EBA Cement07 abril 2025

SuperEBA® EBA Cement07 abril 2025

você pode gostar

-

Summer Time Render - Baka-Updates Manga07 abril 2025

Summer Time Render - Baka-Updates Manga07 abril 2025 -

Noire The Next Black Kassadin Skin spotlight – Balor Skins07 abril 2025

Noire The Next Black Kassadin Skin spotlight – Balor Skins07 abril 2025 -

Melhor Jogo De Carros Brasileiros Que Roda Em Qualquer Pc!😱07 abril 2025

Melhor Jogo De Carros Brasileiros Que Roda Em Qualquer Pc!😱07 abril 2025 -

Dia das Bruxas. A Idade Média. Bruxa assustadora. fotos, imagens de © fotoatelie #8640515007 abril 2025

Dia das Bruxas. A Idade Média. Bruxa assustadora. fotos, imagens de © fotoatelie #8640515007 abril 2025 -

Shadow vs Control, Blox Fruits07 abril 2025

Shadow vs Control, Blox Fruits07 abril 2025 -

Usagimodoki Theme Chrome Theme - ThemeBeta07 abril 2025

Usagimodoki Theme Chrome Theme - ThemeBeta07 abril 2025 -

Download Minecraft Mod APK Latest Version free on Android 2024 - ApkExit07 abril 2025

Download Minecraft Mod APK Latest Version free on Android 2024 - ApkExit07 abril 2025 -

Meme: Se vc usa na ft de perfil um coreano do kapop Sua opinião n conta - All Templates07 abril 2025

Meme: Se vc usa na ft de perfil um coreano do kapop Sua opinião n conta - All Templates07 abril 2025 -

Mattel Phase 10 Card Game Intl: Buy Mattel Phase 10 Card Game Intl Online at Best Price in India07 abril 2025

Mattel Phase 10 Card Game Intl: Buy Mattel Phase 10 Card Game Intl Online at Best Price in India07 abril 2025 -

Como os portugueses descobriram o pau-brasil? - Charada e Resposta - Geniol07 abril 2025

Como os portugueses descobriram o pau-brasil? - Charada e Resposta - Geniol07 abril 2025