Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 06 abril 2025

How 28% GST can be the death knell for India's gaming industry

28% GST on online gaming: India Inc fears new taxation could nip the nascent sector

New tax regime on online money games kicks in

crypto tax: Govt working on classification of cryptocurrency under GST law - The Economic Times

Online gaming in India – the GST connundrum

:max_bytes(150000):strip_icc()/consumption-tax.asp_FINAL-96e3b673009d46b8b71253303e0efa38.png)

Goods and Services Tax (GST): Definition, Types, and How It's Calculated

GST Council to also tax online gaming transactions in virtual digital assets at 28%

Revised GST Slab Rates in India F.Y. 2023-24 by Council

)

GST Council okays 28% tax on online gaming, casinos and horse racing

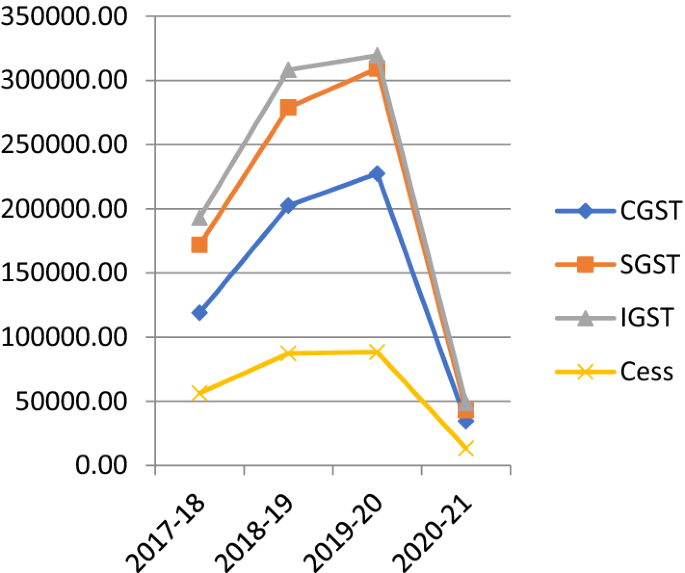

Goods and Services Tax (GST) Implementation in India: A SAP–LAP–Twitter Analytic Perspective

Online gaming companies gets GST notices worth Rs 1 lakh cr - Times of India

Explained Will 28% GST on online gaming affect its growth? - The Hindu

online games gst: Govt may classify online games as games of skill, chance; levy differential GST rate - The Economic Times

Recomendado para você

-

All in one Game, All Games - Apps on Google Play06 abril 2025

-

2019 Top 10 Free Online Games You Should Know About06 abril 2025

2019 Top 10 Free Online Games You Should Know About06 abril 2025 -

:max_bytes(150000):strip_icc()/ezgif.com-webp-to-jpg-5bddfef7c9e77c00514c691a.jpg) The 12 Best Fun Online Games to Play in 202306 abril 2025

The 12 Best Fun Online Games to Play in 202306 abril 2025 -

Energize Yourself with Free Online Games - - Freelancing06 abril 2025

Energize Yourself with Free Online Games - - Freelancing06 abril 2025 -

Fun Brain Games That Train the Mind at06 abril 2025

Fun Brain Games That Train the Mind at06 abril 2025 -

Nostalgic Online Games You Can Play Now From Childhood06 abril 2025

Nostalgic Online Games You Can Play Now From Childhood06 abril 2025 -

Games and puzzles - Mind06 abril 2025

Games and puzzles - Mind06 abril 2025 -

Free Online Games Over the Years06 abril 2025

Free Online Games Over the Years06 abril 2025 -

How Playing Online Games Can Help You Improve Your Problem-Solving Skills06 abril 2025

How Playing Online Games Can Help You Improve Your Problem-Solving Skills06 abril 2025 -

Online games06 abril 2025

você pode gostar

-

Top 30 melhores jogos de guerra do Xbox One e Series S e X06 abril 2025

Top 30 melhores jogos de guerra do Xbox One e Series S e X06 abril 2025 -

Shadowrun #6: A Fistful of Data: A Shadowrun Novel (Shadowrun) by06 abril 2025

Shadowrun #6: A Fistful of Data: A Shadowrun Novel (Shadowrun) by06 abril 2025 -

Pin by Cécile on PARIS,MON AMOUR Eiffel tower silhouette, Eiffel06 abril 2025

Pin by Cécile on PARIS,MON AMOUR Eiffel tower silhouette, Eiffel06 abril 2025 -

Resident Evil 406 abril 2025

Resident Evil 406 abril 2025 -

Huggy Wuggy Chapter 3 APK for Android Download06 abril 2025

Huggy Wuggy Chapter 3 APK for Android Download06 abril 2025 -

Is Body Commentary Ever OK? - Foodtrainers®06 abril 2025

Is Body Commentary Ever OK? - Foodtrainers®06 abril 2025 -

![Funny Cat Pfp - Top 15 Funny Cat Pfp, Avatar, Dp, icon [ HQ ]](http://m.gettywallpapers.com/wp-content/uploads/2023/09/Funny-Cat-Pfp-for-discord.jpg) Funny Cat Pfp - Top 15 Funny Cat Pfp, Avatar, Dp, icon [ HQ ]06 abril 2025

Funny Cat Pfp - Top 15 Funny Cat Pfp, Avatar, Dp, icon [ HQ ]06 abril 2025 -

Gucci x Disney Donald Duck Flash Cartoon Design Gucci Shoes / Sneakers Mens06 abril 2025

Gucci x Disney Donald Duck Flash Cartoon Design Gucci Shoes / Sneakers Mens06 abril 2025 -

Giveaway Logo Vector Art, Icons, and Graphics for Free Download06 abril 2025

Giveaway Logo Vector Art, Icons, and Graphics for Free Download06 abril 2025 -

![Fortnite | 1 x CONTA DE FORTNITE [87 SKINS] +](https://cdn.ggmax.com.br/images/6b2512314cdb3f4eeeb4b8003688c423.sm.jpg) Fortnite | 1 x CONTA DE FORTNITE [87 SKINS] +06 abril 2025

Fortnite | 1 x CONTA DE FORTNITE [87 SKINS] +06 abril 2025