DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 25 abril 2025

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

Introduction to DasherDirect

DoorDash Taxes Schedule C FAQs For Dashers - Courier Hacker

DoorDash or Uber Taxes 1099 NEC What you need to know!

Here's How to Prepare for Filing Your Taxes

DoorDash 1099 Taxes: Your Guide to Forms, Write-Offs, and More

Introduction to DasherDirect

20+ DoorDash Driver Tips Every Dasher Must Know! (2024) - MoneyPantry

How have you guys been able to pay little to no taxes with making

Tax Deductions for Rideshare (Uber and Lyft) Drivers and Food

Travel expense tax deduction guide: How to maximize write-offs

DoorDash Tax Deductions, Maximize Take Home Income

Recomendado para você

-

DoorDash - Dasher - Apps on Google Play25 abril 2025

-

DoorDash Driver Review: How Much Money Can You Make?25 abril 2025

DoorDash Driver Review: How Much Money Can You Make?25 abril 2025 -

How to Become a DoorDash Driver - Studying in Switzerland25 abril 2025

How to Become a DoorDash Driver - Studying in Switzerland25 abril 2025 -

(3 Pack) Heavy Duty Doordash Car Magnets Door Signs for Delivery Drivers, Dashers Accessories (White Background) : Industrial & Scientific25 abril 2025

(3 Pack) Heavy Duty Doordash Car Magnets Door Signs for Delivery Drivers, Dashers Accessories (White Background) : Industrial & Scientific25 abril 2025 -

DoorDash 15-minute delivery starts with employees - Protocol25 abril 2025

DoorDash 15-minute delivery starts with employees - Protocol25 abril 2025 -

DoorDash Delivery Driver: What I Wish I Knew Before Taking the Job25 abril 2025

-

Seattle mandates higher pay for third-party delivery drivers25 abril 2025

Seattle mandates higher pay for third-party delivery drivers25 abril 2025 -

DoorDash Driver Reviews - Food Delivery Guru25 abril 2025

DoorDash Driver Reviews - Food Delivery Guru25 abril 2025 -

Drive API DoorDash Developer Services25 abril 2025

Drive API DoorDash Developer Services25 abril 2025 -

DoorDash, Shifting Business Model, Will Offer Drivers Hourly Pay25 abril 2025

DoorDash, Shifting Business Model, Will Offer Drivers Hourly Pay25 abril 2025

você pode gostar

-

OneTravel Visa® Credit Card: Swipe and Earn Every Time You Travel! Review: Swipe and Earn Every Time You Travel!25 abril 2025

OneTravel Visa® Credit Card: Swipe and Earn Every Time You Travel! Review: Swipe and Earn Every Time You Travel!25 abril 2025 -

Pin on fitz25 abril 2025

Pin on fitz25 abril 2025 -

LOTR: Rings of Power Scores High With Critics, But Audiences Aren25 abril 2025

LOTR: Rings of Power Scores High With Critics, But Audiences Aren25 abril 2025 -

Which Anime Character Do You Resemble, Based On Your Personality25 abril 2025

Which Anime Character Do You Resemble, Based On Your Personality25 abril 2025 -

Copa do mundo 2022. modelo de calendário de jogos. tabela de resultados de futebol grupo h, calendário de jogos arquivo vetorial.25 abril 2025

Copa do mundo 2022. modelo de calendário de jogos. tabela de resultados de futebol grupo h, calendário de jogos arquivo vetorial.25 abril 2025 -

Call of Duty WWII Language Change25 abril 2025

Call of Duty WWII Language Change25 abril 2025 -

Test Drive Unlimited Solar Crown - Brasil25 abril 2025

-

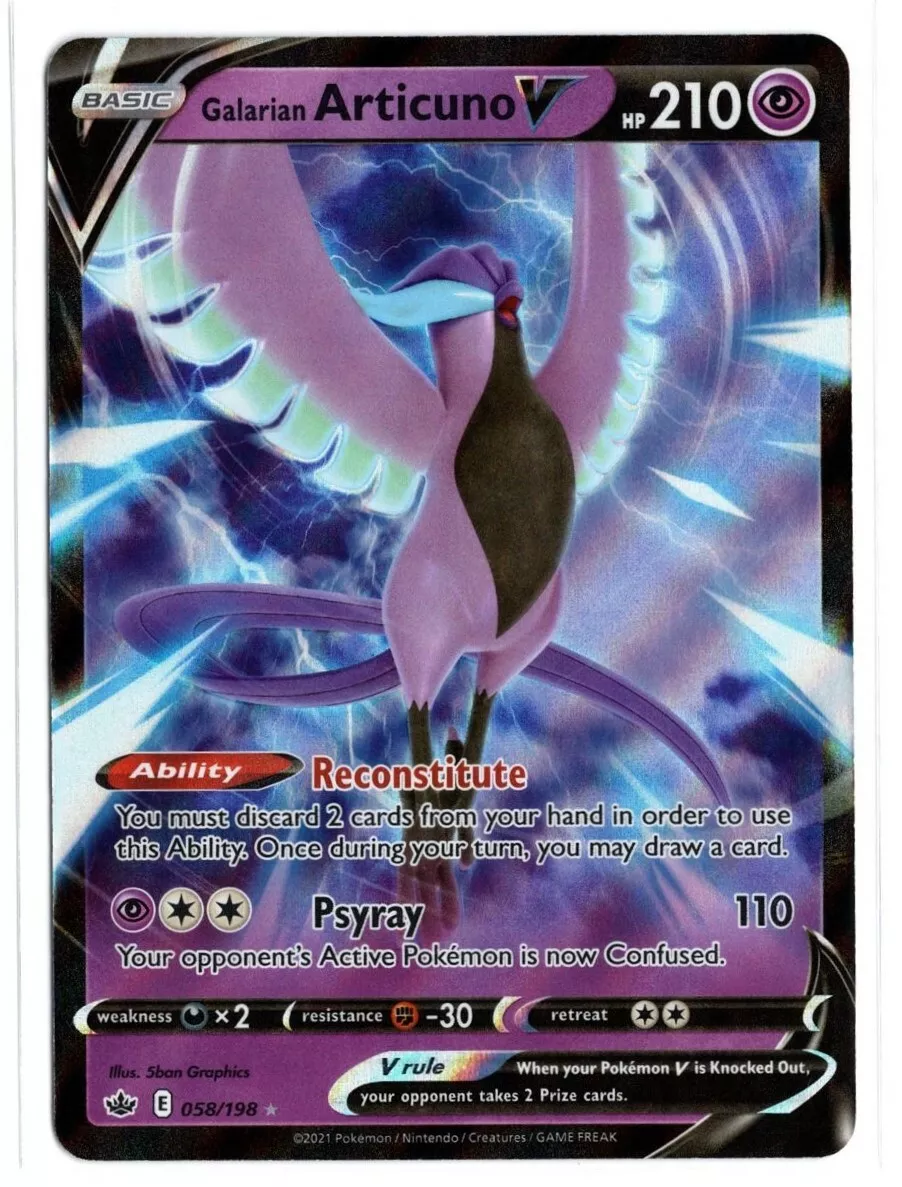

Galarian Articuno V 058/198 NM/M - Pokémon TCG: Chilling Reign - *Brand New*25 abril 2025

Galarian Articuno V 058/198 NM/M - Pokémon TCG: Chilling Reign - *Brand New*25 abril 2025 -

4K wallpapers of Black & Dark in HD, 4K, 5K for PC desktop25 abril 2025

4K wallpapers of Black & Dark in HD, 4K, 5K for PC desktop25 abril 2025 -

Disney Zootopia25 abril 2025

Disney Zootopia25 abril 2025