FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 12 abril 2025

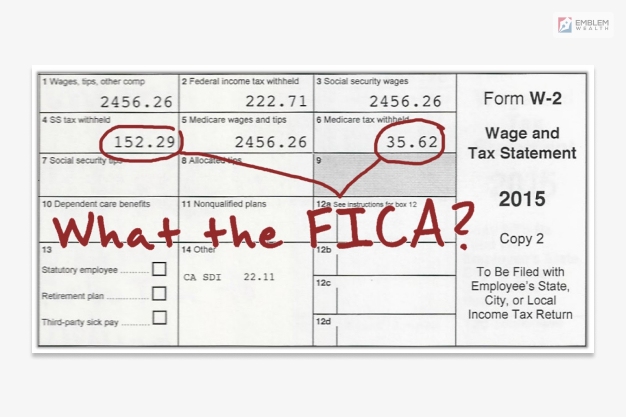

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

What is a 401(k) Plan? - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

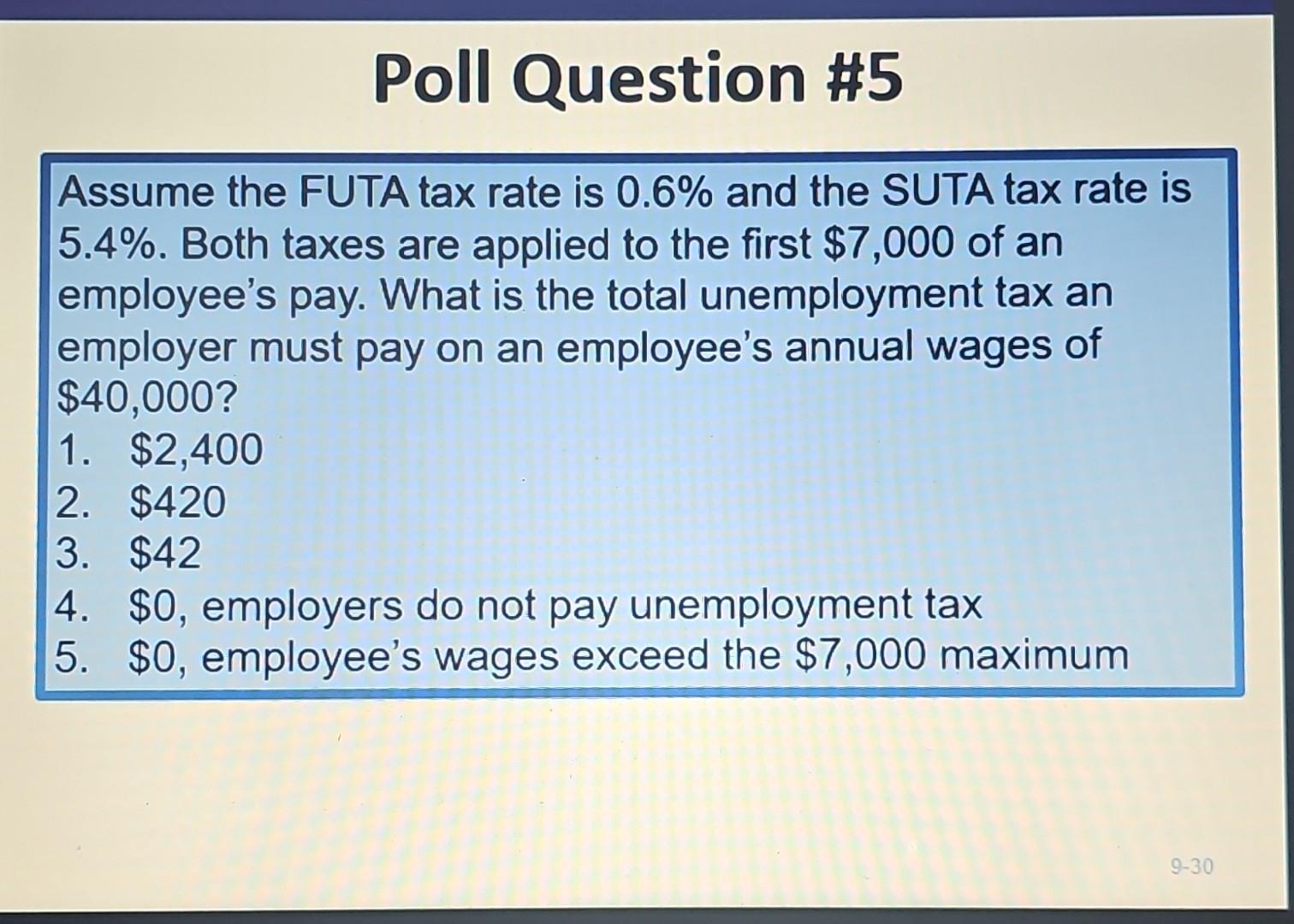

What are the major federal payroll taxes, and how much money do they raise?

How to Pay Freelance Work Taxes in 2023

Federal Insurance Contributions Act: FICA - FasterCapital

What Is FICA On My Paycheck? What Is FICA Tax?

Solved An employee earned $50,000 during the year. FICA tax

Document

Restricted Stock Units: What You Need to Know About RSUs - NerdWallet

Recomendado para você

-

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays12 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays12 abril 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out12 abril 2025

-

What are FICA Tax Payable? – SuperfastCPA CPA Review12 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review12 abril 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime12 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime12 abril 2025 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence12 abril 2025

The FICA Tax: How Social Security Is Funded – Social Security Intelligence12 abril 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and12 abril 2025

-

What it means: COVID-19 Deferral of Employee FICA Tax12 abril 2025

What it means: COVID-19 Deferral of Employee FICA Tax12 abril 2025 -

Vola12 abril 2025

Vola12 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers12 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers12 abril 2025 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —12 abril 2025

Students on an F1 Visa Don't Have to Pay FICA Taxes —12 abril 2025

você pode gostar

-

Rance (series) - Wikipedia12 abril 2025

Rance (series) - Wikipedia12 abril 2025 -

Is Easter Island on your bucket list? I am so glad I made the12 abril 2025

Is Easter Island on your bucket list? I am so glad I made the12 abril 2025 -

Óculos de Sol Juliet X-Metal Lentes Rosas Pink Polarizadas, 24k, tio12 abril 2025

Óculos de Sol Juliet X-Metal Lentes Rosas Pink Polarizadas, 24k, tio12 abril 2025 -

Zoran Ilic - The Sicilian With Qb6 PDF, PDF12 abril 2025

-

/43481495/3985344/cd_cover.jpg?1) Alexandre Pires - Acústico Rádio Mania (2011) - Pagode - Sua Música12 abril 2025

Alexandre Pires - Acústico Rádio Mania (2011) - Pagode - Sua Música12 abril 2025 -

Playboi Carti Shares New “Sky” Video: Watch12 abril 2025

Playboi Carti Shares New “Sky” Video: Watch12 abril 2025 -

News and Media12 abril 2025

News and Media12 abril 2025 -

Desenhos de Pescaria Para Colorir e Imprimir - Pintar Grátis Online12 abril 2025

Desenhos de Pescaria Para Colorir e Imprimir - Pintar Grátis Online12 abril 2025 -

83 ideias de Dinossauro rei dinossauro rei, dinossauro, dinossauros12 abril 2025

83 ideias de Dinossauro rei dinossauro rei, dinossauro, dinossauros12 abril 2025 -

Download Mysterix mod 10.0 (Android) for GTA San Andreas (iOS12 abril 2025

Download Mysterix mod 10.0 (Android) for GTA San Andreas (iOS12 abril 2025