Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Last updated 12 abril 2025

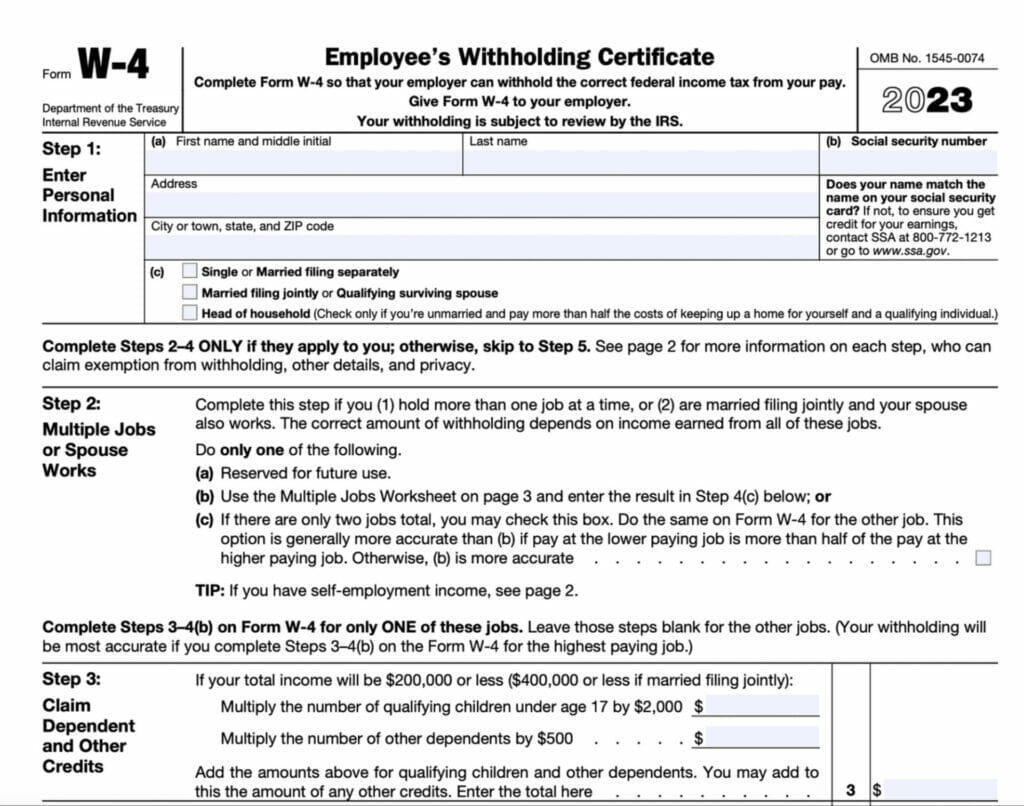

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

What Is the FICA Tax Refund? —

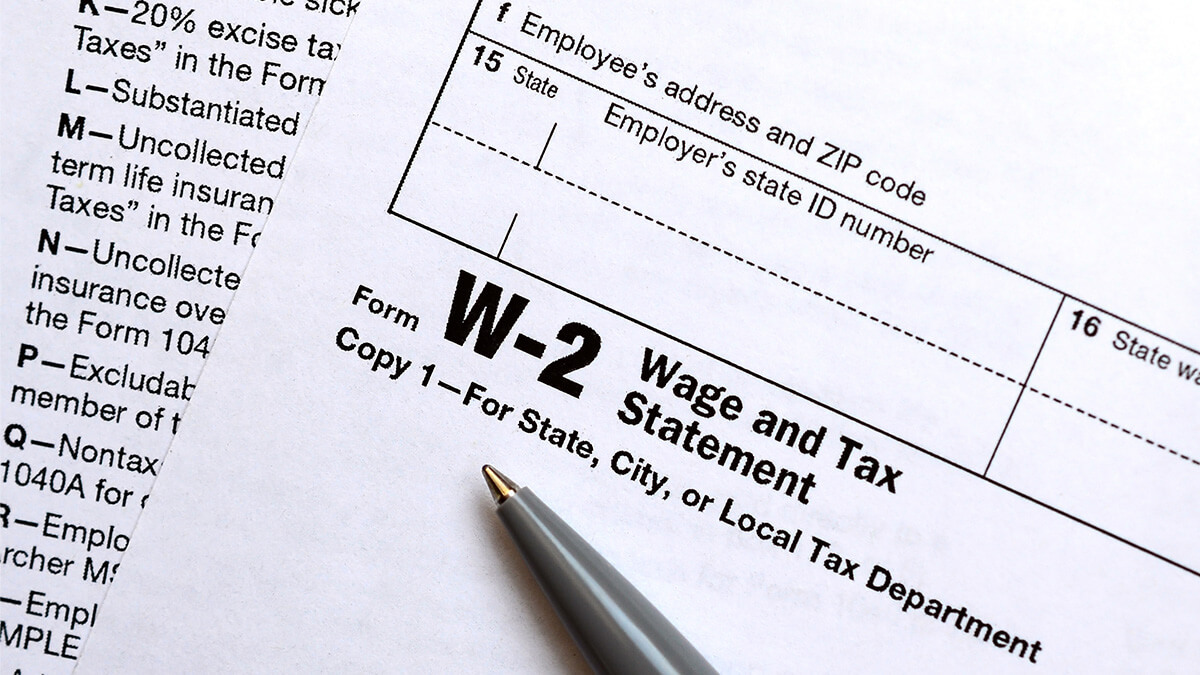

Form W-2 Box 12 Codes Codes and Explanations [Chart]

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843: Claim for Refund and Request for Abatement: How to File

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

Form W-2 H&R Block

Employee Retention Credit (ERC): Frequently Asked Qestions

What is a W2 Form Wage and Tax Statement?

How to Fill Out a W-2 Form丨PDF Reader Pro

Form W-2 Wage and Tax Statement: What It Is and How to Read It

What Is the Difference Between Forms W-4, W-2, W-9 & 1099-NEC?

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog12 abril 2025

-

What is FICA Tax? - Optima Tax Relief12 abril 2025

What is FICA Tax? - Optima Tax Relief12 abril 2025 -

What Is the FICA Tax and Why Does It Exist? - TheStreet12 abril 2025

What Is the FICA Tax and Why Does It Exist? - TheStreet12 abril 2025 -

Historical Social Security and FICA Tax Rates for a Family of Four12 abril 2025

Historical Social Security and FICA Tax Rates for a Family of Four12 abril 2025 -

How An S Corporation Reduces FICA Self-Employment Taxes12 abril 2025

How An S Corporation Reduces FICA Self-Employment Taxes12 abril 2025 -

What Is FICA Tax?12 abril 2025

What Is FICA Tax?12 abril 2025 -

What Is FICA Tax? —12 abril 2025

What Is FICA Tax? —12 abril 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 abril 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.12 abril 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.12 abril 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons12 abril 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons12 abril 2025

você pode gostar

-

Hitmonlee, Nintendo12 abril 2025

Hitmonlee, Nintendo12 abril 2025 -

GTA 5 APK Grand Theft Auto 5 Android Download - AndroPalace12 abril 2025

GTA 5 APK Grand Theft Auto 5 Android Download - AndroPalace12 abril 2025 -

Tycoon Hamster Game - idle cheesecake para Android - Download12 abril 2025

Tycoon Hamster Game - idle cheesecake para Android - Download12 abril 2025 -

Férias! 10 jogos de tabuleiro para se divertir com as crianças - Revista Crescer12 abril 2025

Férias! 10 jogos de tabuleiro para se divertir com as crianças - Revista Crescer12 abril 2025 -

AH Guide: Skate 3: Zombie Mode12 abril 2025

AH Guide: Skate 3: Zombie Mode12 abril 2025 -

Fondos de Pantalla Gran Turismo 5 Juegos descargar imagenes12 abril 2025

Fondos de Pantalla Gran Turismo 5 Juegos descargar imagenes12 abril 2025 -

Batman: The Animated Series, Fighting the Invisible Man12 abril 2025

Batman: The Animated Series, Fighting the Invisible Man12 abril 2025 -

Mega lucario cartinha pokemon12 abril 2025

Mega lucario cartinha pokemon12 abril 2025 -

Pin by Wanderley Kennedy on goku Dragon ball tattoo, Dragon ball12 abril 2025

Pin by Wanderley Kennedy on goku Dragon ball tattoo, Dragon ball12 abril 2025 -

Instagram lança jogo de perguntas no stories: Você já recebeu alguma pergunta indelicada? – Rádio Mix FM12 abril 2025

Instagram lança jogo de perguntas no stories: Você já recebeu alguma pergunta indelicada? – Rádio Mix FM12 abril 2025