FICA Tax & Who Pays It

Por um escritor misterioso

Last updated 15 abril 2025

FICA taxes are mandated payroll taxes that benefit federal insurance programs. In this article, we are discussing what FICA taxes are, how they’re paid, and what they mean for employers and employees. Looking for information on

What Are FICA Taxes? – Forbes Advisor

fica tax - FasterCapital

FICA Tax & Who Pays It

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

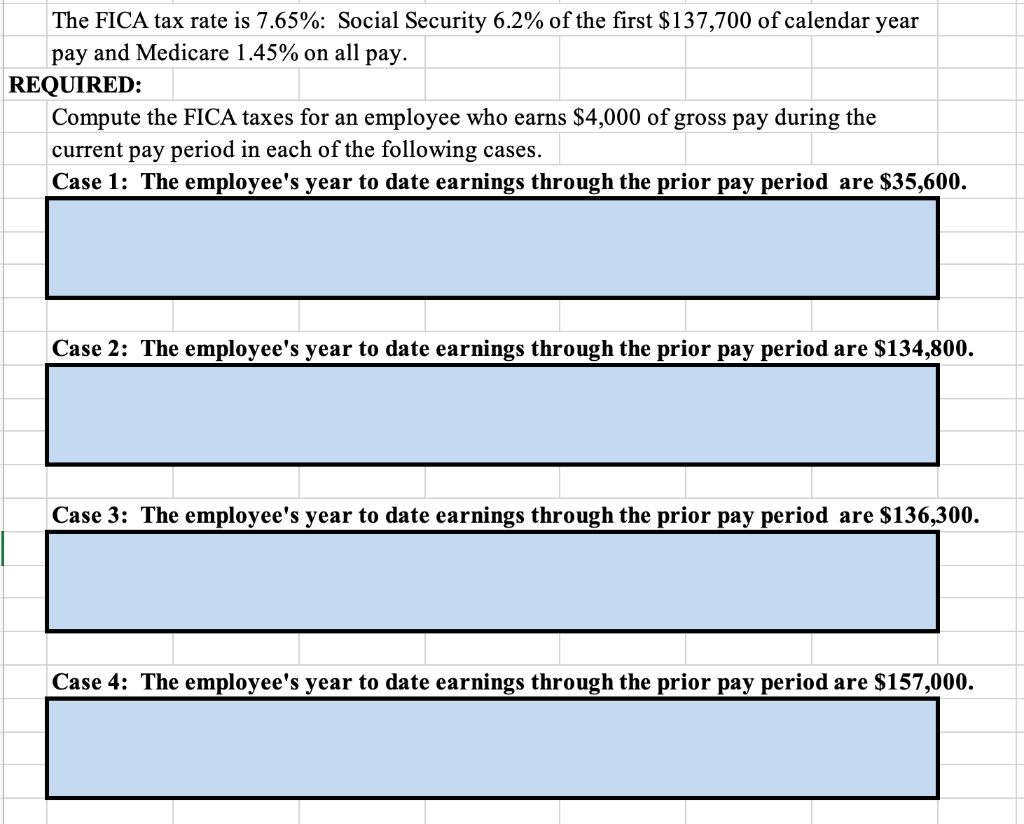

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Medicare Tax - FasterCapital

8 Key Facts to Know About FICA Taxes - HR Future

FICA Tax Rate: What is the percentage of this tax and how you can calculated?

fica tax - FasterCapital

Which taxes are only paid by the employer? - Quora

FICA Tax & Who Pays It

FICA Tax: Understanding Social Security and Medicare Taxes

FICA Taxes Tax source Social Security Medicaid A. $3,720 C. $4,590 Tax rate 6.2% 1.45% How much

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes15 abril 2025

Learn About FICA, Social Security, and Medicare Taxes15 abril 2025 -

What Is FICA Tax? A Complete Guide for Small Businesses15 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses15 abril 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out15 abril 2025

-

What is a payroll tax?, Payroll tax definition, types, and employer obligations15 abril 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations15 abril 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software15 abril 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software15 abril 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and15 abril 2025

-

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student15 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student15 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers15 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers15 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association15 abril 2025

FICA Tax Tip Fairness Pro Beauty Association15 abril 2025 -

FICA TAX PROVISIONS (1967-1980)15 abril 2025

FICA TAX PROVISIONS (1967-1980)15 abril 2025

você pode gostar

-

Leorio and Kurapika Inspired Full Set Nintendo Switch Online15 abril 2025

Leorio and Kurapika Inspired Full Set Nintendo Switch Online15 abril 2025 -

foofighters #hero #lyrics Foo fighters lyrics quotes, Foo fighters lyrics, Foo fighters tattoo lyrics15 abril 2025

foofighters #hero #lyrics Foo fighters lyrics quotes, Foo fighters lyrics, Foo fighters tattoo lyrics15 abril 2025 -

A FEEMG não para! Inscrições abertas para o 2º Campeonato Estadual Escolar de Xadrez Online.15 abril 2025

A FEEMG não para! Inscrições abertas para o 2º Campeonato Estadual Escolar de Xadrez Online.15 abril 2025 -

Fenômeno do , Gato Galáctico estreia dois shows no Cartoon Network - ABC da Comunicação15 abril 2025

Fenômeno do , Gato Galáctico estreia dois shows no Cartoon Network - ABC da Comunicação15 abril 2025 -

Mini Quebra cabeça de madeira Carnaval no Recife - Puzzle5515 abril 2025

Mini Quebra cabeça de madeira Carnaval no Recife - Puzzle5515 abril 2025 -

![Quiz] Escolha animes antigos e daremos um anime novo para assistir](https://kanto.legiaodosherois.com.br/w760-h398-gnw-cfill-q95/wp-content/uploads/2022/12/legiao_ALJekFUsfHMP.png.webp) Quiz] Escolha animes antigos e daremos um anime novo para assistir15 abril 2025

Quiz] Escolha animes antigos e daremos um anime novo para assistir15 abril 2025 -

Doors A-90 Jumpscare #doors #roblox #robloxdoorsgame15 abril 2025

-

Crash Champions on LinkedIn: Crash Champions just got bigger and better 💪 We are proud to welcome our…15 abril 2025

-

Annapurna Interactive on X: we officially retired the outer wilds15 abril 2025

Annapurna Interactive on X: we officially retired the outer wilds15 abril 2025 -

Day of monster jogo de kaiju15 abril 2025

Day of monster jogo de kaiju15 abril 2025