FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 10 abril 2025

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

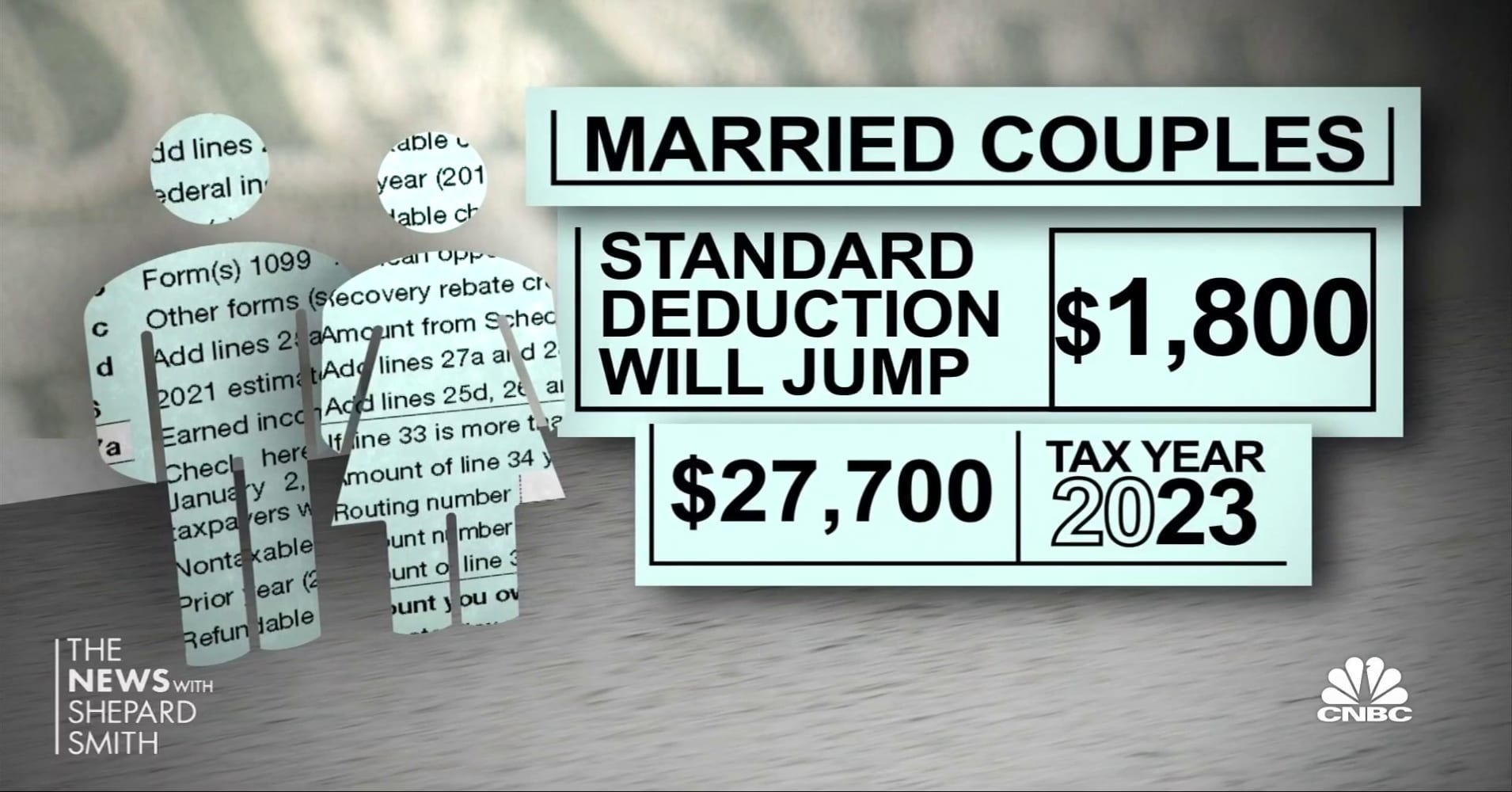

2023 Tax Changes and Key Amounts

Employers: The Social Security Wage Base is Increasing in 2022 - BGM

Do Social Security Recipients Need to File a Tax Return? - CNET

What 8.7% Social Security COLA for 2023 means for taxes on benefits

Self-Employment Tax: What Is It, How to Calculate It, and When to

FICA tax rate: Figures and formulas employers need to know

Inflation Could Put More Money in Your Paycheck Next Year: Tax

What is Self-Employment Tax? (2022-23 Rates and Calculator)

2023 Social Security Changes - Milwaukee Courier Weekly Newspaper

2024 State Business Tax Climate Index

Social Security wage base is $160,200 in 2023, meaning more FICA

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief10 abril 2025

What is FICA Tax? - Optima Tax Relief10 abril 2025 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks10 abril 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks10 abril 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays10 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays10 abril 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)10 abril 2025

2023 FICA Tax Limits and Rates (How it Affects You)10 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes10 abril 2025

-

What Is FICA on a Paycheck? FICA Tax Explained - Chime10 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime10 abril 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto10 abril 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto10 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax10 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax10 abril 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student10 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student10 abril 2025 -

2017 FICA Tax: What You Need to Know10 abril 2025

2017 FICA Tax: What You Need to Know10 abril 2025

você pode gostar

-

Sad Story – música e letra de Bích Sơn Nhật10 abril 2025

-

2013 The Last of Us PS3 Print Ad/Poster Authentic Official Video Game Promo Art10 abril 2025

2013 The Last of Us PS3 Print Ad/Poster Authentic Official Video Game Promo Art10 abril 2025 -

Bio Androids – Dragon Ball Universe10 abril 2025

Bio Androids – Dragon Ball Universe10 abril 2025 -

roupas bonitas para fazer no gacha club10 abril 2025

roupas bonitas para fazer no gacha club10 abril 2025 -

Casa de Oxalá - Ilê Axé Olokun Oni Jobokun10 abril 2025

-

Little Alchemy. Fantastic airplane mode game. No ads what do ever. #a10 abril 2025

-

![How to See What Discord Servers Someone Is in [ ✓ Solved ] - Alvaro Trigo's Blog](https://alvarotrigo.com/blog/assets/imgs/2023-02-08/hide-mutual-servers-discord-step2.jpeg) How to See What Discord Servers Someone Is in [ ✓ Solved ] - Alvaro Trigo's Blog10 abril 2025

How to See What Discord Servers Someone Is in [ ✓ Solved ] - Alvaro Trigo's Blog10 abril 2025 -

Carro Carrinho Controle Remoto 4x4 Grande Elétrico Recarregavel10 abril 2025

Carro Carrinho Controle Remoto 4x4 Grande Elétrico Recarregavel10 abril 2025 -

Yu-Gi-Oh! 5D's – NewZect10 abril 2025

Yu-Gi-Oh! 5D's – NewZect10 abril 2025 -

Demon Slayer season 3 episode 10: Demon Slayer Season 3 Episode 1010 abril 2025

Demon Slayer season 3 episode 10: Demon Slayer Season 3 Episode 1010 abril 2025