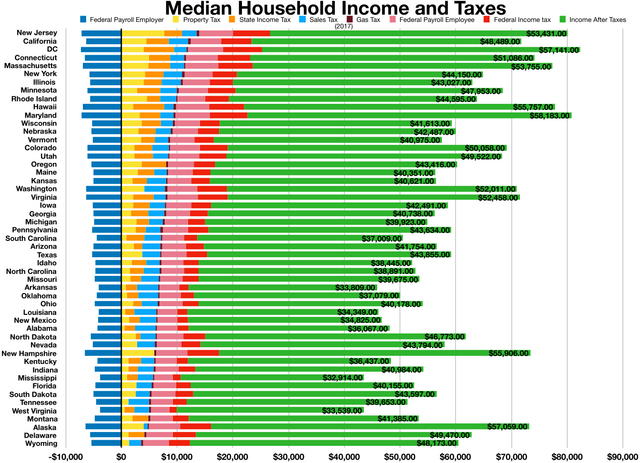

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Last updated 12 abril 2025

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

Which taxes are only paid by the employer? - Quora

Students on an F1 Visa Don't Have to Pay FICA Taxes —

Federal Insurance Contributions Act: FICA - FasterCapital

What is FICA?

The ABCs of FICA: Federal Insurance Contributions Act Explained

Federal Insurance Contributions Act - Wikipedia

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

The Basics on Payroll Tax

Federal Insurance Contributions Act (FICA): Definition

The ABCs of FICA: Federal Insurance Contributions Act Explained

Solved] 1- An employee earned $43,600 during the year working for

Federal Insurance Contributions Act (FICA)

Federal Insurance Contributions Act (FICA)

Chapter 9 MCQ's Flashcards

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief12 abril 2025

What is FICA Tax? - Optima Tax Relief12 abril 2025 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest12 abril 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest12 abril 2025 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?12 abril 2025

FICA Tax Rate: What is the percentage of this tax and how you can calculated?12 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes12 abril 2025

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?12 abril 2025

Why Is There a Cap on the FICA Tax?12 abril 2025 -

.jpg) What is FICA tax? Understanding FICA for small business12 abril 2025

What is FICA tax? Understanding FICA for small business12 abril 2025 -

What Eliminating FICA Tax Means for Your Retirement12 abril 2025

-

Understanding FICA Taxes and Wage Base Limit12 abril 2025

Understanding FICA Taxes and Wage Base Limit12 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example12 abril 2025

What Is Social Security Tax? Definition, Exemptions, and Example12 abril 2025 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?12 abril 2025

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?12 abril 2025

você pode gostar

-

Obanai Iguro, Wikia Liber Proeliis12 abril 2025

Obanai Iguro, Wikia Liber Proeliis12 abril 2025 -

Good Morning, Afternoon, Evening, Night: Qual Horário Usar12 abril 2025

Good Morning, Afternoon, Evening, Night: Qual Horário Usar12 abril 2025 -

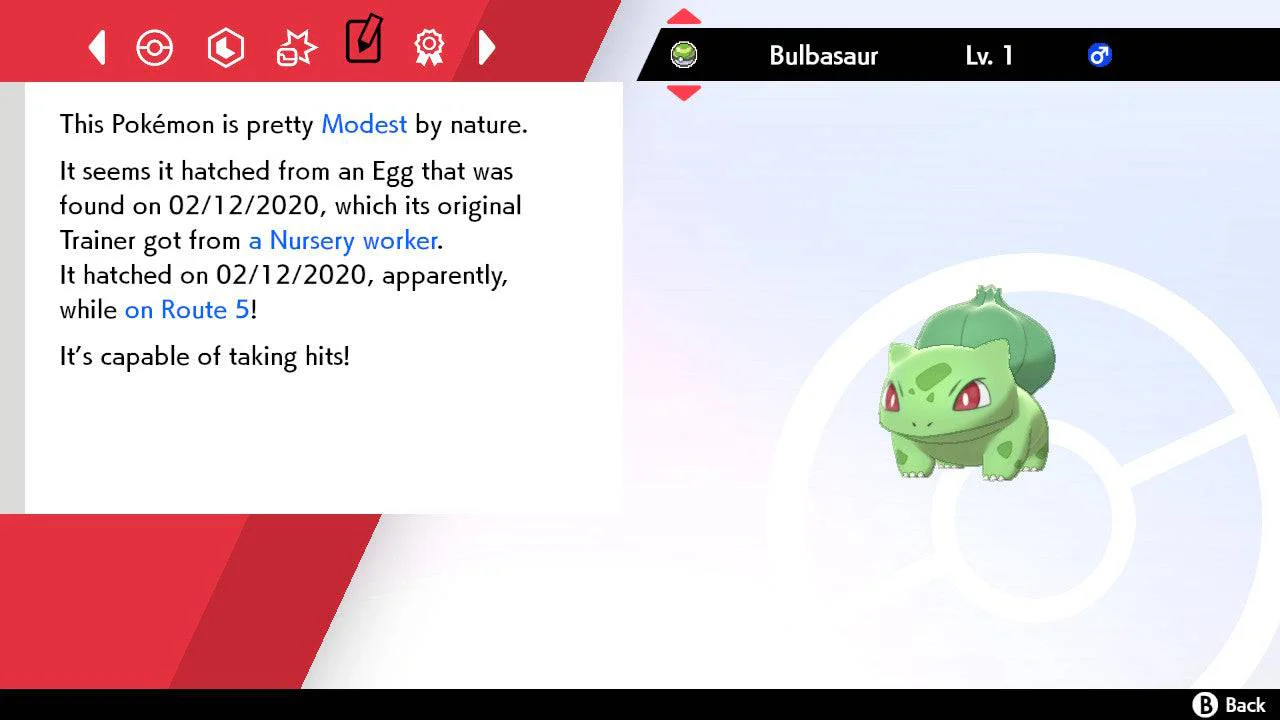

Pokemon Sword and Shield Shiny Level 1 Bulbasaur 6IV-EV Trained – Pokemon4Ever12 abril 2025

Pokemon Sword and Shield Shiny Level 1 Bulbasaur 6IV-EV Trained – Pokemon4Ever12 abril 2025 -

The Punisher PS2 usate per 80 EUR su Ripollet su WALLAPOP12 abril 2025

The Punisher PS2 usate per 80 EUR su Ripollet su WALLAPOP12 abril 2025 -

![A Believable Tragedy.. The Eminence in Shadow Episode 9 [Review] – OTAKU SINH](https://otakusinh.files.wordpress.com/2022/12/cid-11.png?w=1200) A Believable Tragedy.. The Eminence in Shadow Episode 9 [Review] – OTAKU SINH12 abril 2025

A Believable Tragedy.. The Eminence in Shadow Episode 9 [Review] – OTAKU SINH12 abril 2025 -

Livro de atividades infantis 365 atividades e desenhos para colorir Patrulha Canina em Promoção na Americanas12 abril 2025

Livro de atividades infantis 365 atividades e desenhos para colorir Patrulha Canina em Promoção na Americanas12 abril 2025 -

Ever After High collection Monster high dolls, Ever after dolls12 abril 2025

Ever After High collection Monster high dolls, Ever after dolls12 abril 2025 -

Blaze Crash: Saiba o que é, como jogar e se é confiável12 abril 2025

-

Pokemon Black Version 2 Cheats and Hints for Nintendo DS12 abril 2025

Pokemon Black Version 2 Cheats and Hints for Nintendo DS12 abril 2025 -

lelouch lamperouge code geass zero Resolution HD A iPhone Wallpapers Free Download12 abril 2025

lelouch lamperouge code geass zero Resolution HD A iPhone Wallpapers Free Download12 abril 2025