Important 2020 Federal Tax Deadlines for Small Businesses - Workest

Por um escritor misterioso

Last updated 11 abril 2025

Every Tax Deadline You Need To Know - TurboTax Tax Tips & Videos

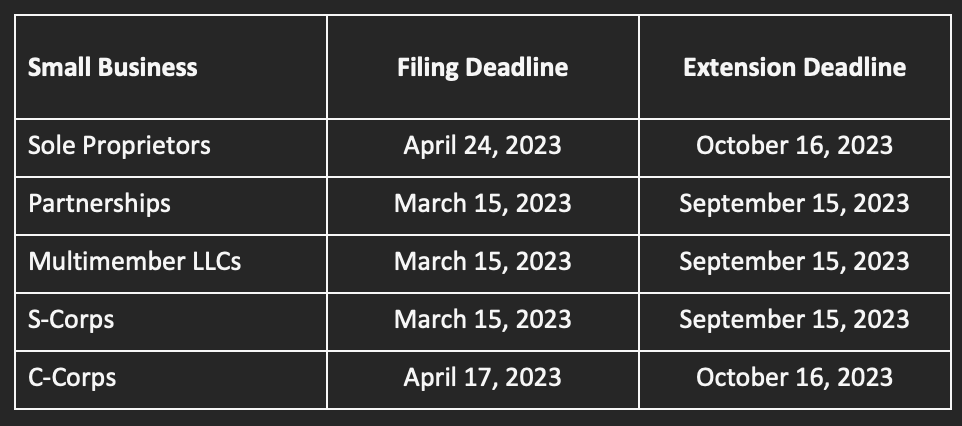

Business Tax Deadline Key Dates and What You Need to Know (2023)

Why small business owners may want to file taxes AFTER July 15 deadline - MarketWatch

When Are Taxes Due 2024? Your Guide to Tax Deadlines - NerdWallet

16 ways business owners can save on taxes - Clover Blog

When Are Taxes Due for 2022 Tax Return

2024 State Business Tax Climate Index

US Tax Revenue by Tax Type: Sources of US Government Revenue

Tax Deadline for 2024

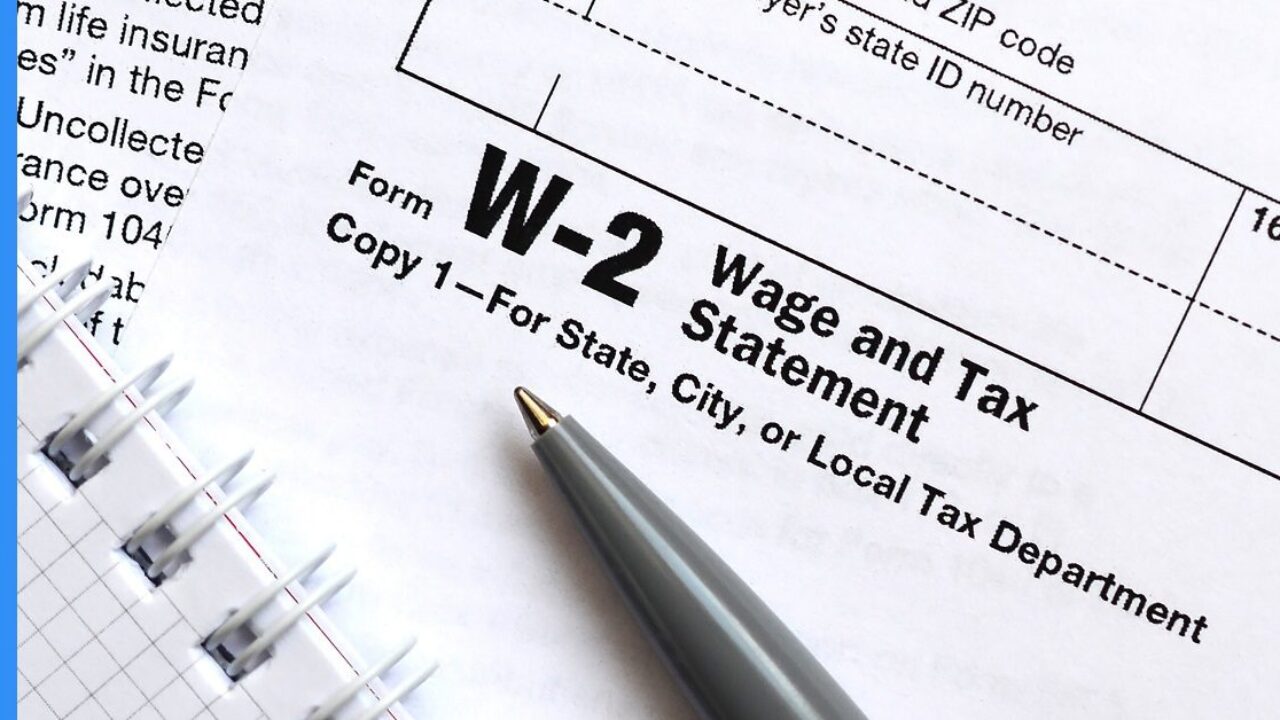

What is the 1099 and W2 Deadline This Year?

LLC Tax Deadline 2023: Key Deadlines for Your Small Business

2021 Tax Filing Deadlines for Businesses - Workest

2021 federal tax deadline for businesses

25 small business tax forms all SMBs should know

Every Tax Deadline You Need To Know - TurboTax Tax Tips & Videos

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses11 abril 2025

What Is FICA Tax? A Complete Guide for Small Businesses11 abril 2025 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?11 abril 2025

Family Finance Favs: Don't Leave Teens Wondering What The FICA?11 abril 2025 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes11 abril 2025

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes11 abril 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202311 abril 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202311 abril 2025 -

Overview of FICA Tax- Medicare & Social Security11 abril 2025

Overview of FICA Tax- Medicare & Social Security11 abril 2025 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers11 abril 2025

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers11 abril 2025 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime11 abril 2025

What Is FICA on a Paycheck? FICA Tax Explained - Chime11 abril 2025 -

FICA Tax - An Explanation - RMS Accounting11 abril 2025

FICA Tax - An Explanation - RMS Accounting11 abril 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements11 abril 2025

What Is FICA Tax, Understanding Payroll Tax Requirements11 abril 2025 -

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local11 abril 2025

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local11 abril 2025

você pode gostar

-

Day 1 of drawing characters from the Papa Louie Series : r/flipline11 abril 2025

Day 1 of drawing characters from the Papa Louie Series : r/flipline11 abril 2025 -

Quiz: who are the players in these World Cup pictures?, World Cup 201811 abril 2025

Quiz: who are the players in these World Cup pictures?, World Cup 201811 abril 2025 -

Weirdcore/Dreamcore oc by ShySkele on DeviantArt11 abril 2025

Weirdcore/Dreamcore oc by ShySkele on DeviantArt11 abril 2025 -

Mmmm glyphs11 abril 2025

Mmmm glyphs11 abril 2025 -

Sonic the Hedgehog CD (Video Game) - TV Tropes11 abril 2025

Sonic the Hedgehog CD (Video Game) - TV Tropes11 abril 2025 -

God of War Ragnarok será o último da saga. – PNBR11 abril 2025

God of War Ragnarok será o último da saga. – PNBR11 abril 2025 -

Jogo God of War: Ragnarok - PS4 - MeuGameUsado11 abril 2025

Jogo God of War: Ragnarok - PS4 - MeuGameUsado11 abril 2025 -

Roblox $50 Gift Card (Email Delivery)11 abril 2025

Roblox $50 Gift Card (Email Delivery)11 abril 2025 -

the best mm2 script|TikTok Search11 abril 2025

-

Layers of Fear Inheritance gameplay walkthrough by Frank Scrub - Issuu11 abril 2025

Layers of Fear Inheritance gameplay walkthrough by Frank Scrub - Issuu11 abril 2025