How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Last updated 11 abril 2025

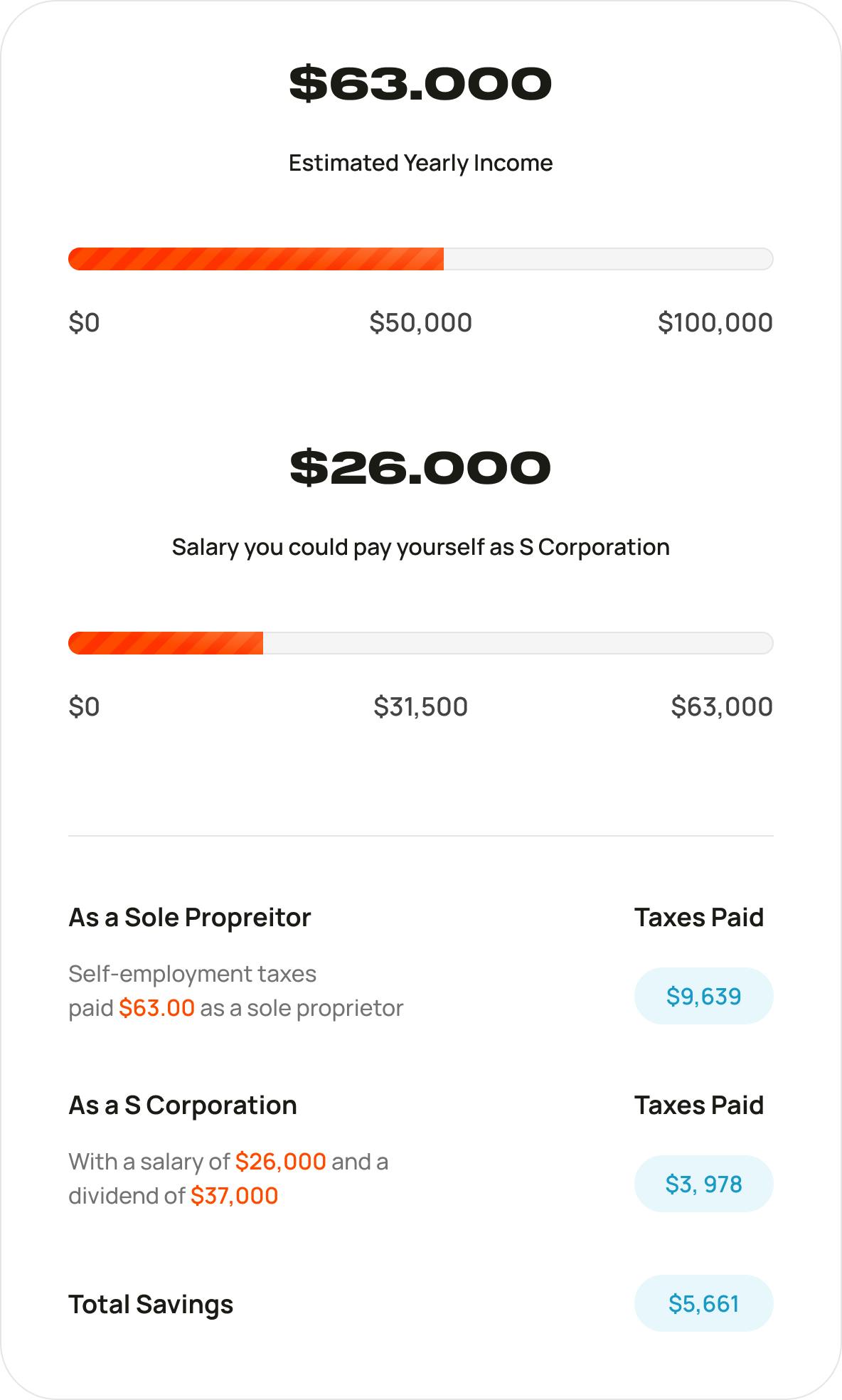

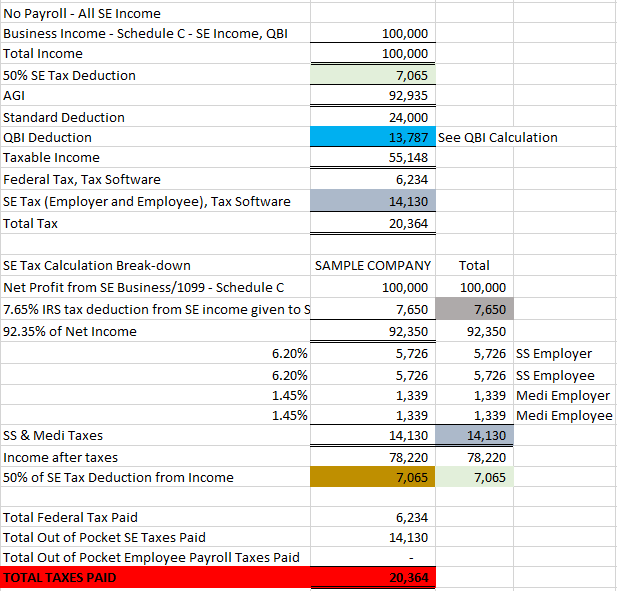

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Filing S Corp Taxes 101 — How to File S Corp Taxes

Using an S corporation to avoid self-employment tax

Tax Benefits of S-Corps: How Does an S-Corporation Save Taxes? - Small Business Accounting & Finance Blog

LLC or S Corp for My Business?

Have Your LLC Taxed as an S Corp - S Corp Election Form 2553

How to calculate self employment taxes

Advantages and Responsibilities of an S Corp

Reduce self-employment taxes with a corporation or LLC

How an S Corporation Can Reduce Self-Employment Taxes

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN S-CORP – Houston TX, Certified Public Accountant, Accounting, Tax, Financial Services, QuickBooks

S Corp Tax Benefits: How Business And Its Shareholders Are Taxed

Recomendado para você

-

What is FICA11 abril 2025

What is FICA11 abril 2025 -

What are FICA Taxes? 2022-2023 Rates and Instructions11 abril 2025

-

FICA Tax: What It is and How to Calculate It11 abril 2025

FICA Tax: What It is and How to Calculate It11 abril 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays11 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays11 abril 2025 -

Overview of FICA Tax- Medicare & Social Security11 abril 2025

Overview of FICA Tax- Medicare & Social Security11 abril 2025 -

Employee Social Security Tax Deferral Repayment11 abril 2025

Employee Social Security Tax Deferral Repayment11 abril 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto11 abril 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto11 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax11 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax11 abril 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax11 abril 2025

What it means: COVID-19 Deferral of Employee FICA Tax11 abril 2025 -

FICA Tax Tip Fairness Pro Beauty Association11 abril 2025

FICA Tax Tip Fairness Pro Beauty Association11 abril 2025

você pode gostar

-

File:Open book nae 02.svg - Wikimedia Commons11 abril 2025

File:Open book nae 02.svg - Wikimedia Commons11 abril 2025 -

Roarsome! – Chronicle Books11 abril 2025

Roarsome! – Chronicle Books11 abril 2025 -

Reddit - fivenightsatfreddys - The Cliffs Cover Remake11 abril 2025

Reddit - fivenightsatfreddys - The Cliffs Cover Remake11 abril 2025 -

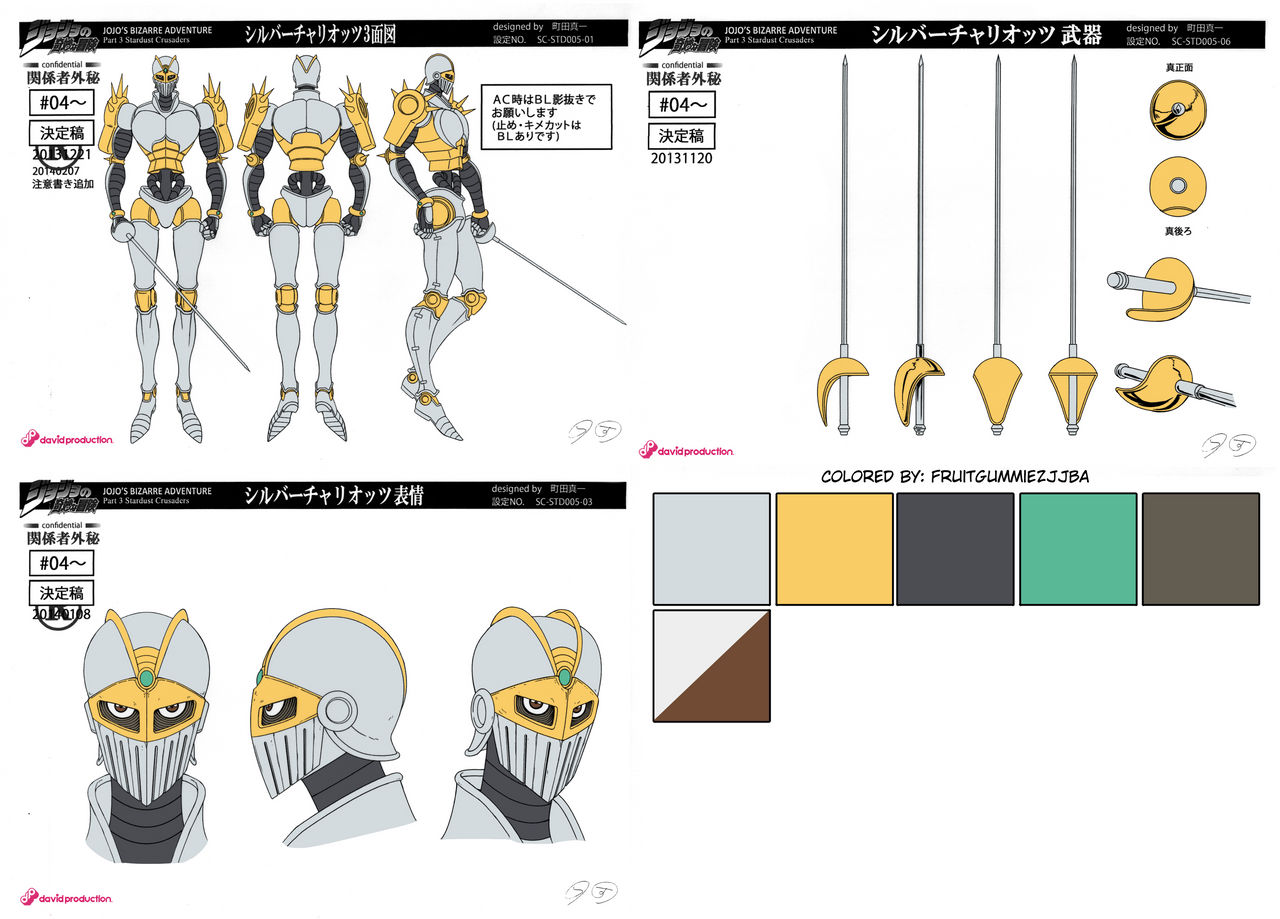

Silver Chariot ova (Stardust Crusaders) by FruitgummiezJJBA on DeviantArt11 abril 2025

Silver Chariot ova (Stardust Crusaders) by FruitgummiezJJBA on DeviantArt11 abril 2025 -

Taenjooy Halloween Call of Ghost Mask MW2 Cod Skull11 abril 2025

Taenjooy Halloween Call of Ghost Mask MW2 Cod Skull11 abril 2025 -

Shrek Png Fiona Png Shrek and Fiona Png Kids Coloring11 abril 2025

Shrek Png Fiona Png Shrek and Fiona Png Kids Coloring11 abril 2025 -

Oc UwU 2 Club design, Club outfits, Bookmarks kids11 abril 2025

Oc UwU 2 Club design, Club outfits, Bookmarks kids11 abril 2025 -

Minecraft xbox 360: 2 player split screen (how 2 Tutorial) Must be in HD!11 abril 2025

Minecraft xbox 360: 2 player split screen (how 2 Tutorial) Must be in HD!11 abril 2025 -

Assistir Doupo Cangqiong – 5ª Temporada Todos os Episódios em HD Online Grátis - AniDong11 abril 2025

Assistir Doupo Cangqiong – 5ª Temporada Todos os Episódios em HD Online Grátis - AniDong11 abril 2025 -

Câmera de ler código de barras - Samsung Members11 abril 2025