Itemize - Home

Por um escritor misterioso

Last updated 14 abril 2025

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

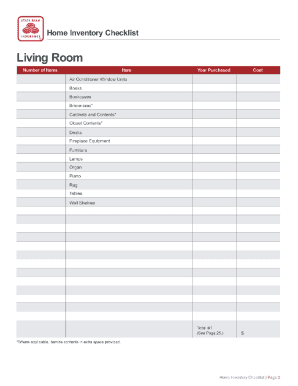

26 Printable Home Inventory Sheet Forms and Templates - Fillable Samples in PDF, Word to Download

Article

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules for Claiming a Property Tax Deduction

4 Tax Benefits Built Into Home Ownership - Venture CPAs - Accounting Firm Aurora

Are Your Home Improvements Tax-Deductible?

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

A qualified and practising financial, property, retirement and tax adviser's take on why a home business offers so many significant, immediate and

Deduct Your Home

Is New Flooring Tax Deductible?

Solved) - A self-employed taxpayer who itemized deductions owns a home, of (1 Answer)

Second Home Tax Deductions & Benefits: What Can You Deduct? - Orchard

Should I Itemize My Tax Deductions or Take the Standard Deduction?

What Deductions Can You Claim When Buying a Home?

Do You Itemize or Take the Standard Deduction - The Tech Savvy CPA

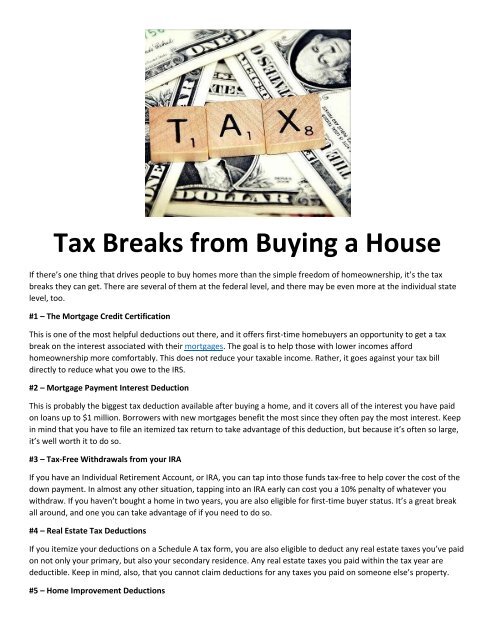

Tax Breaks from Buying a House

Are closing costs tax deductible?, New Homes

Recomendado para você

-

3-Way Match and Accounts Payable • MHC14 abril 2025

3-Way Match and Accounts Payable • MHC14 abril 2025 -

Invoice Number — What You Need to Know14 abril 2025

Invoice Number — What You Need to Know14 abril 2025 -

20 Ways to Find Savings14 abril 2025

20 Ways to Find Savings14 abril 2025 -

Invoice Home14 abril 2025

-

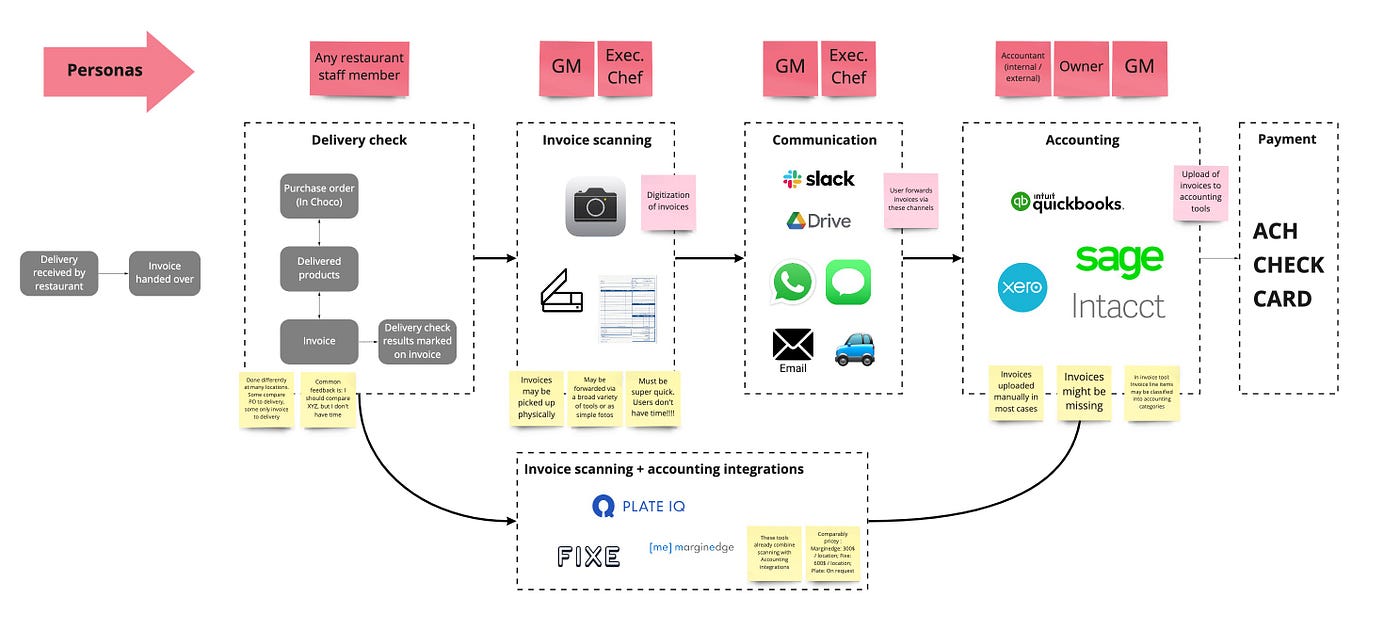

Building a payment experience, in the B2B space, by Shweta Bendre14 abril 2025

Building a payment experience, in the B2B space, by Shweta Bendre14 abril 2025 -

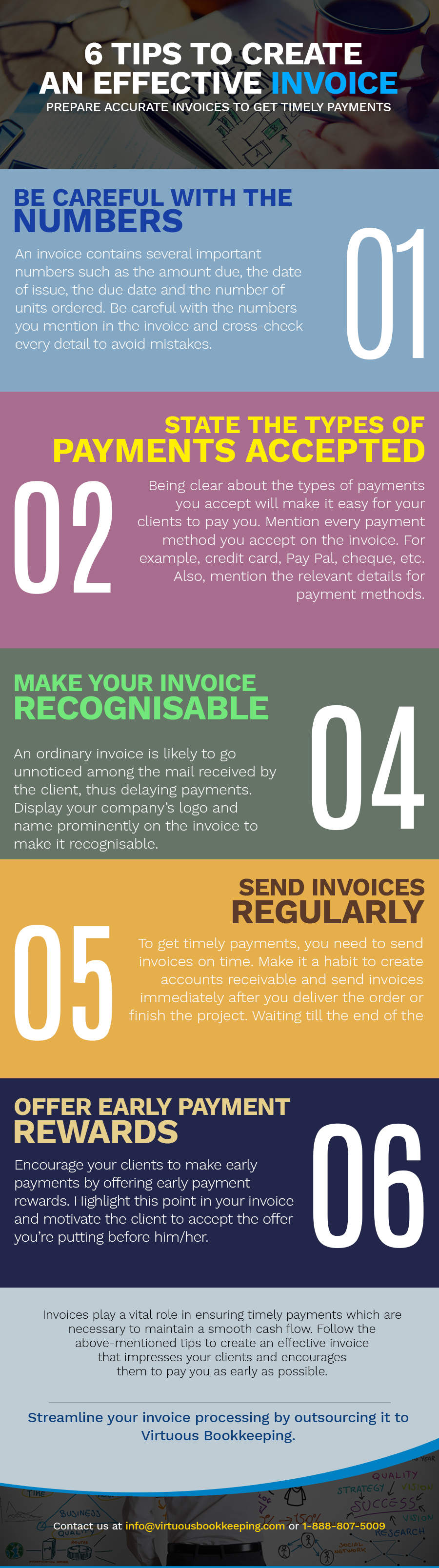

6 Tips to Create an Effective Invoice - Virtuous Bookkeeping14 abril 2025

6 Tips to Create an Effective Invoice - Virtuous Bookkeeping14 abril 2025 -

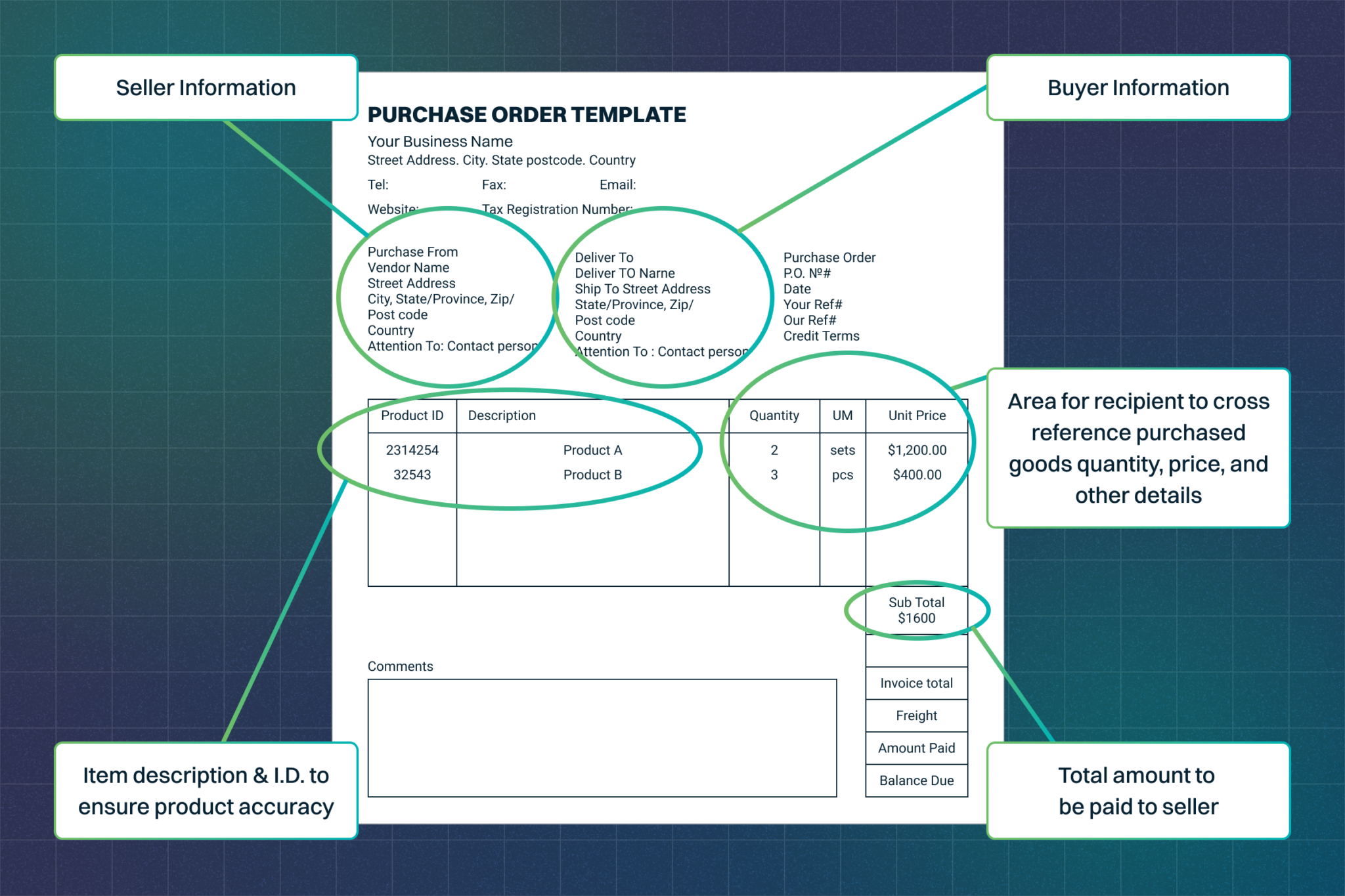

Know the difference: POs, packing slips, & invoices - Linnworks14 abril 2025

Know the difference: POs, packing slips, & invoices - Linnworks14 abril 2025 -

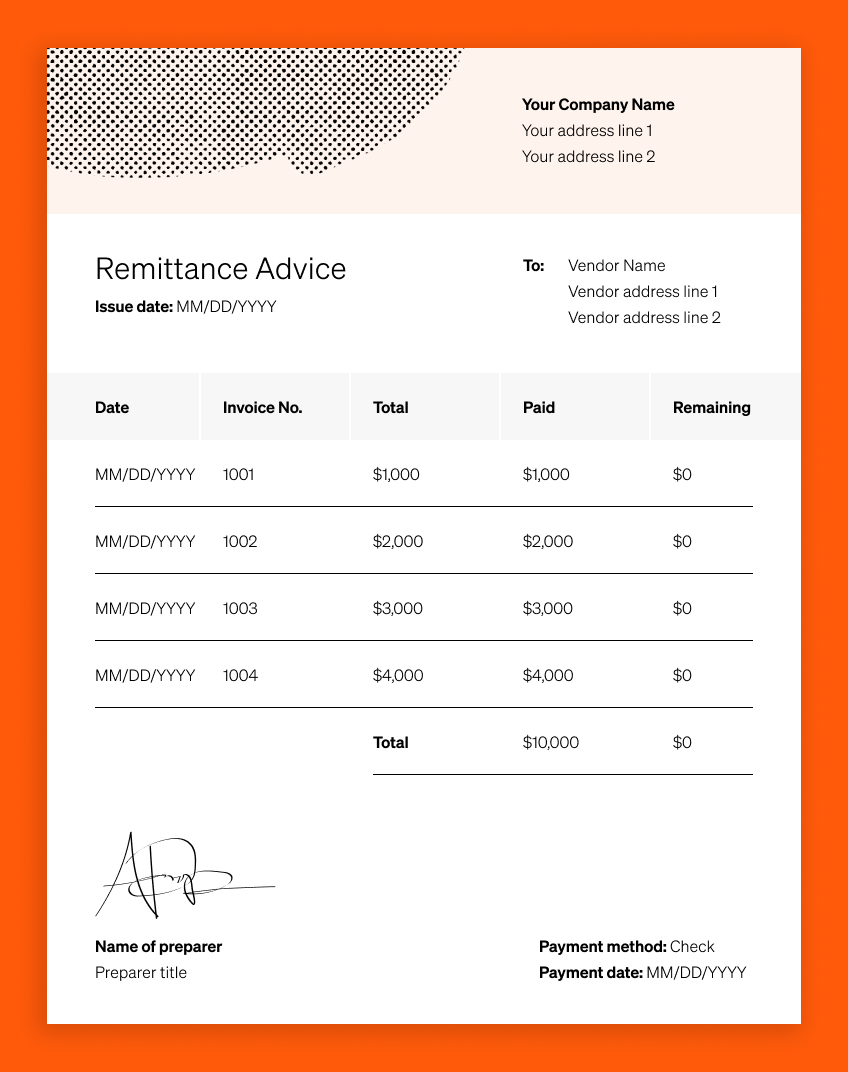

Remittance advice definition—and why it's useful14 abril 2025

Remittance advice definition—and why it's useful14 abril 2025 -

ABA File14 abril 2025

ABA File14 abril 2025 -

When Should You Follow Up On An Invoice: 8 Most Effective Payment Tricks14 abril 2025

When Should You Follow Up On An Invoice: 8 Most Effective Payment Tricks14 abril 2025

você pode gostar

-

bruce lee fighter Urban streetwear t-shirt design bundle, urban streetstyle, pop culture, urban clothing, t-shirt print design, shirt design, retro design - Buy t-shirt designs14 abril 2025

bruce lee fighter Urban streetwear t-shirt design bundle, urban streetstyle, pop culture, urban clothing, t-shirt print design, shirt design, retro design - Buy t-shirt designs14 abril 2025 -

When was the last time Arsenal won the Premier League14 abril 2025

When was the last time Arsenal won the Premier League14 abril 2025 -

GTA San Andreas - VEÍCULOS INDESTRUTÍVEIS PT. 514 abril 2025

-

Pokemon Lugia's Ocean Part 1 I Choose You!, Valle Nevado14 abril 2025

Pokemon Lugia's Ocean Part 1 I Choose You!, Valle Nevado14 abril 2025 -

Camiseta Esportiva Futebol Americano Manga Curta Preto14 abril 2025

Camiseta Esportiva Futebol Americano Manga Curta Preto14 abril 2025 -

Ear piercings - 14 piercing types and how painful they are14 abril 2025

Ear piercings - 14 piercing types and how painful they are14 abril 2025 -

Yoyo (ioiô) Profissional Com Rolamento Timeless Mars Premium + 1014 abril 2025

Yoyo (ioiô) Profissional Com Rolamento Timeless Mars Premium + 1014 abril 2025 -

Cardiff City FC Women welcome Nathaniel Cars as Front of Shirt14 abril 2025

Cardiff City FC Women welcome Nathaniel Cars as Front of Shirt14 abril 2025 -

SHIKIMORI'S NOT JUST A CUTIE14 abril 2025

SHIKIMORI'S NOT JUST A CUTIE14 abril 2025 -

osananajimi ga zettai ni makenai love comedy todos os episódios14 abril 2025

osananajimi ga zettai ni makenai love comedy todos os episódios14 abril 2025