What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Last updated 10 abril 2025

How To Read Schedule K-1?

IRS Takes Aim At Copyrighted Trust Scheme

What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Tax Implications of Trust and Estate Distributions

How Long Does a Trustee Have to Distribute Assets?

Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Publicly traded partnerships: Tax treatment of investors

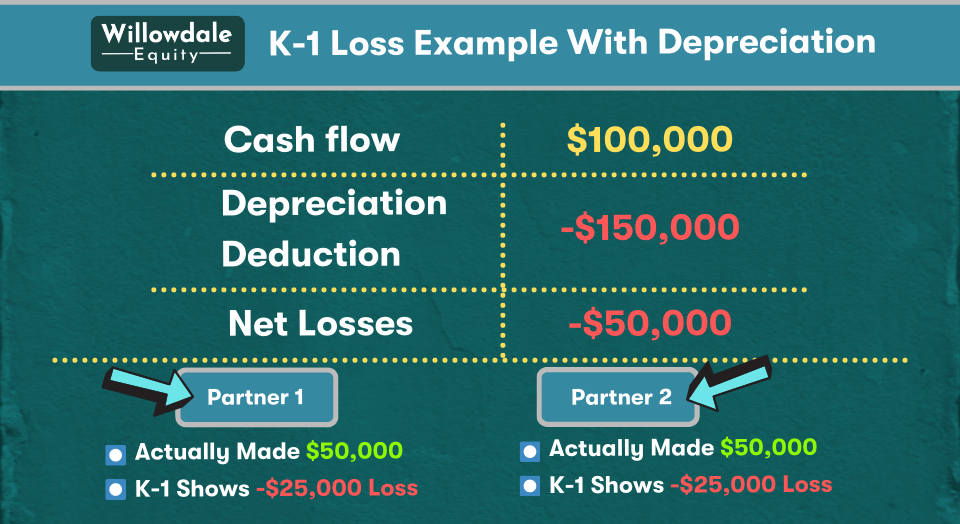

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate Explained

Shareholder Salary vs. Dividends: Tax Implications & Tips

Do I Have to Pay Income Tax on My Trust Distributions?

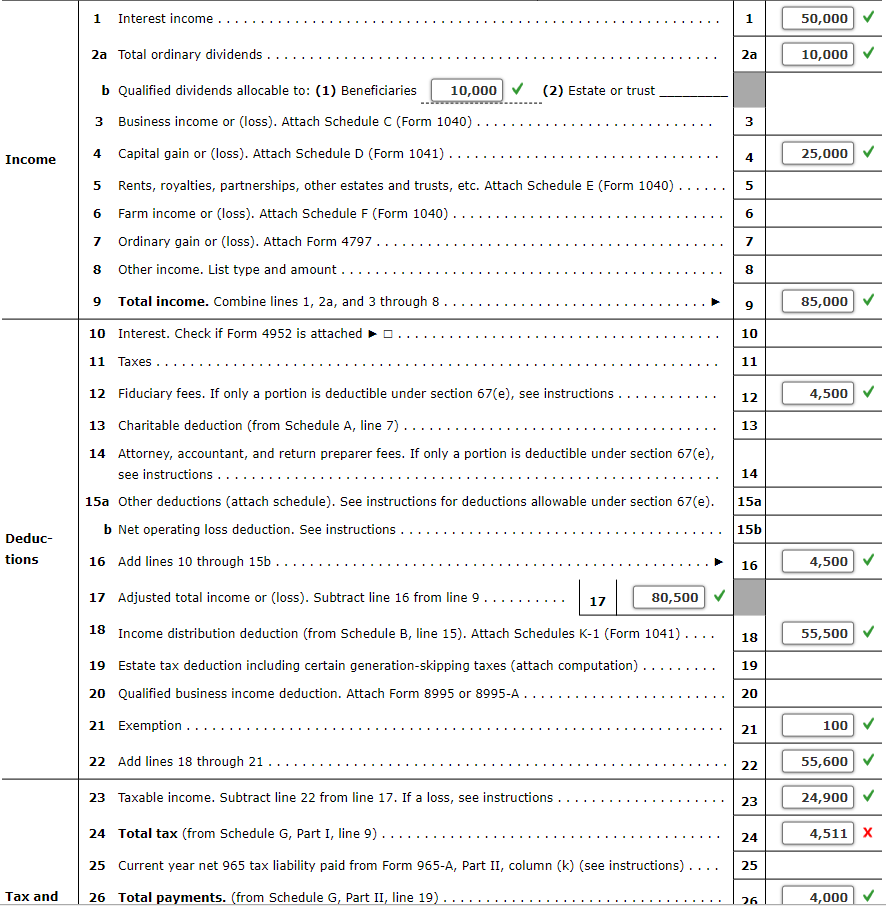

Solved Prepare the 2021 fiduciary income tax return (Form

How Advisors Can Offer Tax Planning And Stay In Compliance

How Distributions and Profit & Loss Allocations are Taxed - The Fork CPAs

Tax Implications of Trust and Estate Distributions

Free Trust Administration Worksheet - Rocket Lawyer

Recomendado para você

-

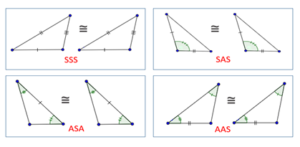

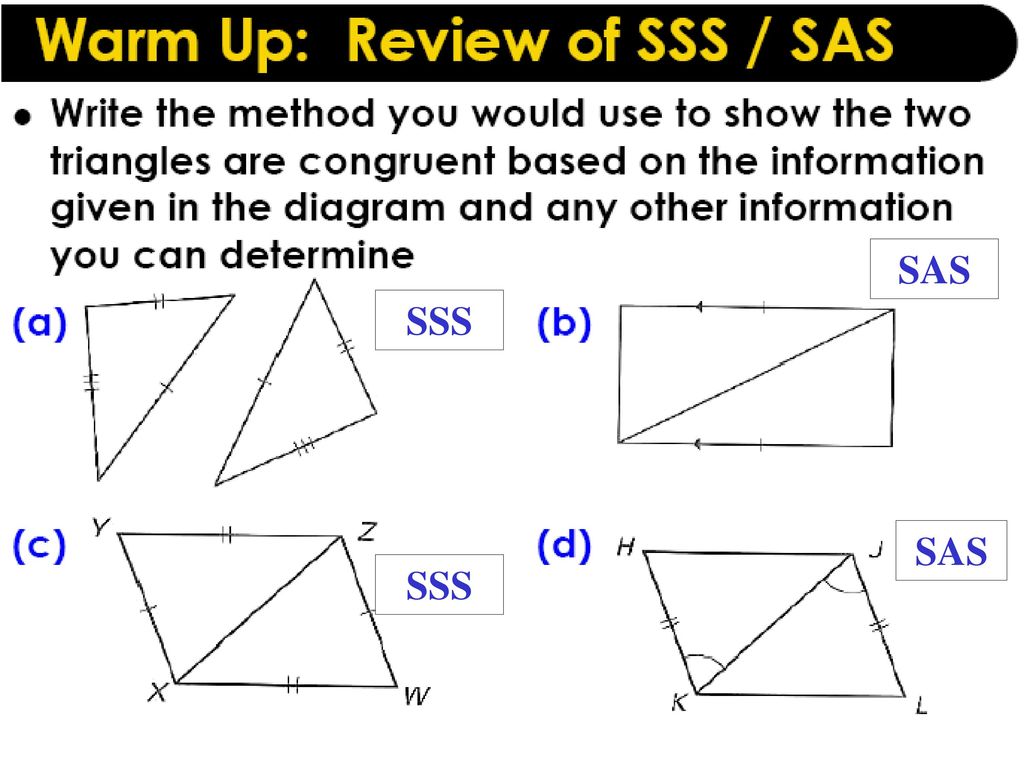

BASICS TO SSS, SAS, ASA, AAS RULES: – MBA CET 202410 abril 2025

BASICS TO SSS, SAS, ASA, AAS RULES: – MBA CET 202410 abril 2025 -

SSS Team - ATTENTION: ALL SSS PENSIONERS WHO ARE NOT RECEIVING10 abril 2025

-

Rappler on X: All Social Security System (SSS) branches are open10 abril 2025

Rappler on X: All Social Security System (SSS) branches are open10 abril 2025 -

![who sent me this video bro [SSS #058]](https://i.ytimg.com/vi/fDtsXkN-lsA/maxresdefault.jpg) who sent me this video bro [SSS #058]10 abril 2025

who sent me this video bro [SSS #058]10 abril 2025 -

SAS SSS SAS SSS. - ppt download10 abril 2025

SAS SSS SAS SSS. - ppt download10 abril 2025 -

Symptom Severity scale (SSS) and Extent of Somatic Symptoms (ESS10 abril 2025

Symptom Severity scale (SSS) and Extent of Somatic Symptoms (ESS10 abril 2025 -

Street Style Store - Online Fashion10 abril 2025

Street Style Store - Online Fashion10 abril 2025 -

FYI: On Crafting S-class Staffs : r/NoMansSkyTheGame10 abril 2025

FYI: On Crafting S-class Staffs : r/NoMansSkyTheGame10 abril 2025 -

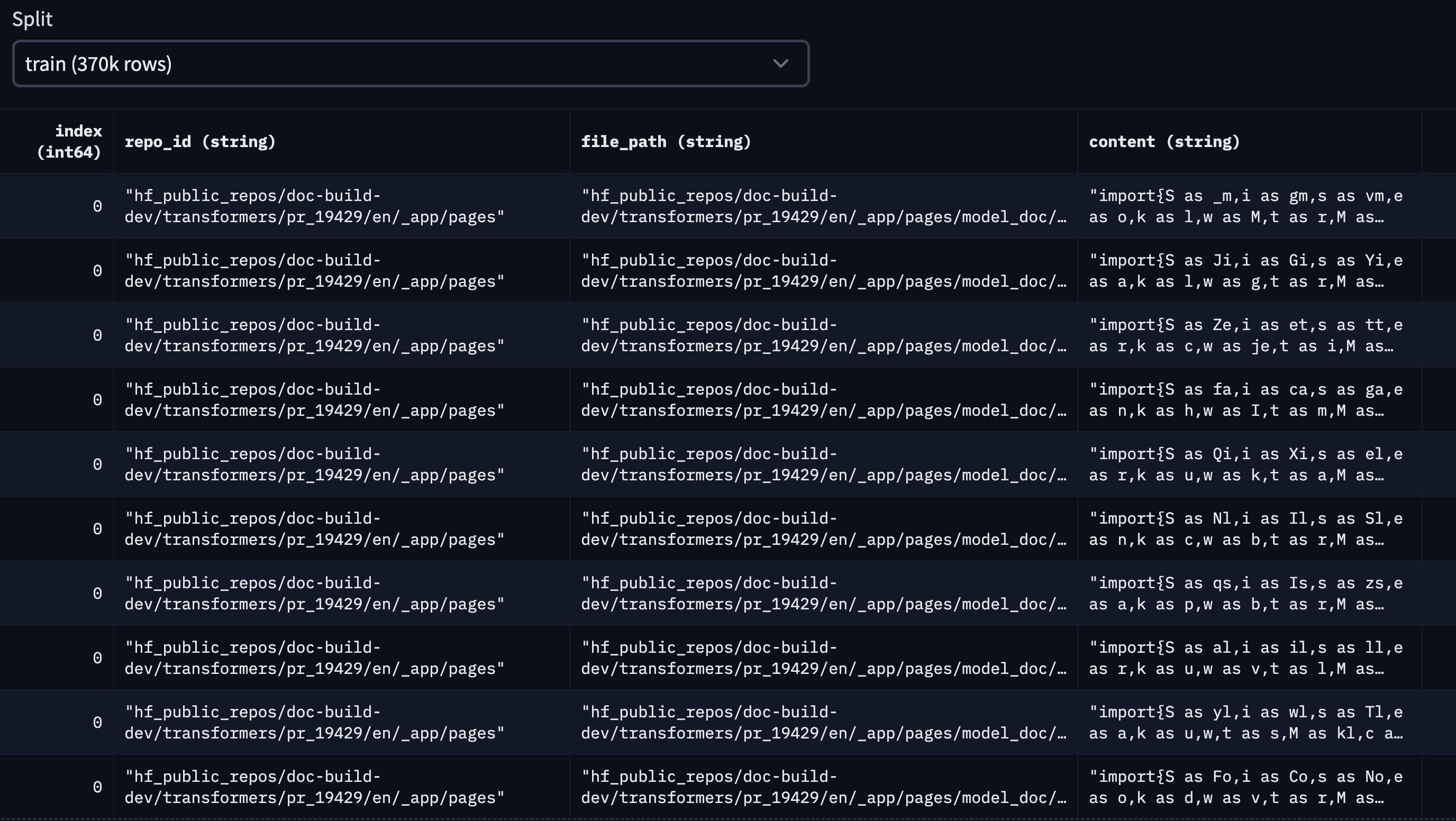

Personal Copilot: Train Your Own Coding Assistant10 abril 2025

Personal Copilot: Train Your Own Coding Assistant10 abril 2025 -

Morgan State University - Maryland's Preeminent Urban Public10 abril 2025

você pode gostar

-

Leak: Trapped in a Dating Sim vai ter segunda temporada10 abril 2025

Leak: Trapped in a Dating Sim vai ter segunda temporada10 abril 2025 -

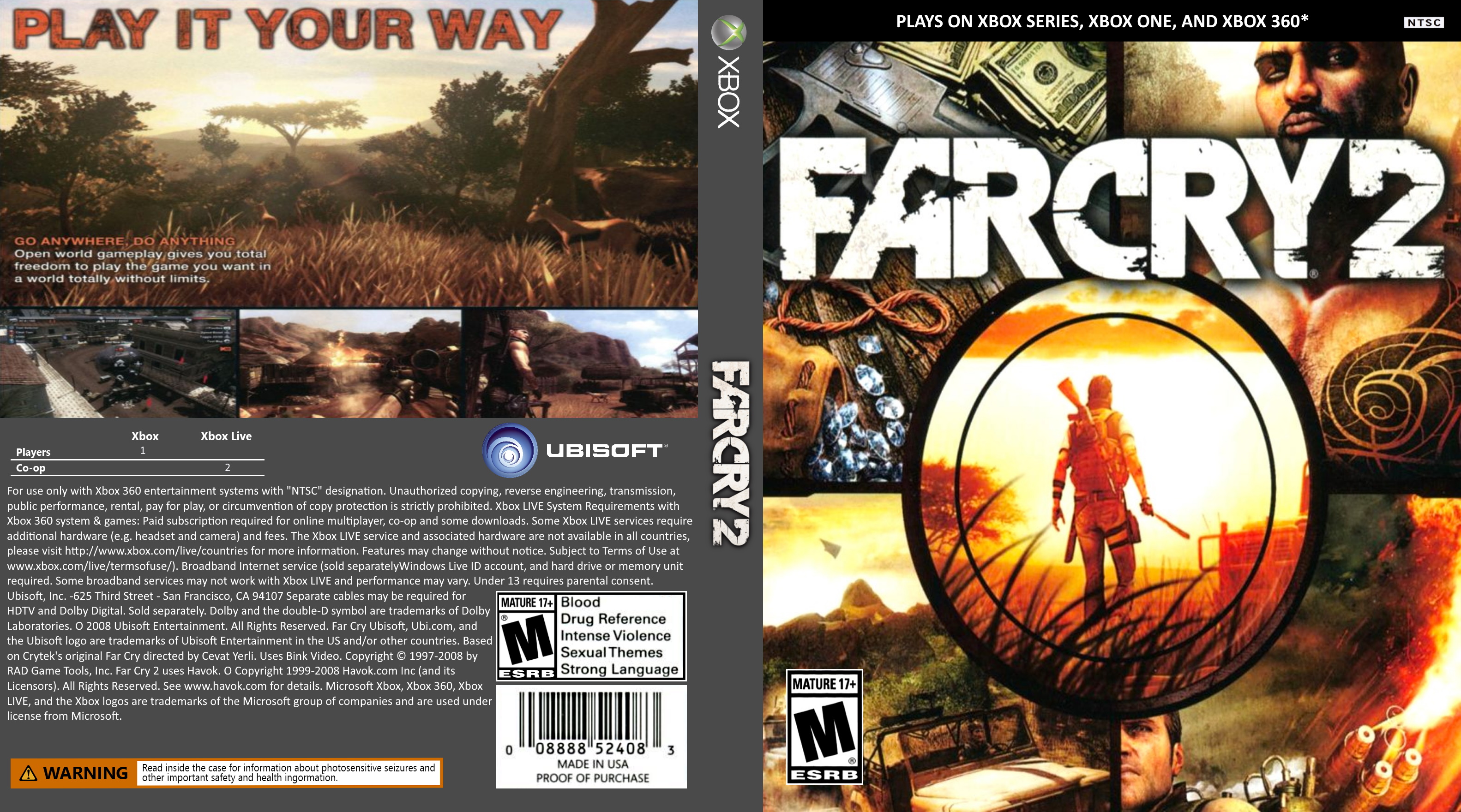

Far Cry 2 by SnowCoveredPlains on DeviantArt10 abril 2025

Far Cry 2 by SnowCoveredPlains on DeviantArt10 abril 2025 -

Basquete: São Paulo estreia na Champions das Américas em busca do bi10 abril 2025

Basquete: São Paulo estreia na Champions das Américas em busca do bi10 abril 2025 -

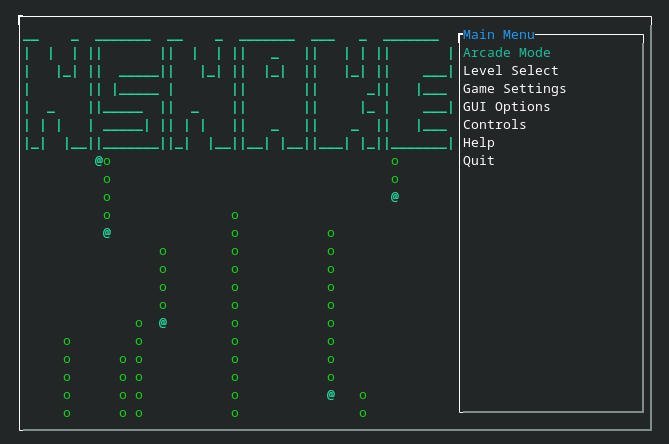

Enjoy the Classic Snake Game in Your Linux Terminal10 abril 2025

Enjoy the Classic Snake Game in Your Linux Terminal10 abril 2025 -

How good can you get at chess by just completing puzzles, (specifically the training on Lichess app)? - Quora10 abril 2025

How good can you get at chess by just completing puzzles, (specifically the training on Lichess app)? - Quora10 abril 2025 -

BULLY Speedrun (Any% NCS: 2 hours, 35 minutes, 20 seconds)10 abril 2025

BULLY Speedrun (Any% NCS: 2 hours, 35 minutes, 20 seconds)10 abril 2025 -

xadrez-titãs APK (Android Game) - Baixar Grátis10 abril 2025

-

Chutzpah Season 1 Series Review - Popcorn Reviewss10 abril 2025

Chutzpah Season 1 Series Review - Popcorn Reviewss10 abril 2025 -

Simescu Radu: Rating FIDE Online Arena10 abril 2025

Simescu Radu: Rating FIDE Online Arena10 abril 2025 -

Frango Xadrez Swift 350g - Swift10 abril 2025

Frango Xadrez Swift 350g - Swift10 abril 2025