MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Last updated 12 abril 2025

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

CRSPL on LinkedIn: #crspl #thecrspl #crspltech #crspltechnologies #businessgrowthstrategy…

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZZKLJYCN3JNXNBKEVV2V3ELZGQ.jpg)

China extends tax breaks for foreign workers until 2027

Benefits And Challenges Of Sending Overseas

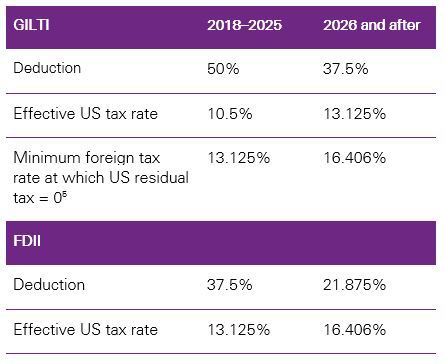

United States - Taxation of cross-border M&A - KPMG Global

Tax Challenges for German Industry in the People's Republic of China by Bundesverband der Deutschen Industrie e.V. - Issuu

How Much Do U.S. Multinational Corporations Pay in Foreign Income Taxes?

How do companies avoid paying international taxes?

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DY66ULGMPJN3RKE7MFTAOF5374.jpg)

COVID-19's new expatriate employees

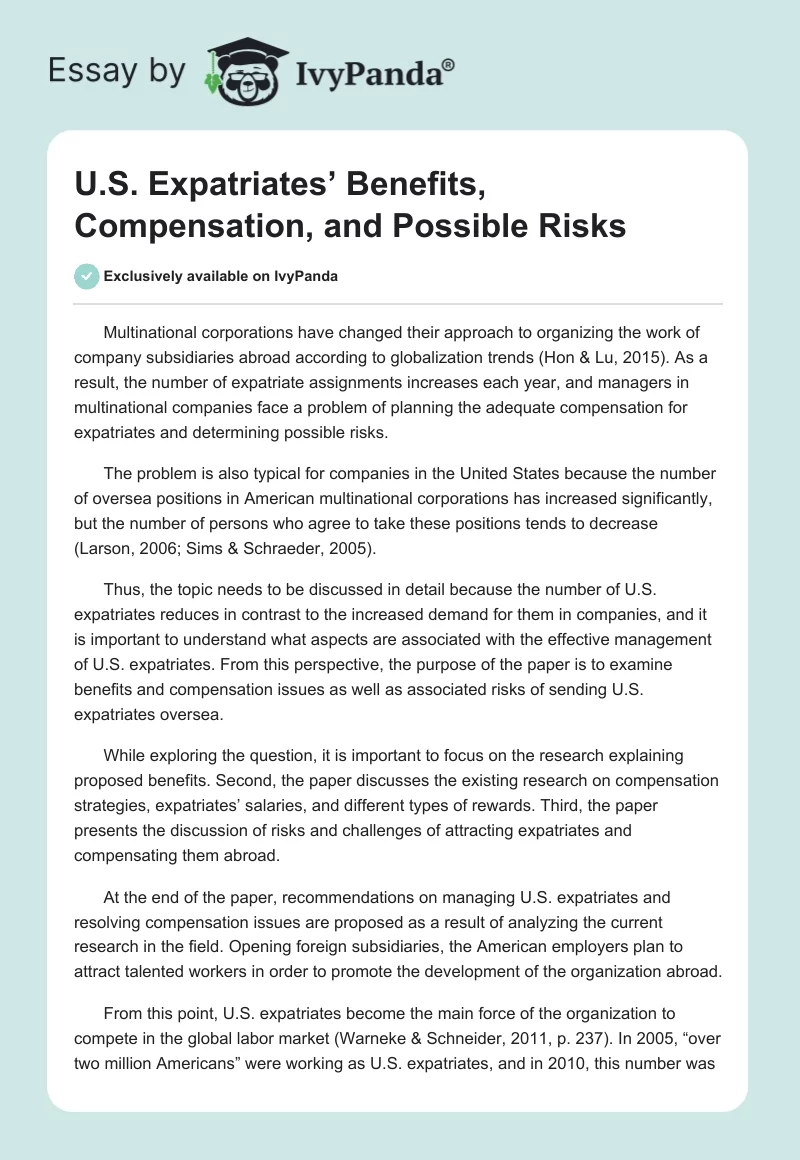

U.S. Expatriates' Benefits, Compensation, and Possible Risks - 4248 Words

India arms of 1,000 MNCs asked to pay GST on expat salaries, allowances

Recomendado para você

-

Dantiano Contract Wars Gameplay: Guia do novato, habilidades, armas e armaduras12 abril 2025

Dantiano Contract Wars Gameplay: Guia do novato, habilidades, armas e armaduras12 abril 2025 -

How Covid-19 is escalating problem debt12 abril 2025

-

The Price of Sausages: The Telegraph's Calculator of Hate' – Byline Times12 abril 2025

The Price of Sausages: The Telegraph's Calculator of Hate' – Byline Times12 abril 2025 -

Customs Bonds Financial Assessments12 abril 2025

Customs Bonds Financial Assessments12 abril 2025 -

Reminder for students to get their bursary applications in12 abril 2025

Reminder for students to get their bursary applications in12 abril 2025 -

Finally, An Open Source Calculator12 abril 2025

Finally, An Open Source Calculator12 abril 2025 -

AT&T snaps up Sony Ericsson Xperia X10 - CNET12 abril 2025

AT&T snaps up Sony Ericsson Xperia X10 - CNET12 abril 2025 -

Kyle Tucker: The Man and His Dream Contract12 abril 2025

Kyle Tucker: The Man and His Dream Contract12 abril 2025 -

How To Calculate and Increase Customer Lifetime Value12 abril 2025

How To Calculate and Increase Customer Lifetime Value12 abril 2025 -

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZWU3JII6UBDQ5AKZNBKJI4RTIU.jpg) The Blocksize Wars Revisited: How Bitcoin's Civil War About12 abril 2025

The Blocksize Wars Revisited: How Bitcoin's Civil War About12 abril 2025

você pode gostar

-

O que é empatia e como trabalhar ela no ambiente de trabalho?12 abril 2025

O que é empatia e como trabalhar ela no ambiente de trabalho?12 abril 2025 -

Did I noclip? : r/backrooms12 abril 2025

Did I noclip? : r/backrooms12 abril 2025 -

BF5 game Saber model with Animations!!! Free Model by Rjiig123 on DeviantArt12 abril 2025

BF5 game Saber model with Animations!!! Free Model by Rjiig123 on DeviantArt12 abril 2025 -

elfen lied - Who was this girl by Lucy in special episode 10.512 abril 2025

elfen lied - Who was this girl by Lucy in special episode 10.512 abril 2025 -

Emilio Sansolini on X: #Galatasaray vs #Beşiktaş 🇹🇷💪 / X12 abril 2025

Emilio Sansolini on X: #Galatasaray vs #Beşiktaş 🇹🇷💪 / X12 abril 2025 -

Miraculous Ladybug Season 5 episode 10 This is Halloween Part 3 - BiliBili12 abril 2025

Miraculous Ladybug Season 5 episode 10 This is Halloween Part 3 - BiliBili12 abril 2025 -

GT Stunt Car Game - Car Games for Android - Download12 abril 2025

GT Stunt Car Game - Car Games for Android - Download12 abril 2025 -

imgs./1558554035/1xg.jpg12 abril 2025

imgs./1558554035/1xg.jpg12 abril 2025 -

Fada Dos Dentes Em Uma Fantasia De Bruxa E Dentes Em Um Truque De Fantasia De Vampiro Esboçado Para Coloração Em Branco Ilustração do Vetor - Ilustração de bandeira, feliz: 23392786012 abril 2025

Fada Dos Dentes Em Uma Fantasia De Bruxa E Dentes Em Um Truque De Fantasia De Vampiro Esboçado Para Coloração Em Branco Ilustração do Vetor - Ilustração de bandeira, feliz: 23392786012 abril 2025 -

Elon Musk vs Mark Zuckerberg. Who would win?12 abril 2025