Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 27 março 2025

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

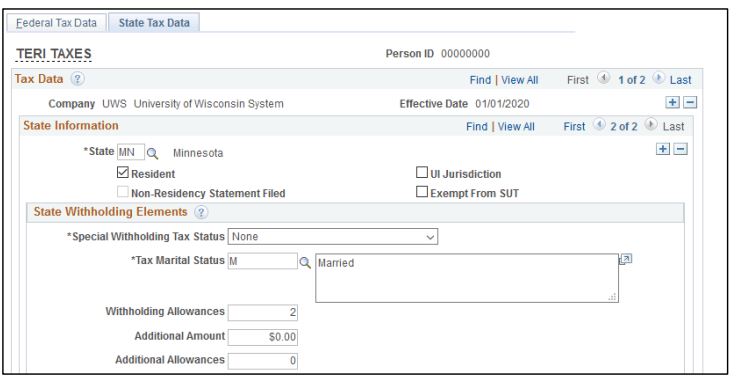

UW–Shared Services KnowledgeBase

Which Employees Are Exempt From Tax Withholding?

FICA Tax Exemption for Nonresident Aliens Explained

What Is FICA Tax: How It Works And Why You Pay

How to Legally Hire Independent Contractors Worldwide

Who Is Exempt from Paying Social Security Tax? - TurboTax Tax Tips

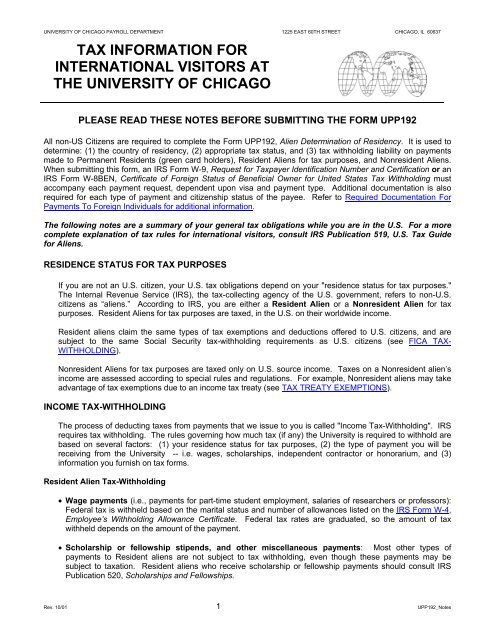

UPP 192 Instructions - University of Chicago

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained: Types and How It's Calculated

FICA Tax Exemption for Nonresident Aliens Explained

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040-NR: U.S. Nonresident Alien Income Tax Return Explained

Which Employees Are Exempt From Tax Withholding?

Recomendado para você

-

What is FICA27 março 2025

What is FICA27 março 2025 -

What Is FICA Tax: How It Works And Why You Pay27 março 2025

What Is FICA Tax: How It Works And Why You Pay27 março 2025 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?27 março 2025

FICA Tax Rate: What is the percentage of this tax and how you can calculated?27 março 2025 -

What Is the FICA Tax and Why Does It Exist? - TheStreet27 março 2025

What Is the FICA Tax and Why Does It Exist? - TheStreet27 março 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)27 março 2025

2023 FICA Tax Limits and Rates (How it Affects You)27 março 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review27 março 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review27 março 2025 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence27 março 2025

The FICA Tax: How Social Security Is Funded – Social Security Intelligence27 março 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social27 março 2025

-

How An S Corporation Reduces FICA Self-Employment Taxes27 março 2025

How An S Corporation Reduces FICA Self-Employment Taxes27 março 2025 -

What is the FICA Tax Refund? - Boundless27 março 2025

What is the FICA Tax Refund? - Boundless27 março 2025

você pode gostar

-

Tengen Toppa Gurren Lagann & 9 Other Gigantic Anime Mecha, Ranked27 março 2025

Tengen Toppa Gurren Lagann & 9 Other Gigantic Anime Mecha, Ranked27 março 2025 -

Trash Talkers Stock Photo - Download Image Now - Slander, 201527 março 2025

Trash Talkers Stock Photo - Download Image Now - Slander, 201527 março 2025 -

Asda launches influencer 'content house' in Yorkshire Dales, News27 março 2025

Asda launches influencer 'content house' in Yorkshire Dales, News27 março 2025 -

Flavio Bianchi (Genoa) celebrates after scoring a goal during27 março 2025

Flavio Bianchi (Genoa) celebrates after scoring a goal during27 março 2025 -

Pokémon Ultra Sun and Ultra Moon ROM & CIA - Nintendo 3DS Game27 março 2025

Pokémon Ultra Sun and Ultra Moon ROM & CIA - Nintendo 3DS Game27 março 2025 -

Ganhe ouro com o código no Blox Fruits! - Blox Fruits27 março 2025

Ganhe ouro com o código no Blox Fruits! - Blox Fruits27 março 2025 -

Google Play Music para Android - Baixe o APK na Uptodown27 março 2025

-

LA VOZ DEL FUTSAL. Desde 1998, un sitio con todo el sentimiento del Fútbol Sala de AFA: UAI URQUIZA JUGARÁ CON REGATAS ROSARIO Y UN COMBINADO DE LAFA27 março 2025

LA VOZ DEL FUTSAL. Desde 1998, un sitio con todo el sentimiento del Fútbol Sala de AFA: UAI URQUIZA JUGARÁ CON REGATAS ROSARIO Y UN COMBINADO DE LAFA27 março 2025 -

Pokemon Genesect (Shock) / Shiny / 3x, 30lvl PTC Acc27 março 2025

Pokemon Genesect (Shock) / Shiny / 3x, 30lvl PTC Acc27 março 2025 -

Obito Uchiha Naruto Anime Series Matte Finish Poster Paper Print - Animation & Cartoons posters in India - Buy art, film, design, movie, music, nature and educational paintings/wallpapers at27 março 2025

Obito Uchiha Naruto Anime Series Matte Finish Poster Paper Print - Animation & Cartoons posters in India - Buy art, film, design, movie, music, nature and educational paintings/wallpapers at27 março 2025