Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 09 abril 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Top 10 Tax Penalties and How to Avoid Them

For those who pay estimated taxes, second quarter June 15 deadline approaches – Larson Accouting

How Retirees Can Avoid Paying Quarterly Taxes Without Getting Penalized – Financial Success MD

What Is The Penalty For Failure To File Taxes?

How to Avoid Tax Underpayment Penalties When Performing a Roth Conversion!

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

Underpayment Penalty? Turbo Tax tells me I may owe?

All About Estimated Tax Penalty Rate & How To Avoid It

Tax Penalties and Interest: IRS Tax Penalty Details For Many Situations

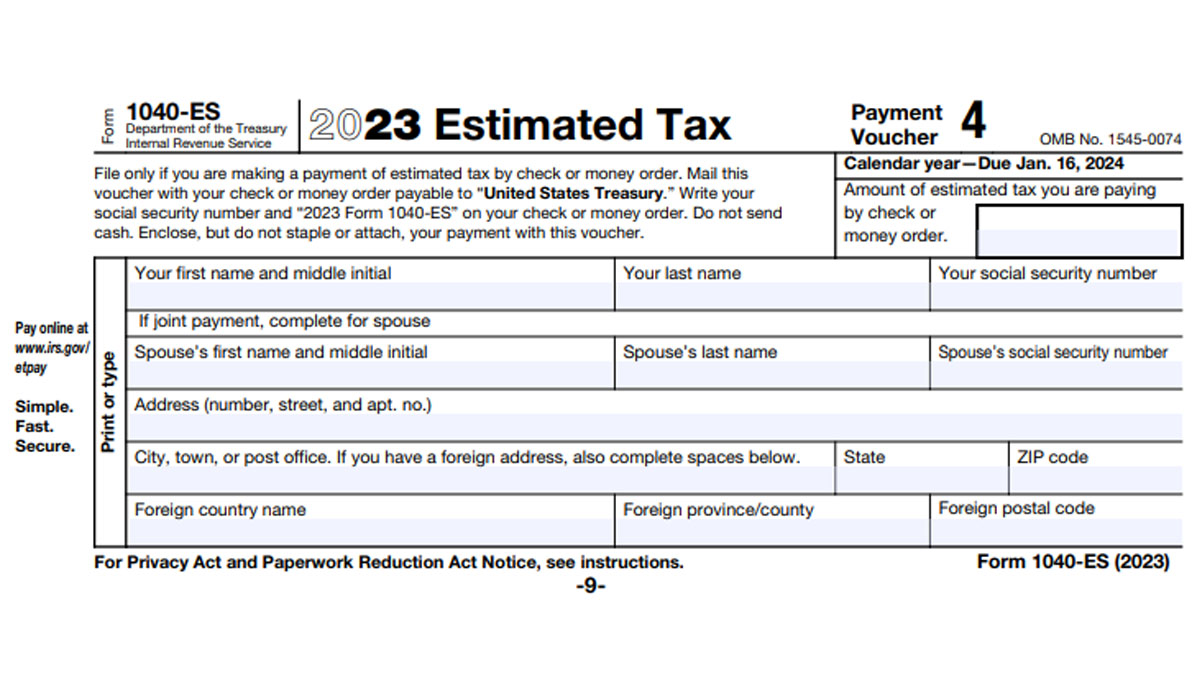

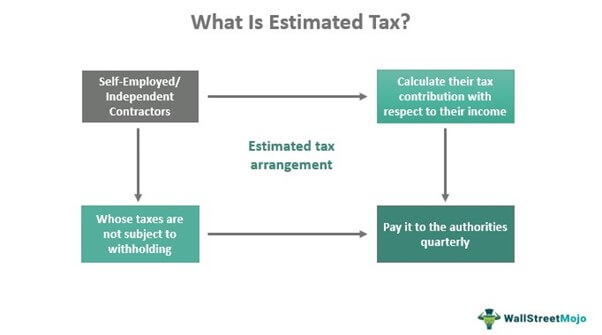

Estimated Tax - Definition, Calculation, Examples, Penalties

Safe harbors and other ways to avoid estimated tax penalties - Don't Mess With Taxes

Recomendado para você

-

Why penalty shootouts, despite their problems, are here to stay09 abril 2025

Why penalty shootouts, despite their problems, are here to stay09 abril 2025 -

Soccer Penalty Kicks: Rules and Strategies09 abril 2025

Soccer Penalty Kicks: Rules and Strategies09 abril 2025 -

Penalty pain: Players converted just 4 of the first 8 penalty09 abril 2025

-

Penalty kicks may be predictable09 abril 2025

Penalty kicks may be predictable09 abril 2025 -

The science behind penalty shootouts: Analysis and probabilities09 abril 2025

The science behind penalty shootouts: Analysis and probabilities09 abril 2025 -

How to score a penalty in EA FC 24: Tips & tricks for penalties09 abril 2025

How to score a penalty in EA FC 24: Tips & tricks for penalties09 abril 2025 -

Australia Beats France on Penalties to Reach World Cup Semifinals09 abril 2025

Australia Beats France on Penalties to Reach World Cup Semifinals09 abril 2025 -

How many penalties have there been at the World Cup 2022?09 abril 2025

How many penalties have there been at the World Cup 2022?09 abril 2025 -

What Is The Difference Between Penalty And Free Kick In Football09 abril 2025

What Is The Difference Between Penalty And Free Kick In Football09 abril 2025 -

Get Penalty Kick Soccer Game - Microsoft Store en-GB09 abril 2025

você pode gostar

-

Al-Hilal seeking history in FIFA Club World Cup final against09 abril 2025

Al-Hilal seeking history in FIFA Club World Cup final against09 abril 2025 -

LinkedIn at 20: how a new breed of influencer is transforming the09 abril 2025

LinkedIn at 20: how a new breed of influencer is transforming the09 abril 2025 -

A Plague Tale: Innocence Chapter 2 Walkthrough Guide – The Strangers09 abril 2025

A Plague Tale: Innocence Chapter 2 Walkthrough Guide – The Strangers09 abril 2025 -

TUTORIAIS & EXTRAS - Football Manager09 abril 2025

TUTORIAIS & EXTRAS - Football Manager09 abril 2025 -

Desenhos para colorir, desenhar e pintar : Desenhos para colorir, cachorro dalmatas09 abril 2025

Desenhos para colorir, desenhar e pintar : Desenhos para colorir, cachorro dalmatas09 abril 2025 -

Free 2D UFO Sprites - Royalty Free 2D Game assets09 abril 2025

Free 2D UFO Sprites - Royalty Free 2D Game assets09 abril 2025 -

cajas de blox fruit con codigos walmart|Búsqueda de TikTok09 abril 2025

-

Revestimento com pedra moledo natural09 abril 2025

Revestimento com pedra moledo natural09 abril 2025 -

The manga art is legendary, but can we also appreciate the 199709 abril 2025

The manga art is legendary, but can we also appreciate the 199709 abril 2025 -

Online Gaming Platforms for Employee Engagement Practices09 abril 2025

Online Gaming Platforms for Employee Engagement Practices09 abril 2025