Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Last updated 09 abril 2025

:max_bytes(150000):strip_icc()/Tier_1_Capital_Ratio_final_v3-057aabaee3b247228bde4b73c66ae9de.png)

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

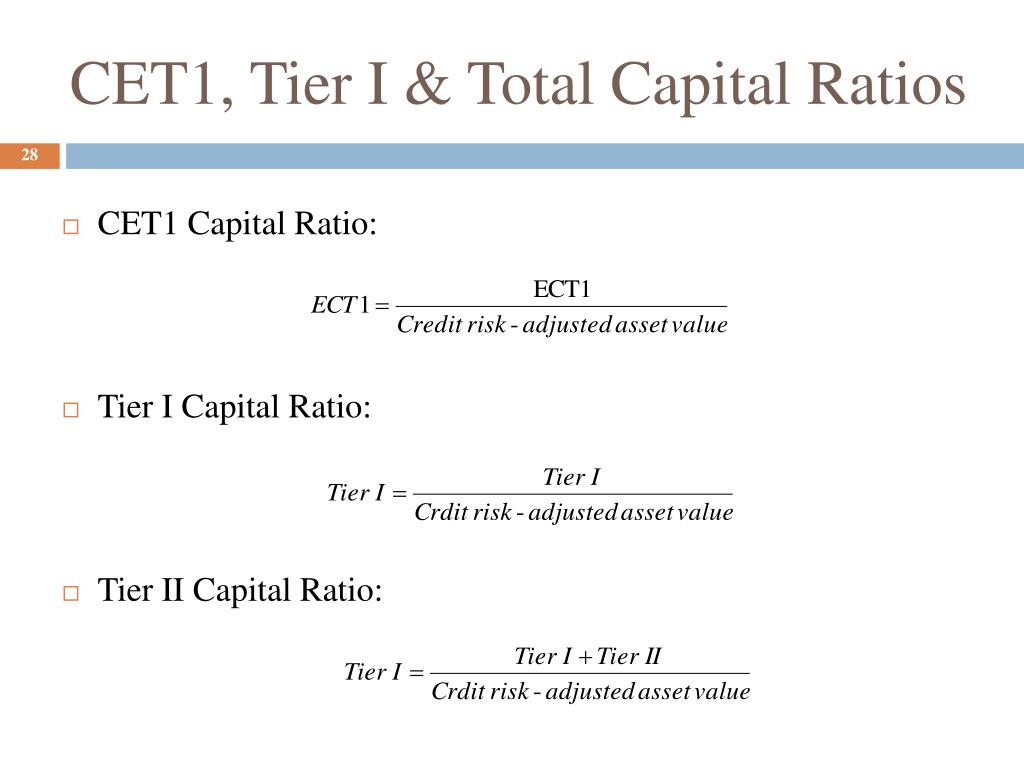

PPT - Capital adequacy PowerPoint Presentation, free download - ID:6926836

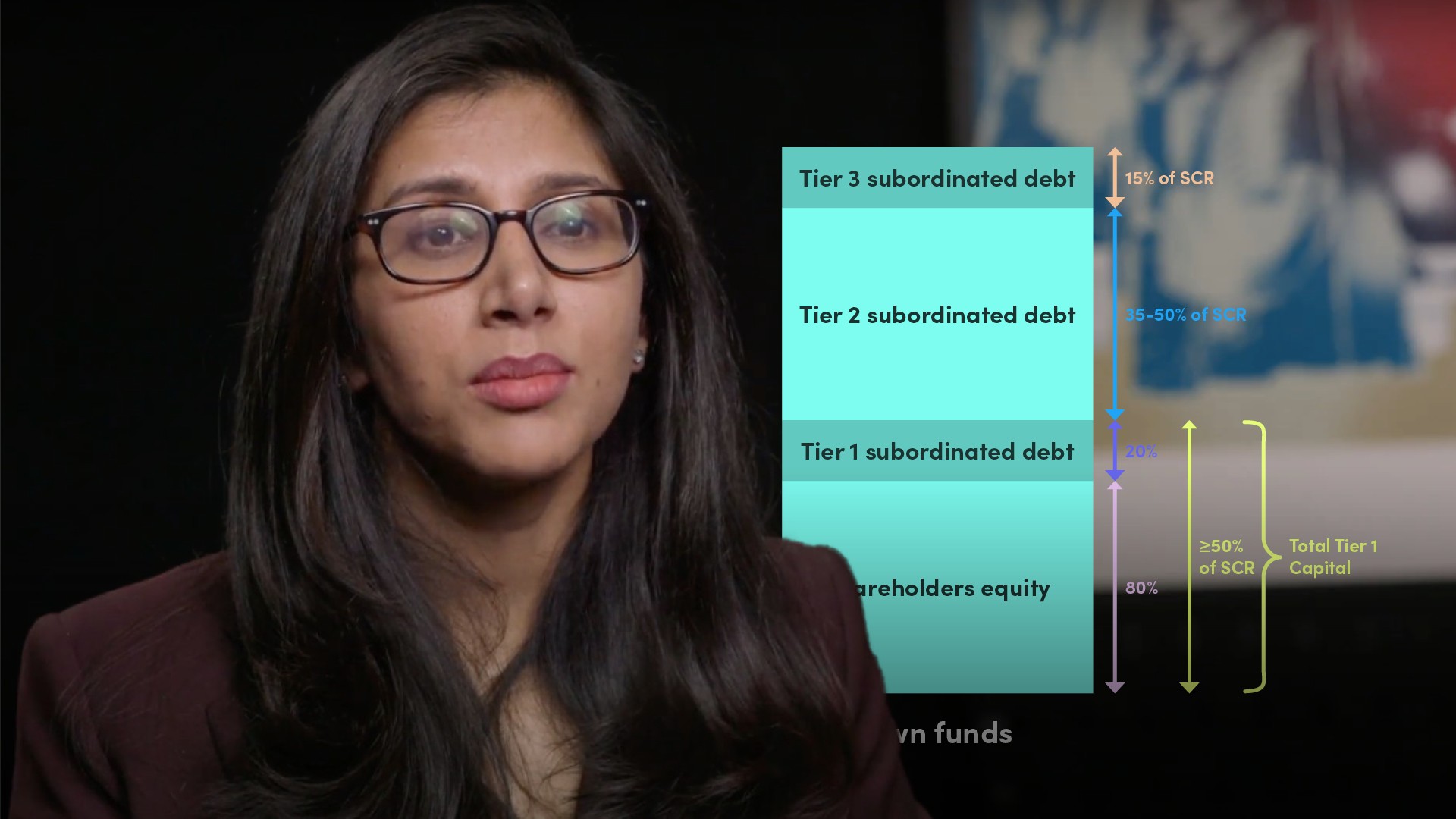

EU Solvency II Capital Requirements Illustration - Finance Unlocked

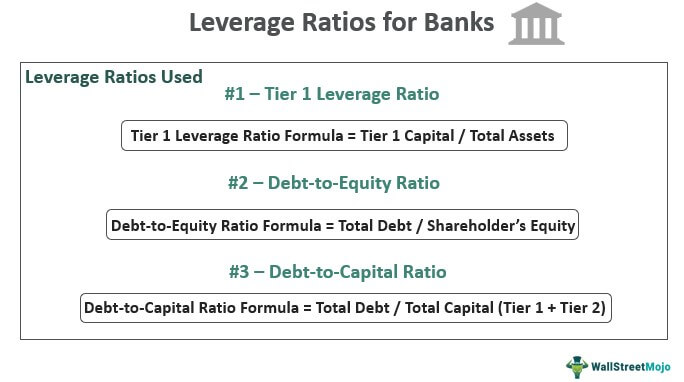

Leverage Ratios for Banks - Definition, Top 3 Leverage Ratios

What is Capital Adequacy Ratio?

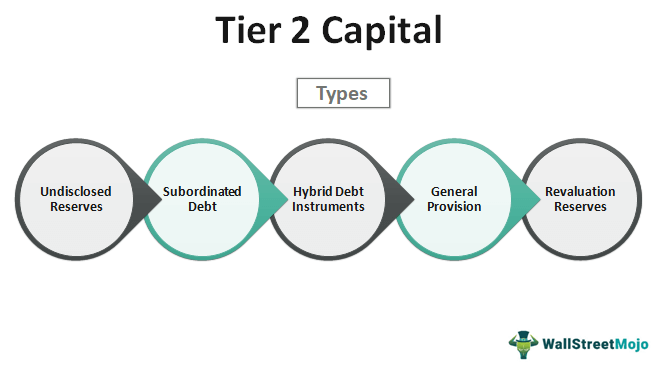

Tier 2 Capital (Meaning, Characteristics)

Average Tier 1 (Total) Capital Ratio and the Tier 1 Leverage Ratio for

Tier 1 Common Capital Ratio: Meaning, Overview, Example

Debt to Equity Ratio - How to Calculate Leverage, Formula, Examples

:max_bytes(150000):strip_icc()/CapitalizationRatios-FINAL-99311834a888422ba70e750cb9144ad9.png)

Capitalization Ratios: Types, Examples and Their Significance

Recomendado para você

-

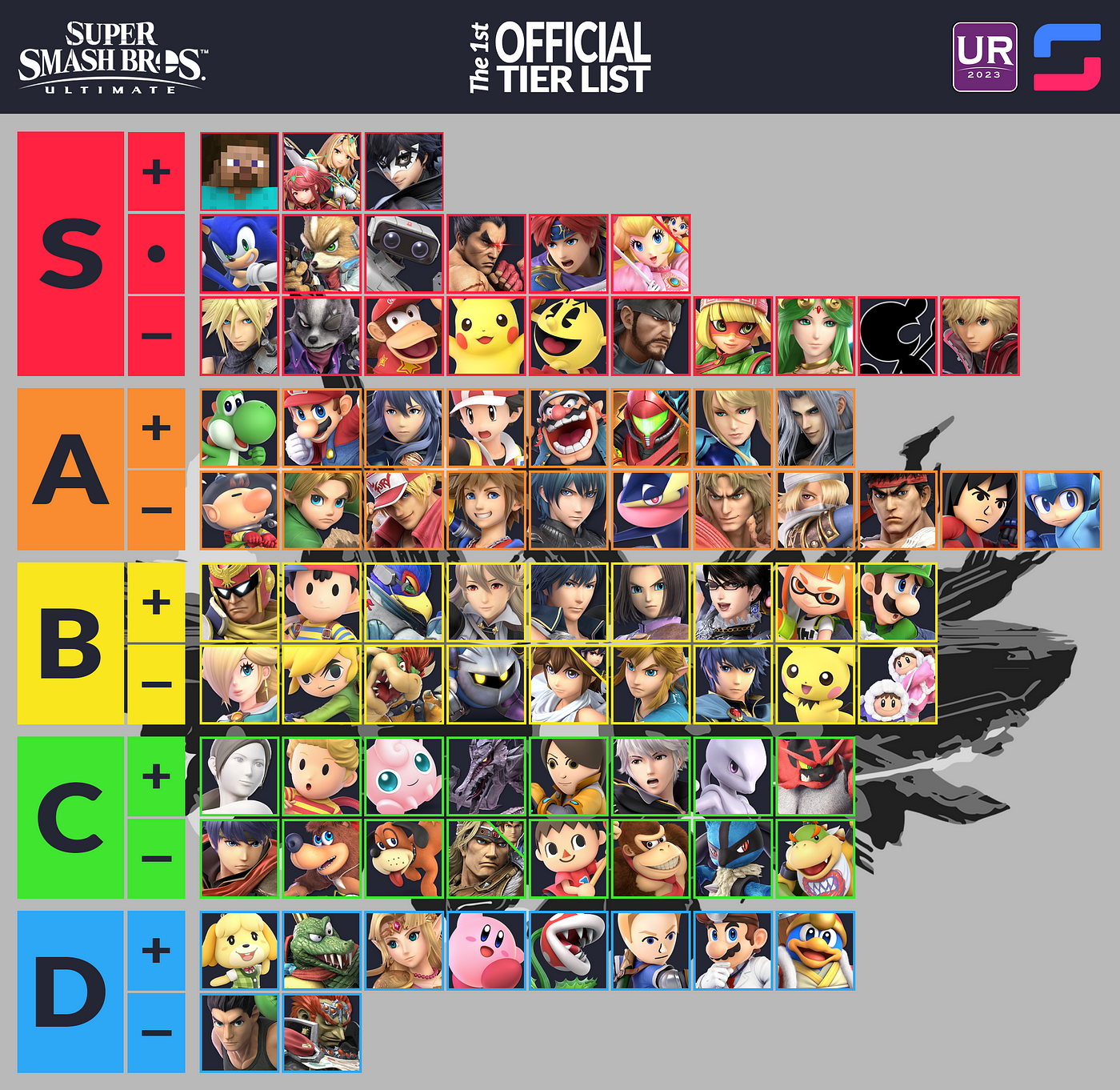

UltRank's First Official SSBU Tier List, by Barnard's Loop09 abril 2025

UltRank's First Official SSBU Tier List, by Barnard's Loop09 abril 2025 -

Top Tier Facebook09 abril 2025

-

Flawed, yet still top tier ❤🧡💯✓09 abril 2025

-

Top Tier Life09 abril 2025

-

Corporate tiering strategies allow schools to focus engagement09 abril 2025

Corporate tiering strategies allow schools to focus engagement09 abril 2025 -

Top Tier Showmen09 abril 2025

-

About, Top Tier Energy09 abril 2025

About, Top Tier Energy09 abril 2025 -

Top Tier Bakery09 abril 2025

-

Top Tier Accounting ® (@toptieraccountingservices) • Instagram09 abril 2025

-

Tier list meaning: How fighting games kicked off a bizarre09 abril 2025

Tier list meaning: How fighting games kicked off a bizarre09 abril 2025

você pode gostar

-

SIM EU DOU MEU CU PRA ROCKSTAR INDEPENDENTEMENTE DO QUE ELA FIZER09 abril 2025

SIM EU DOU MEU CU PRA ROCKSTAR INDEPENDENTEMENTE DO QUE ELA FIZER09 abril 2025 -

The Quintessential Quintuplets Movie Booster Box Weiss Schwarz09 abril 2025

The Quintessential Quintuplets Movie Booster Box Weiss Schwarz09 abril 2025 -

Bolo flor de milho da Dona Julieta – Blog Deli&Co.09 abril 2025

Bolo flor de milho da Dona Julieta – Blog Deli&Co.09 abril 2025 -

Mortal Kombat Online (@MK_Online) / X09 abril 2025

-

The Game Awards on X: Congratulations Ghost of Tsushima and @SuckerPunchProd -- the fans have chosen you as their pick for Player's Voice! / X09 abril 2025

The Game Awards on X: Congratulations Ghost of Tsushima and @SuckerPunchProd -- the fans have chosen you as their pick for Player's Voice! / X09 abril 2025 -

With 'Obi-Wan Kenobi', Moses Ingram sets her sights on the stars - Vogue Australia09 abril 2025

-

Hajime No Ippo - WP by INADIRR on DeviantArt09 abril 2025

Hajime No Ippo - WP by INADIRR on DeviantArt09 abril 2025 -

Explore the Best Protegent Art09 abril 2025

Explore the Best Protegent Art09 abril 2025 -

Microestadio Club Atlético Atlanta :: Argentina :: Página do09 abril 2025

Microestadio Club Atlético Atlanta :: Argentina :: Página do09 abril 2025 -

:strip_icc()/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2021/V/W/5rKL7zR26ZBuGzVVNcmg/pokemon-go-inkay-malamar-espetaculo-psiquico.jpg) Pokémon GO tem Inkay e Malamar em Espetáculo Psíquico; como evoluir09 abril 2025

Pokémon GO tem Inkay e Malamar em Espetáculo Psíquico; como evoluir09 abril 2025