Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Por um escritor misterioso

Last updated 07 abril 2025

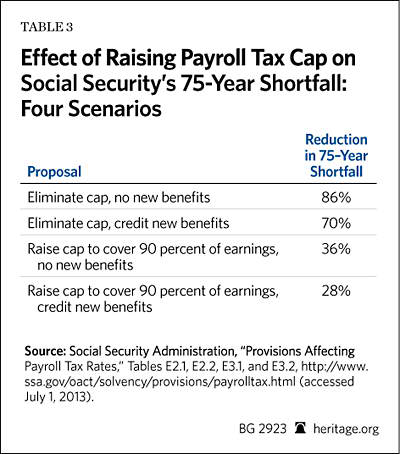

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Unfair Cap Means Millionaires Stop Contributing to Social Security

Social Security to Run Dry in 2034 - SmartReads by SmartAsset

7 changes Americans are willing to make to fix Social Security

Raising the Social Security Payroll Tax Cap: Solving Nothing

Social Security recipients get 8.7% cost-of-living increase, the

Is 'Married Filing Separately' For Better or For Worse? It Depends

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Why Is There a Cap on the FICA Tax?

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Social Security Reform: Ensuring the System s Sustainability

What 8.7% Social Security COLA for 2023 means for taxes on benefits

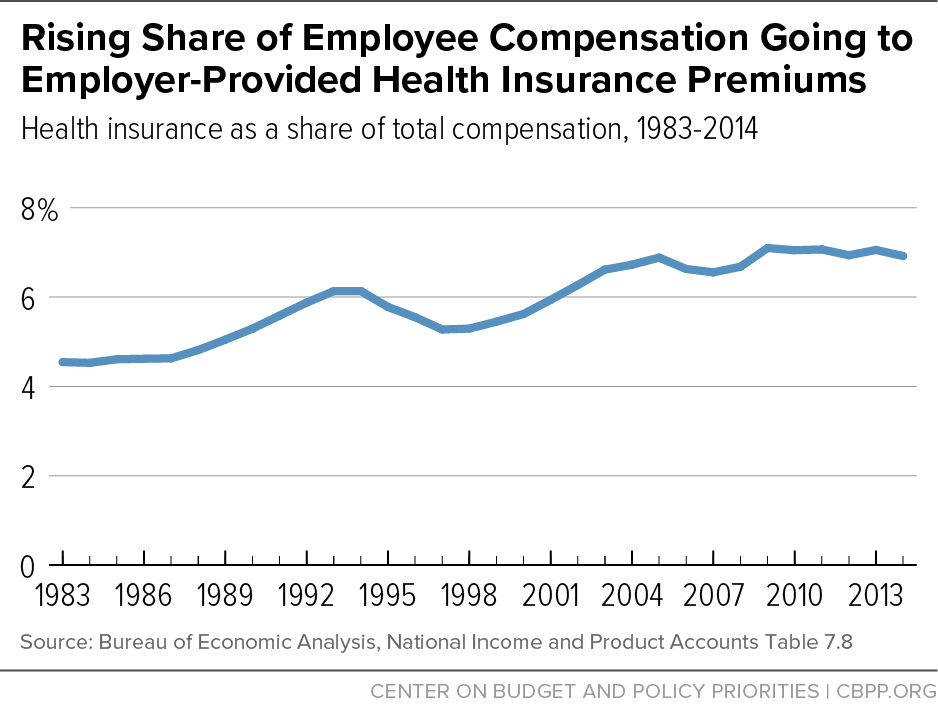

Increasing Payroll Taxes Would Strengthen Social Security

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck07 abril 2025

What is Fica Tax?, What is Fica on My Paycheck07 abril 2025 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations07 abril 2025

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations07 abril 2025 -

Social Security and Medicare • Teacher Guide07 abril 2025

-

What is the FICA Tax Refund?07 abril 2025

What is the FICA Tax Refund?07 abril 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?07 abril 2025

Do You Have To Pay Tax On Your Social Security Benefits?07 abril 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto07 abril 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto07 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax07 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax07 abril 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and07 abril 2025

-

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student07 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student07 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers07 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers07 abril 2025

você pode gostar

-

NOVELINHA:Nascimento d filha da Barbie - Dailymotion Video07 abril 2025

-

Brooklyn Beckham and Chloe Grace Moretz - A timeline of their07 abril 2025

Brooklyn Beckham and Chloe Grace Moretz - A timeline of their07 abril 2025 -

:max_bytes(150000):strip_icc()/the-benefits-of-apple-pectin-89599-primary-recirc-4b2e24390d60442ea9f20a40e869069b.jpg) Apple Pectin: Uses, Benefits, Side Effects, Dosage07 abril 2025

Apple Pectin: Uses, Benefits, Side Effects, Dosage07 abril 2025 -

Sonic.EXE (Gorehog) Concept by sonicexeartist567 on DeviantArt07 abril 2025

Sonic.EXE (Gorehog) Concept by sonicexeartist567 on DeviantArt07 abril 2025 -

Propriedade (filme) – Wikipédia, a enciclopédia livre07 abril 2025

Propriedade (filme) – Wikipédia, a enciclopédia livre07 abril 2025 -

John Doe John Doe Roblox GIF - John Doe John Doe Roblox Roblox - Discover & Share GIFs07 abril 2025

John Doe John Doe Roblox GIF - John Doe John Doe Roblox Roblox - Discover & Share GIFs07 abril 2025 -

How to Make a Zombie, Are Zombies Real?07 abril 2025

How to Make a Zombie, Are Zombies Real?07 abril 2025 -

/cdn.vox-cdn.com/uploads/chorus_asset/file/19166504/Gears5_MicrosoftStudios_Getty_Ringer.jpg) Gears 5' Review: The 'Gears of War' Series Feels Fresh Again - The Ringer07 abril 2025

Gears 5' Review: The 'Gears of War' Series Feels Fresh Again - The Ringer07 abril 2025 -

Tower Defense Jogos de Guerra versão móvel andróide iOS apk baixar07 abril 2025

Tower Defense Jogos de Guerra versão móvel andróide iOS apk baixar07 abril 2025 -

Papa s Pancakeria To Go versão móvel andróide iOS apk baixar gratuitamente-TapTap07 abril 2025

Papa s Pancakeria To Go versão móvel andróide iOS apk baixar gratuitamente-TapTap07 abril 2025