FICA explained: Social Security and Medicare tax rates to know in 2023

Por um escritor misterioso

Last updated 21 março 2025

FICA Taxes Tax source Social Security Medicaid A. $3,720 C. $4,590

What is the FICA Tax and How Does It Work? - Ramsey

What Is Social Security Tax? Calculations & Reporting Information

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

2023 FICA Tax Limits and Rates (How it Affects You)

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

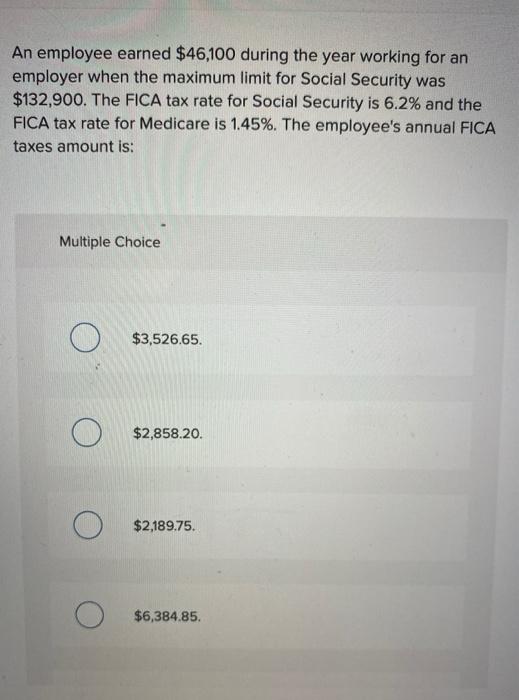

Solved An employee earned $46,100 during the year working

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

What Is FICA on a Paycheck? FICA Tax Explained - Chime

Recomendado para você

-

What is FICA21 março 2025

What is FICA21 março 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202321 março 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202321 março 2025 -

Historical Social Security and FICA Tax Rates for a Family of Four21 março 2025

Historical Social Security and FICA Tax Rates for a Family of Four21 março 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out21 março 2025

-

FICA Tax: Understanding Social Security and Medicare Taxes21 março 2025

-

FICA Refund: How to claim it on your 1040 Tax Return?21 março 2025

FICA Refund: How to claim it on your 1040 Tax Return?21 março 2025 -

What is the FICA Tax Refund? - Boundless21 março 2025

What is the FICA Tax Refund? - Boundless21 março 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax21 março 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax21 março 2025 -

What Eliminating FICA Tax Means for Your Retirement21 março 2025

-

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons21 março 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons21 março 2025

você pode gostar

-

Arrow Battle - 2 Player Games APK for Android Download21 março 2025

Arrow Battle - 2 Player Games APK for Android Download21 março 2025 -

Arquivo de corte topo de bolo mulher de costas21 março 2025

Arquivo de corte topo de bolo mulher de costas21 março 2025 -

Alguns pokemons que mereciam uma mega evolução21 março 2025

Alguns pokemons que mereciam uma mega evolução21 março 2025 -

Endgame Quotes - BrainyQuote21 março 2025

Endgame Quotes - BrainyQuote21 março 2025 -

Shikkakumon no Saikyou Kenja - Dublado – Episódio 9 Online - Hinata Soul21 março 2025

Shikkakumon no Saikyou Kenja - Dublado – Episódio 9 Online - Hinata Soul21 março 2025 -

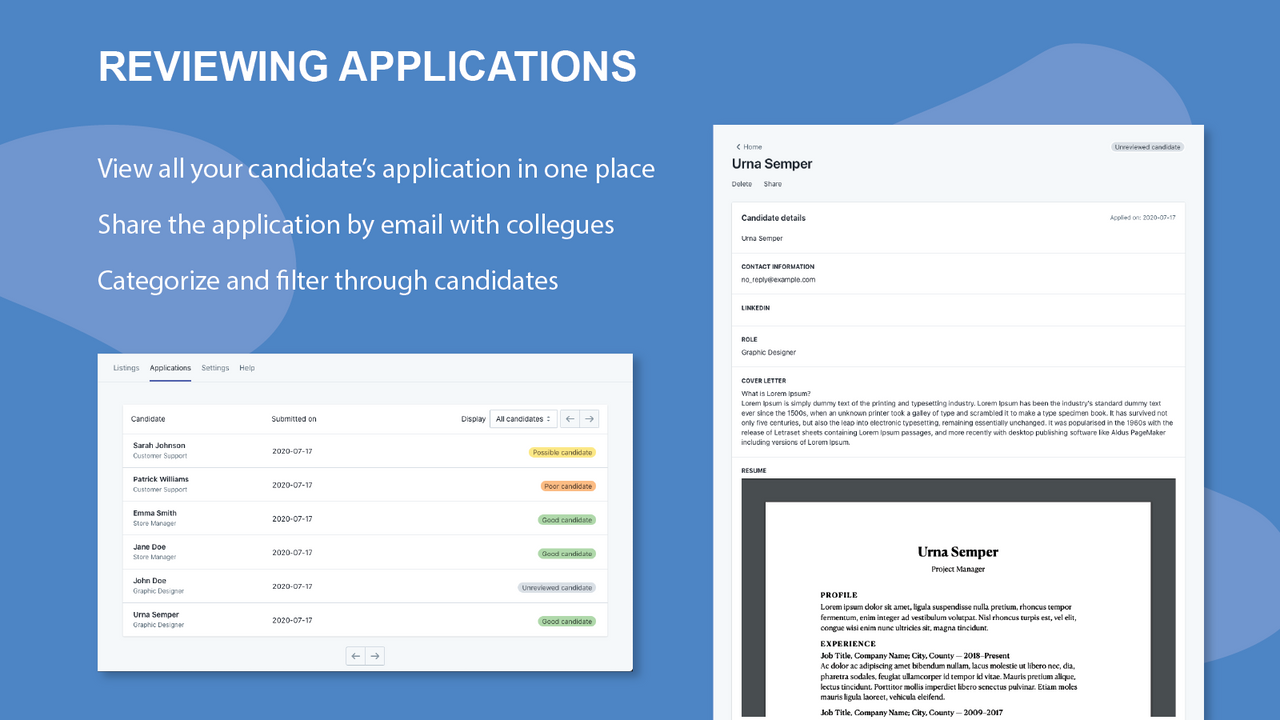

Careers Page Pro - Create a careers page, post jobs and collect applications21 março 2025

Careers Page Pro - Create a careers page, post jobs and collect applications21 março 2025 -

Stream Goofy Ahh Beat (DOMPLOSION) by domplosion21 março 2025

Stream Goofy Ahh Beat (DOMPLOSION) by domplosion21 março 2025 -

4 FOX LOGO Variations - video Dailymotion21 março 2025

-

Gregory van der Wiel en Rose Bertram verwachten tweede kind, Achterklap21 março 2025

Gregory van der Wiel en Rose Bertram verwachten tweede kind, Achterklap21 março 2025 -

Resultados Jogo Do Bicho21 março 2025