What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 25 abril 2025

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Tax Withholding Definition: When And How To Adjust IRS Tax Withholding

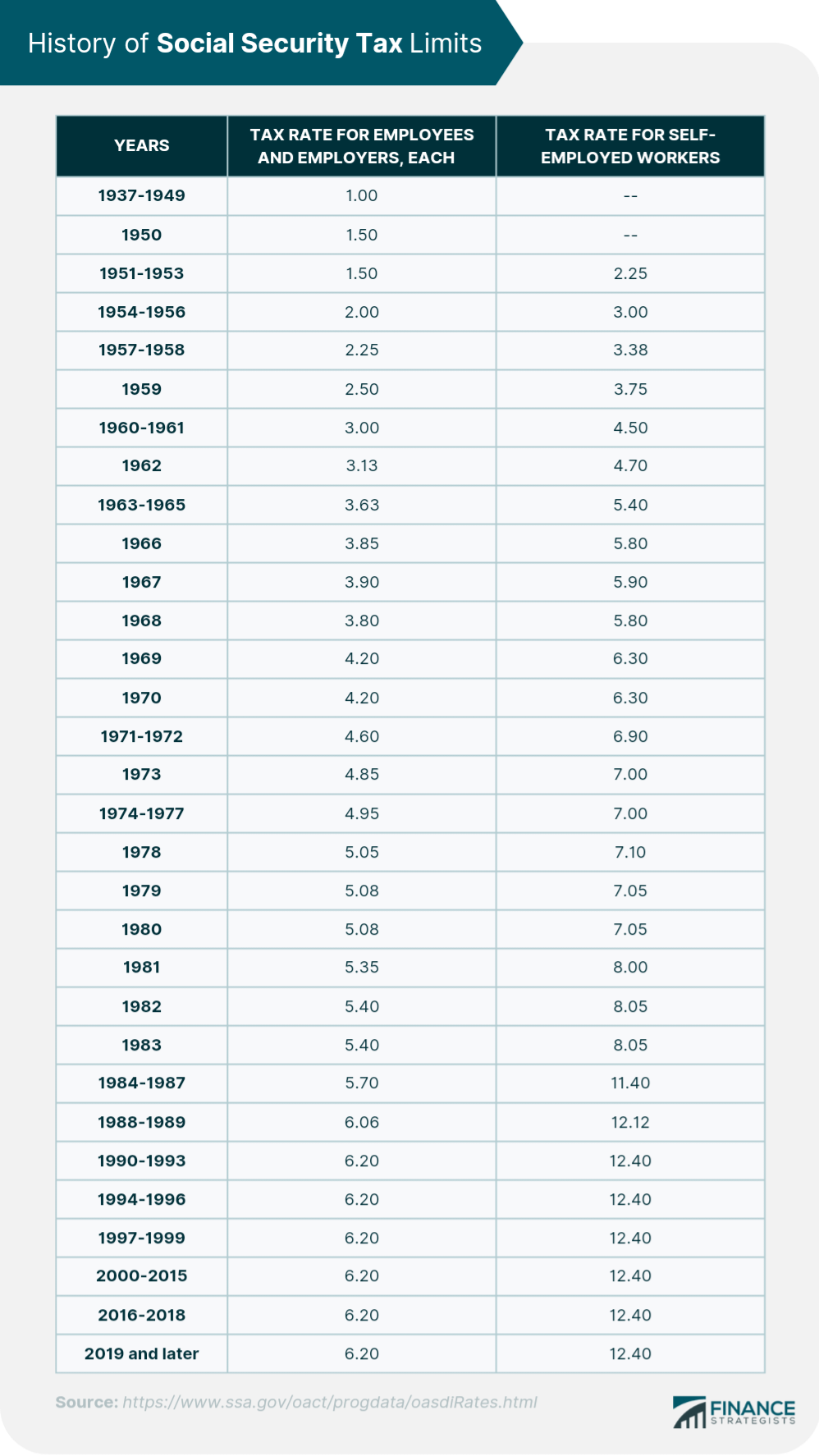

Social Security Tax Definition, How It Works, and Tax Limits

Clergy Taxes: Understanding Social Security: Medicare with IRS Pub 517 - FasterCapital

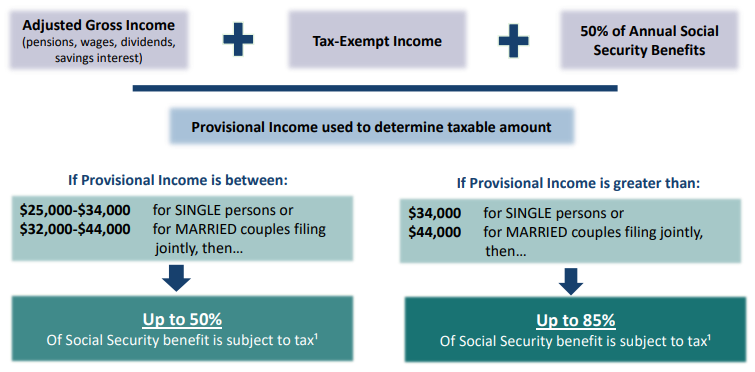

Avoid The Social Security Tax Trap

7 Things to Know About Social Security and Taxes

Types of Taxes – Income, Property, Goods, Services, Federal, State

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

How to Cut Your Social Security Taxes

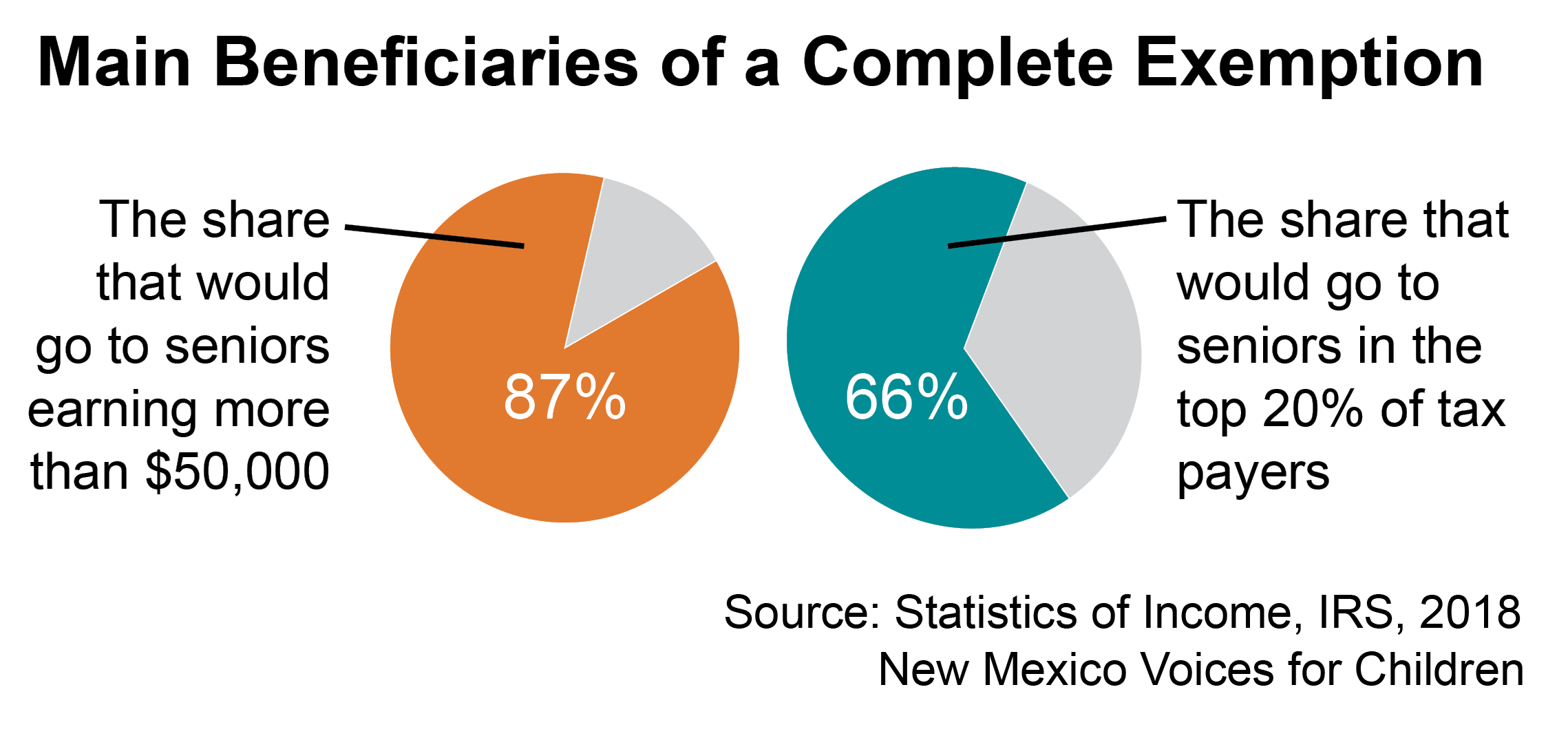

Exempting Social Security Income from Taxation: Not Targeted, Not Necessary, Not Cheap – New Mexico Voices for Children

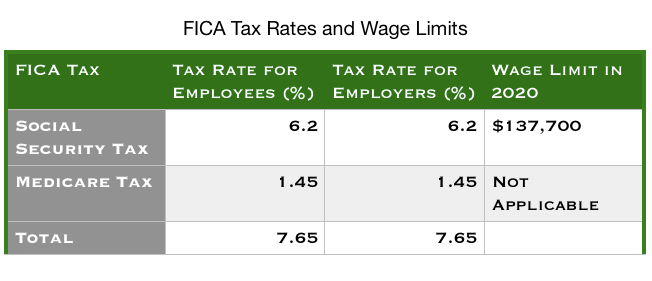

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Recomendado para você

-

FICA Tax: What It is and How to Calculate It25 abril 2025

FICA Tax: What It is and How to Calculate It25 abril 2025 -

What is Fica Tax?, What is Fica on My Paycheck25 abril 2025

What is Fica Tax?, What is Fica on My Paycheck25 abril 2025 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations25 abril 2025

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations25 abril 2025 -

What is the FICA Tax Refund?25 abril 2025

What is the FICA Tax Refund?25 abril 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software25 abril 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software25 abril 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know25 abril 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know25 abril 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax25 abril 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax25 abril 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and25 abril 2025

-

FICA explained: Social Security and Medicare tax rates to know in 202325 abril 2025

FICA explained: Social Security and Medicare tax rates to know in 202325 abril 2025 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?25 abril 2025

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?25 abril 2025

você pode gostar

-

SAMO© For Those of Us Who Merely Tolerate Civilization – Al Diaz25 abril 2025

SAMO© For Those of Us Who Merely Tolerate Civilization – Al Diaz25 abril 2025 -

Brawlhalla just dropped the latest Prime Gaming Bundle! #NightbladeHattori25 abril 2025

Brawlhalla just dropped the latest Prime Gaming Bundle! #NightbladeHattori25 abril 2025 -

Projeto de Graduação II by Gabriela Teixeira - Issuu25 abril 2025

Projeto de Graduação II by Gabriela Teixeira - Issuu25 abril 2025 -

pokémon tipo fada25 abril 2025

pokémon tipo fada25 abril 2025 -

i>Thor: Ragnarok Is One of the Best Marvel Movies Yet, Film/TV25 abril 2025

i>Thor: Ragnarok Is One of the Best Marvel Movies Yet, Film/TV25 abril 2025 -

Fredericksburg Free Lance-Star Events - Watch Barnet vs Oldham Athletic Live Free Stream Online Tv Channel25 abril 2025

Fredericksburg Free Lance-Star Events - Watch Barnet vs Oldham Athletic Live Free Stream Online Tv Channel25 abril 2025 -

VALORANT Esports25 abril 2025

VALORANT Esports25 abril 2025 -

Playstation 4 1TB 1 Controle Sony - com 3 Jogos - Outros Games - Magazine Luiza25 abril 2025

Playstation 4 1TB 1 Controle Sony - com 3 Jogos - Outros Games - Magazine Luiza25 abril 2025 -

See Jack Black Return As Beloved Character In New Trailer25 abril 2025

See Jack Black Return As Beloved Character In New Trailer25 abril 2025 -

Red's Moltres, Pokémon Wiki25 abril 2025

Red's Moltres, Pokémon Wiki25 abril 2025