Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 14 abril 2025

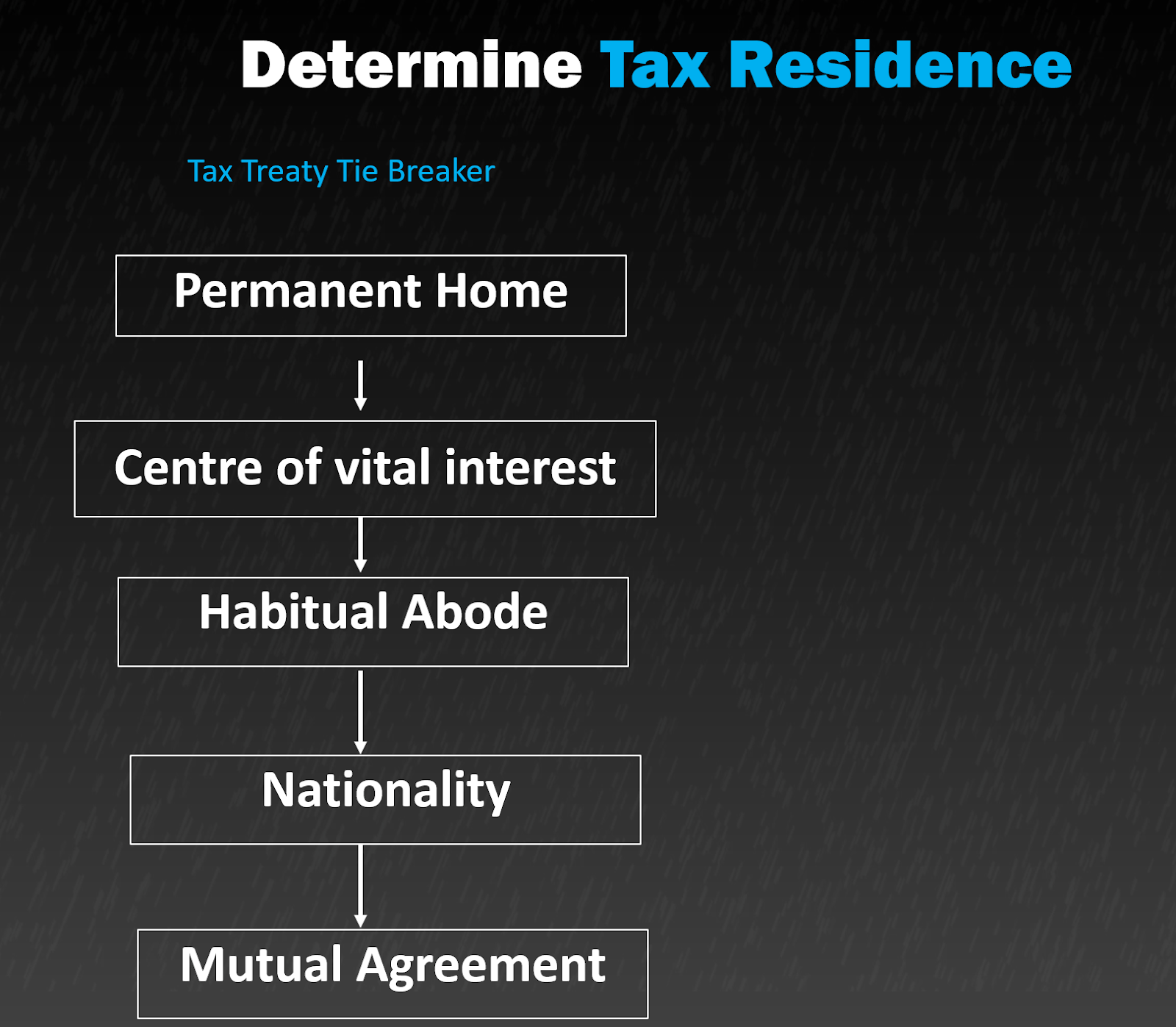

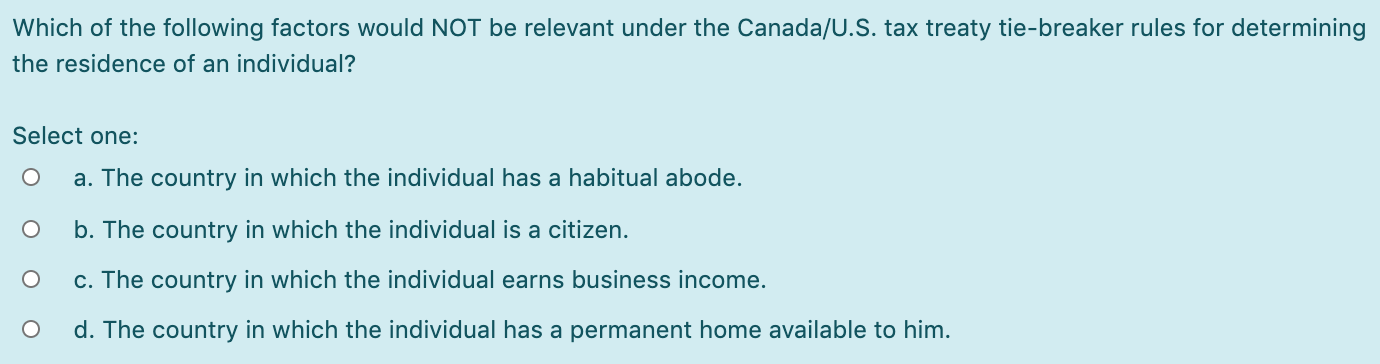

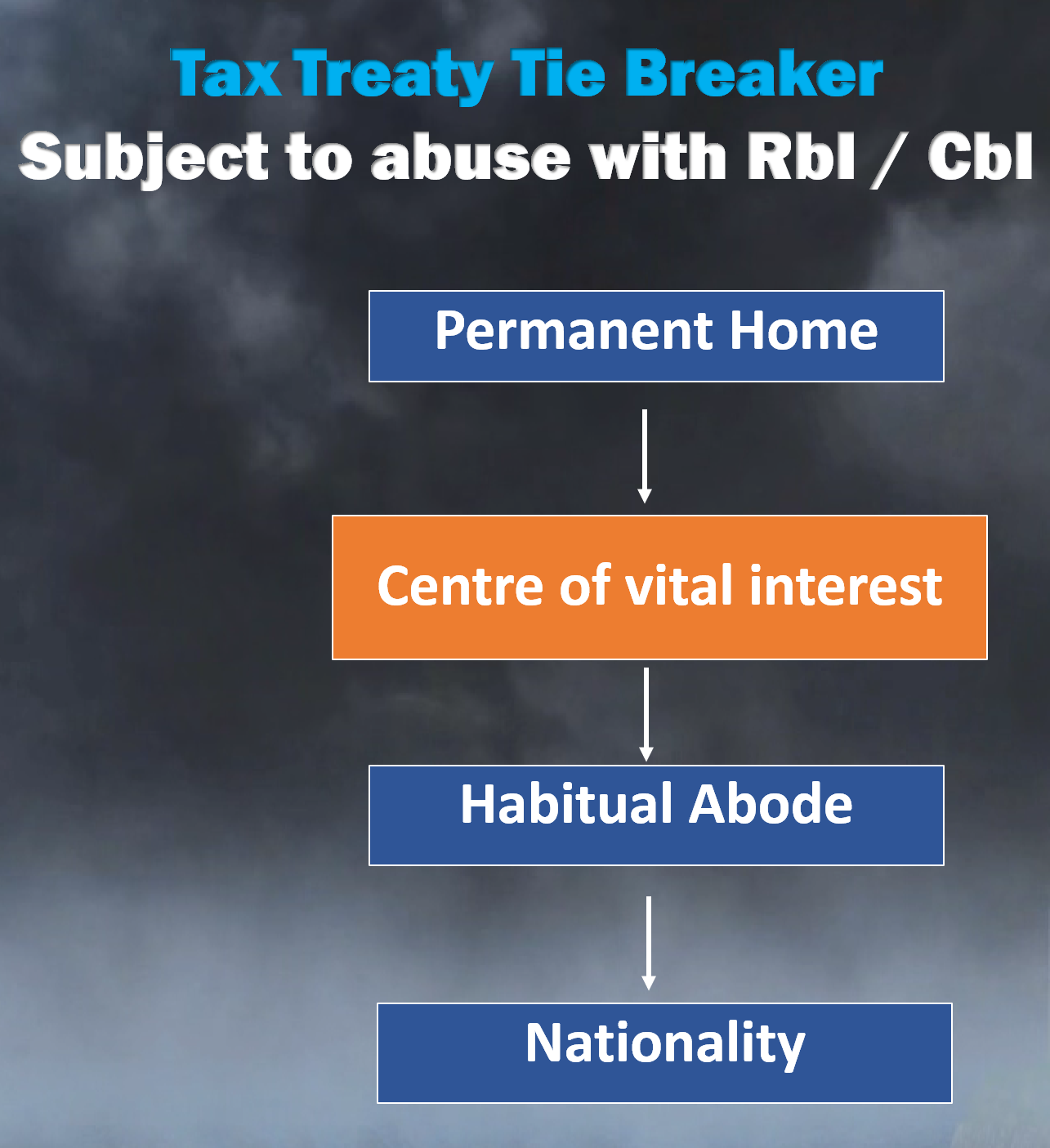

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Closer Connection Test or a Treaty Tie-Breaker Provision

Newcomers to Canada Newcomers to Canada. - ppt download

Residency Tie Breaker Rules & Relevance

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Treaty Tie-Breaker: Oh the Pitfalls Beware! – Virginia – US TAX TALK

Solved Which of the following factors would NOT be relevant

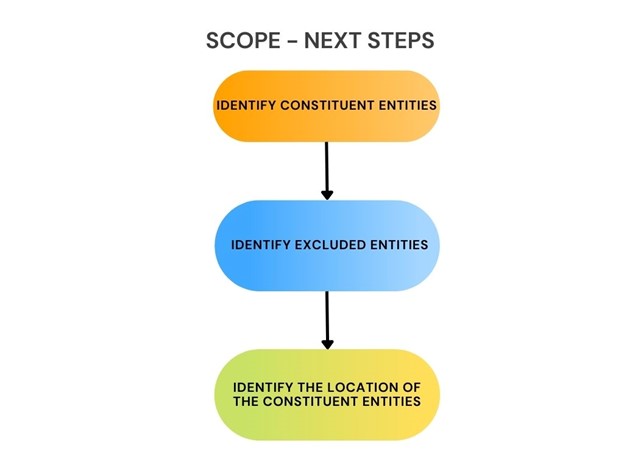

Identify Constituent and Excluded Entities »

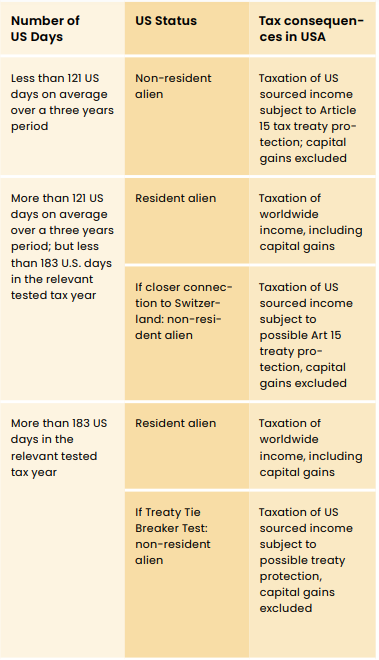

Expansion into the USA: dos and don'ts from a tax point of view - Lexology

The Evolving Global Mobility Landscape Tax Considerations

Importance of Double Tax Agreements for Australian Expats

Canada - U.S. Tie breaker rule - HTK Academy

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Residency: Determining Residency: Exploring Tax Treaties - FasterCapital

Recomendado para você

-

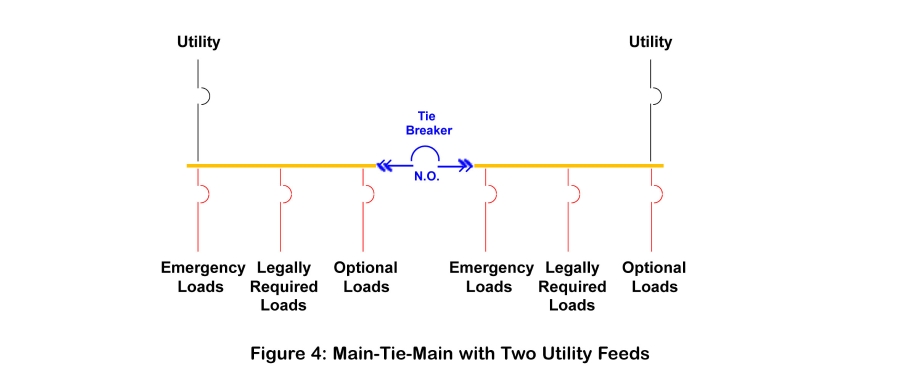

Increasing Power Redundancy14 abril 2025

Increasing Power Redundancy14 abril 2025 -

List of Major League Baseball tie-breakers - Wikipedia14 abril 2025

-

electrical - What is the difference between a handle tie and common trip in circuit breakers? - Home Improvement Stack Exchange14 abril 2025

electrical - What is the difference between a handle tie and common trip in circuit breakers? - Home Improvement Stack Exchange14 abril 2025 -

How Do Tennis Tiebreakers Work? - My Tennis HQ14 abril 2025

How Do Tennis Tiebreakers Work? - My Tennis HQ14 abril 2025 -

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth14 abril 2025

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth14 abril 2025 -

How Does the Express Entry Tie Breaker Rule Work?14 abril 2025

How Does the Express Entry Tie Breaker Rule Work?14 abril 2025 -

Be the Referee: Cross Country Tie-Breaker14 abril 2025

Be the Referee: Cross Country Tie-Breaker14 abril 2025 -

Poker Tie Breaker Rules to Play Texas Holdem Cash Games @14 abril 2025

Poker Tie Breaker Rules to Play Texas Holdem Cash Games @14 abril 2025 -

Tie Breaker Pregnancy Announcement Digital Boho Baby - Digital baby announcement, Pregnancy announcement, Baby announcement pictures14 abril 2025

Tie Breaker Pregnancy Announcement Digital Boho Baby - Digital baby announcement, Pregnancy announcement, Baby announcement pictures14 abril 2025 -

Tie Breaker Prizm Grey Gradient Lenses, Polished Chrome Frame Sunglasses14 abril 2025

Tie Breaker Prizm Grey Gradient Lenses, Polished Chrome Frame Sunglasses14 abril 2025

você pode gostar

-

Kinect Sports • Xbox 360 – Mikes Game Shop14 abril 2025

Kinect Sports • Xbox 360 – Mikes Game Shop14 abril 2025 -

PATRULHA CANINA14 abril 2025

PATRULHA CANINA14 abril 2025 -

Espeto inox Giratório Pilha 80cm GiroBal - Ind. BalCa - canecas personalizadas com qualidade14 abril 2025

Espeto inox Giratório Pilha 80cm GiroBal - Ind. BalCa - canecas personalizadas com qualidade14 abril 2025 -

Sorry GTA 5, We're a TWISTED METAL Channel Now - Rooster Teeth14 abril 2025

Sorry GTA 5, We're a TWISTED METAL Channel Now - Rooster Teeth14 abril 2025 -

Rabiscos da Tia Bia — “Meme” of “Clube do Arcade” group.14 abril 2025

Rabiscos da Tia Bia — “Meme” of “Clube do Arcade” group.14 abril 2025 -

Download Hill Climb Racing 2 MOD APK 1.59.1 (Unlimited Money)14 abril 2025

Download Hill Climb Racing 2 MOD APK 1.59.1 (Unlimited Money)14 abril 2025 -

Henry Cavill Out as Superman Amid Warner Bros.' DC Universe Shake14 abril 2025

Henry Cavill Out as Superman Amid Warner Bros.' DC Universe Shake14 abril 2025 -

Diary of A Roblox Noon Christmas Special and Roblox Noob Story Squid Game by Unofficial , Paperback14 abril 2025

-

![Quiz] Acerte o nome desses personagens de animes famosos apenas por uma frase dita por eles](https://kanto.legiaodosherois.com.br/w760-h398-gnw-cfill-q95/wp-content/uploads/2022/08/legiao_D4LnQ32gpvVG.png.webp) Quiz] Acerte o nome desses personagens de animes famosos apenas por uma frase dita por eles14 abril 2025

Quiz] Acerte o nome desses personagens de animes famosos apenas por uma frase dita por eles14 abril 2025 -

Assistir High Card - Episódio 3 - Goyabu14 abril 2025

Assistir High Card - Episódio 3 - Goyabu14 abril 2025