Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Last updated 14 abril 2025

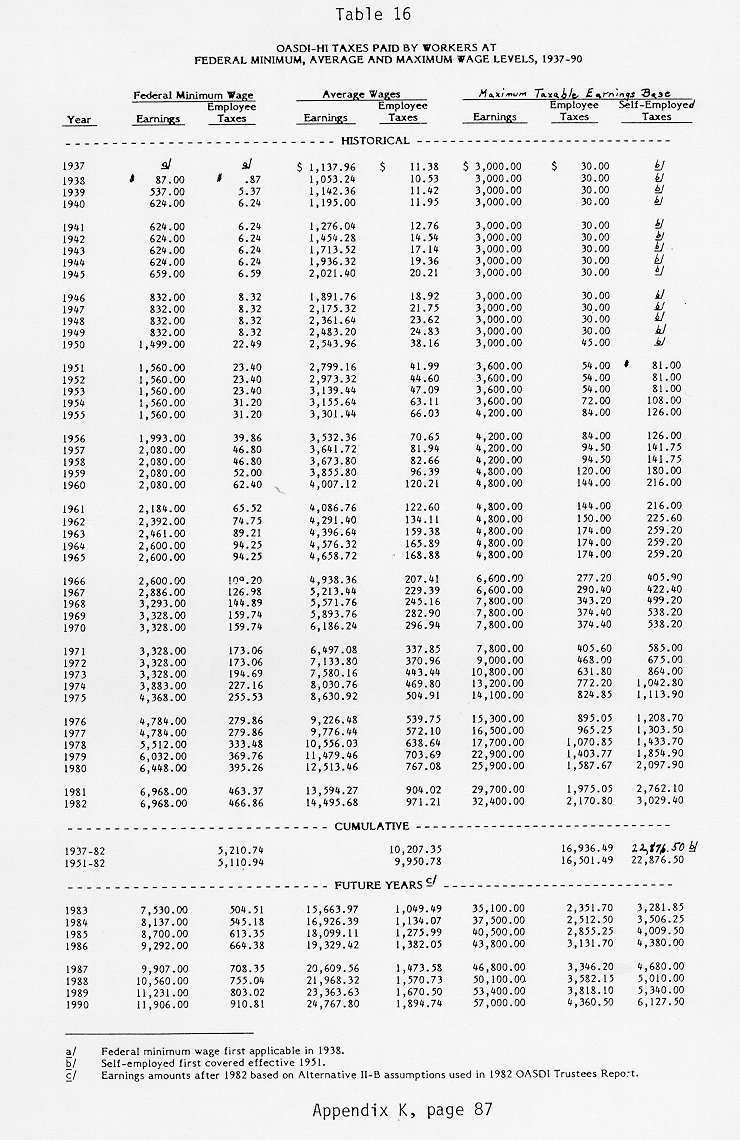

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

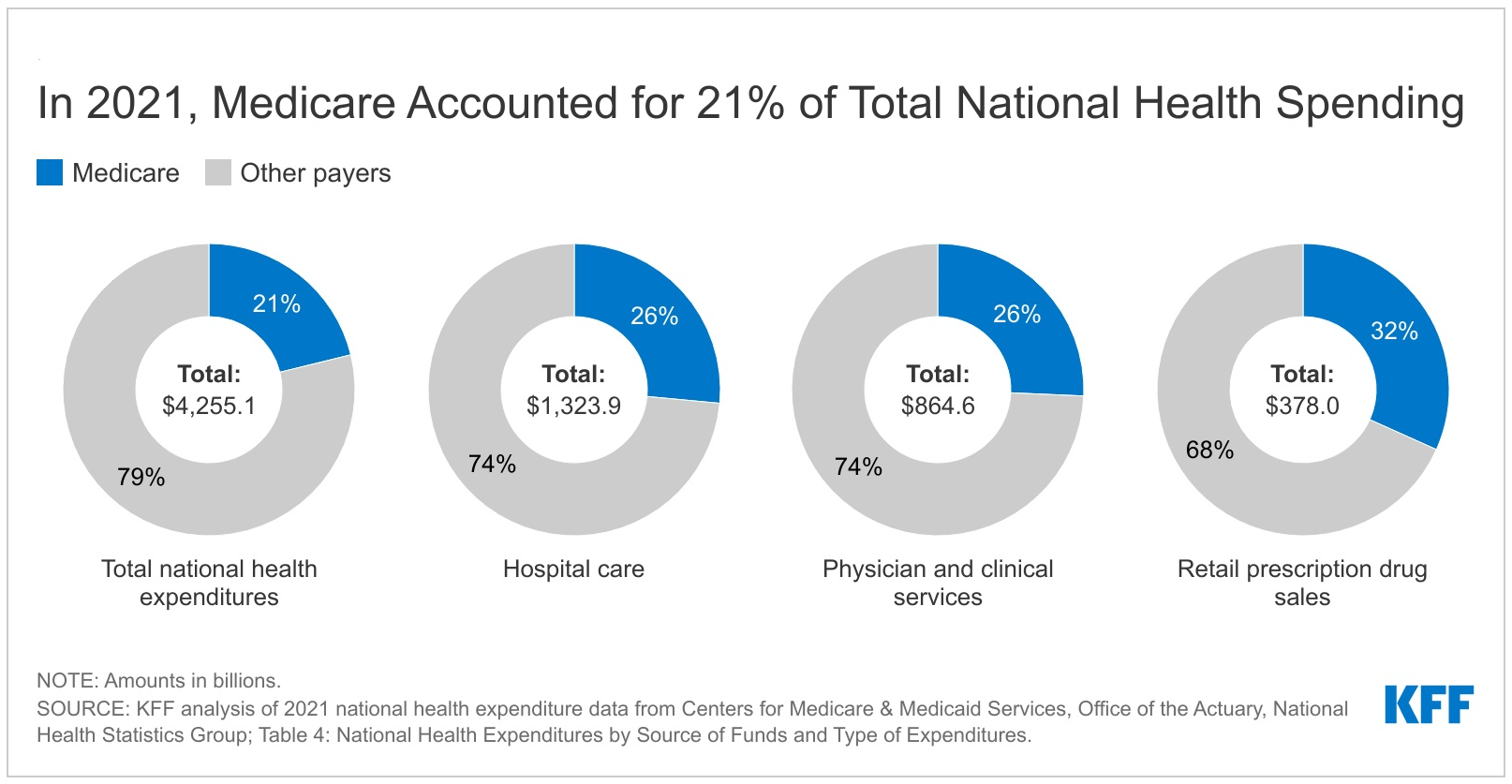

What to Know about Medicare Spending and Financing

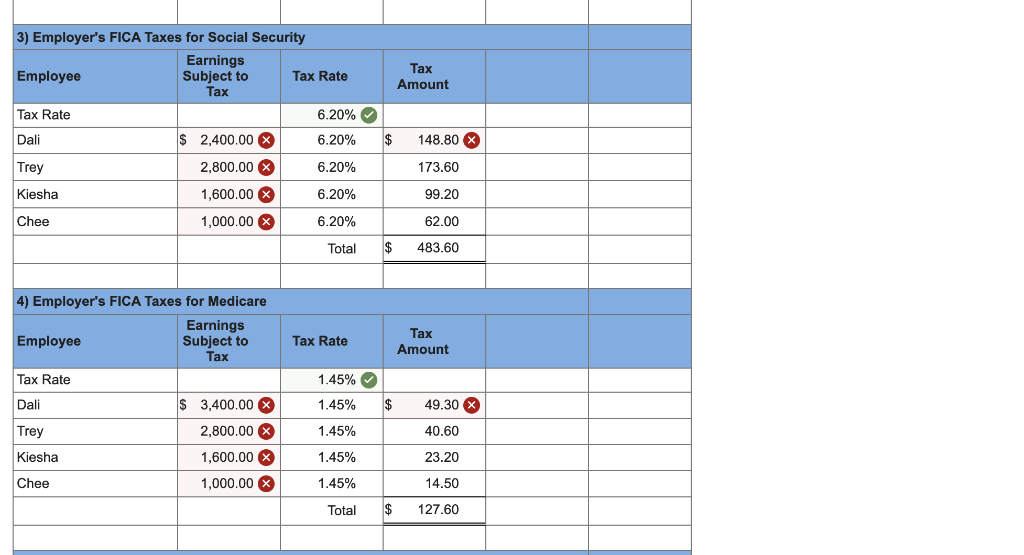

Solved Paloma Co. has four employees. FICA Social Security

Social Security History

What are the Social Security trust funds, and how are they financed?

Income Tax Time: Rates Then & Now – Options Edge

Social Security Act

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Social Security Administration's Master Earnings File: Background Information

Publication 505 (2023), Tax Withholding and Estimated Tax

Historical Federal Income Tax Rates for a Family of Four

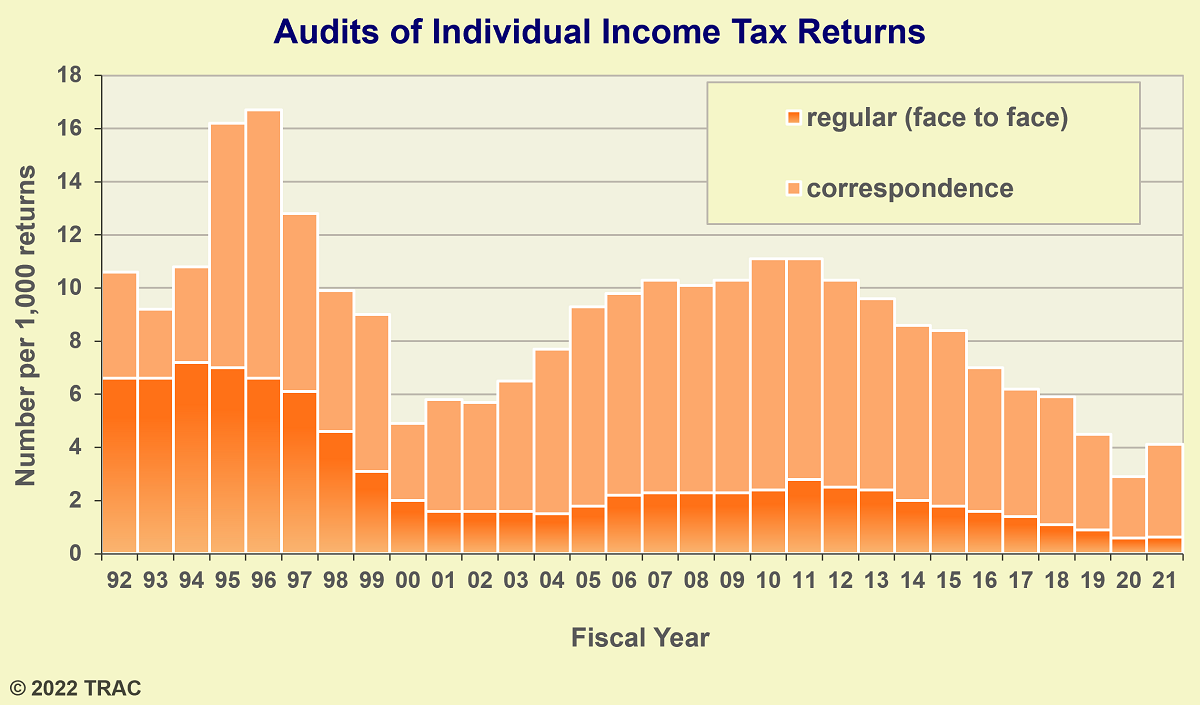

IRS Audits Poorest Families at Five Times the Rate for Everyone Else

Recomendado para você

-

What is the FICA Tax and How Does It Work? - Ramsey14 abril 2025

What is the FICA Tax and How Does It Work? - Ramsey14 abril 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)14 abril 2025

2023 FICA Tax Limits and Rates (How it Affects You)14 abril 2025 -

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?14 abril 2025

Why Is There a Cap on the FICA Tax?14 abril 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet14 abril 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet14 abril 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software14 abril 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software14 abril 2025 -

What Is FICA Tax?14 abril 2025

What Is FICA Tax?14 abril 2025 -

FICA explained: Social Security and Medicare tax rates to know in 202314 abril 2025

FICA explained: Social Security and Medicare tax rates to know in 202314 abril 2025 -

Vola14 abril 2025

Vola14 abril 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements14 abril 2025

What Is FICA Tax, Understanding Payroll Tax Requirements14 abril 2025 -

FICA Tax & Who Pays It14 abril 2025

FICA Tax & Who Pays It14 abril 2025

você pode gostar

-

Books The Kenpire14 abril 2025

Books The Kenpire14 abril 2025 -

Download Area » GTA IV » Scripts Mods » Pro14 abril 2025

Download Area » GTA IV » Scripts Mods » Pro14 abril 2025 -

Brawl is Magic: The Gathering -- Arena's best mode. Make it14 abril 2025

Brawl is Magic: The Gathering -- Arena's best mode. Make it14 abril 2025 -

Tokyo Ghoul Ken Kaneki Anime Desktop, ghoul, cg Artwork, manga, computer Wallpaper png14 abril 2025

Tokyo Ghoul Ken Kaneki Anime Desktop, ghoul, cg Artwork, manga, computer Wallpaper png14 abril 2025 -

Triciclo infantil c/ empurrador e protetor 1-3 anos avespa - maral - Velotrol e Triciclo a Pedal - Magazine Luiza14 abril 2025

Triciclo infantil c/ empurrador e protetor 1-3 anos avespa - maral - Velotrol e Triciclo a Pedal - Magazine Luiza14 abril 2025 -

Undertale Ink Sans 0.37 - Colaboratory14 abril 2025

Undertale Ink Sans 0.37 - Colaboratory14 abril 2025 -

Gvavaya Anime Cosplay Vermeil In Gold Vermeil Cosplay Wig Purple Gradi14 abril 2025

Gvavaya Anime Cosplay Vermeil In Gold Vermeil Cosplay Wig Purple Gradi14 abril 2025 -

Pokemon - Black Version ROM Free Download for NDS - ConsoleRoms14 abril 2025

Pokemon - Black Version ROM Free Download for NDS - ConsoleRoms14 abril 2025 -

📺 Flowey Evil TV Roblox Item - Rolimon's14 abril 2025

-

dark anime pics, Page 514 abril 2025

dark anime pics, Page 514 abril 2025