FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Last updated 10 abril 2025

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

All About F1 Student OPT Tax F1 Visa Tax Exemption & Tax Return

How Do I Get a FICA Tax Refund for F1 Students?

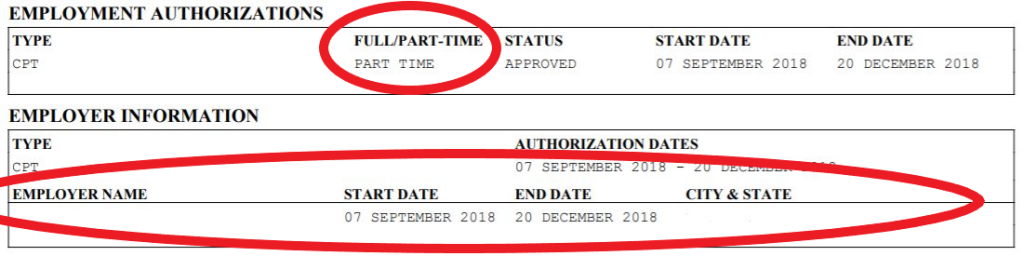

CPT Information for Employers – International Student Services

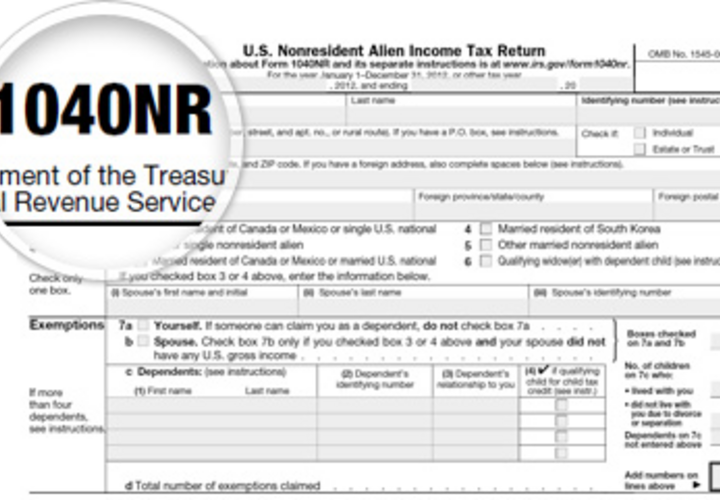

U.S. Taxes Office of International Students & Scholars

How does a student on an F1 OPT visa go about claiming a FICA

The Complete J1 Student Guide to Tax in the US

US Tax Return & Filing Guide for International F1 Students [2021

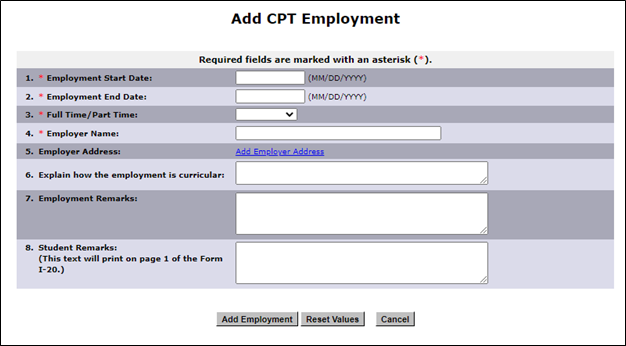

F-1 Curricular Practical Training (CPT)

Sprintax Tax Preparation Software: Office of International Student

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions10 abril 2025

-

What is Fica Tax?, What is Fica on My Paycheck10 abril 2025

What is Fica Tax?, What is Fica on My Paycheck10 abril 2025 -

Overview of FICA Tax- Medicare & Social Security10 abril 2025

Overview of FICA Tax- Medicare & Social Security10 abril 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes10 abril 2025

-

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents10 abril 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents10 abril 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software10 abril 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software10 abril 2025 -

2021 FICA Tax Rates10 abril 2025

-

.jpg) What is FICA tax? Understanding FICA for small business10 abril 2025

What is FICA tax? Understanding FICA for small business10 abril 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 abril 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.10 abril 2025 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —10 abril 2025

Students on an F1 Visa Don't Have to Pay FICA Taxes —10 abril 2025

você pode gostar

-

Home clubs permitem curtir o dia dos pais sem sair do condomínio – Condo .news10 abril 2025

Home clubs permitem curtir o dia dos pais sem sair do condomínio – Condo .news10 abril 2025 -

Vinland Saga Season 2 Episode 23 Discussion (300 - ) - Forums - MyAnimeList .net10 abril 2025

-

This Is My Scary Teacher Costume for Halloween. Fantastic for10 abril 2025

This Is My Scary Teacher Costume for Halloween. Fantastic for10 abril 2025 -

EDITAL DE CONVOCAÇÃO Nº 003/2023 - CONCURSO PÚBLICO - Prefeitura10 abril 2025

EDITAL DE CONVOCAÇÃO Nº 003/2023 - CONCURSO PÚBLICO - Prefeitura10 abril 2025 -

Im Connor Fazendo Connor Coisas Engraçadas Primeiro Nome T-Shirt Camisetas Cupons Algodão Impresso Tops Masculinos & Tees Hip Hop - AliExpress10 abril 2025

Im Connor Fazendo Connor Coisas Engraçadas Primeiro Nome T-Shirt Camisetas Cupons Algodão Impresso Tops Masculinos & Tees Hip Hop - AliExpress10 abril 2025 -

image004.png10 abril 2025

image004.png10 abril 2025 -

:upscale()/2023/08/23/819/n/1922153/1db9102c64e65273224f20.80162085_.jpg) 6 Angled Bob Haircut Styles and Ideas10 abril 2025

6 Angled Bob Haircut Styles and Ideas10 abril 2025 -

roblox vai acabar em 2024|Pesquisa do TikTok10 abril 2025

-

Director Ángel Manuel Soto on the Importance of Blue Beetle10 abril 2025

Director Ángel Manuel Soto on the Importance of Blue Beetle10 abril 2025 -

Steam Workshop::Melhores mods de Garry's mod10 abril 2025