ropay on X: Experience effortless tax calculations with roPay's reverse payroll feature! No more manual calculations or data entry stress. Simply input net salaries, and roPay will automatically determine allowances, pensions, and

Por um escritor misterioso

Last updated 12 abril 2025

Copy of WeeklytaxtableN1005 Tool.xls - QUICK SEARCH: Enter weekly earnings in the green cell A5 to display the amount to withhold With tax-free

W4 -Worksheet & Adjusting Entries - The unadjusted trial balance or R. Tryon Consultant is entered on the partial worksheet below. Write the adjusting

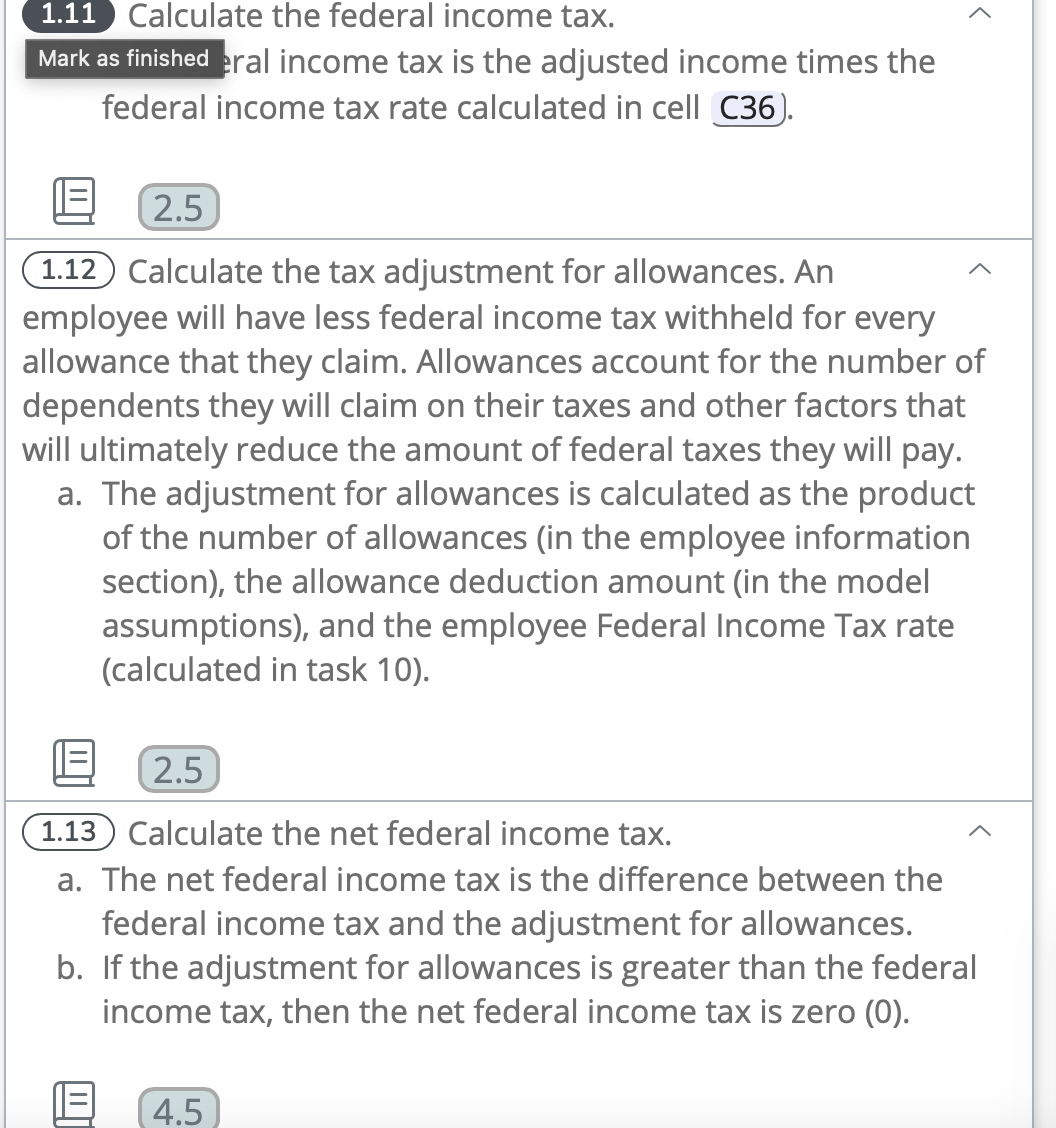

1.10) Use an IF function with hested VLOOKUP

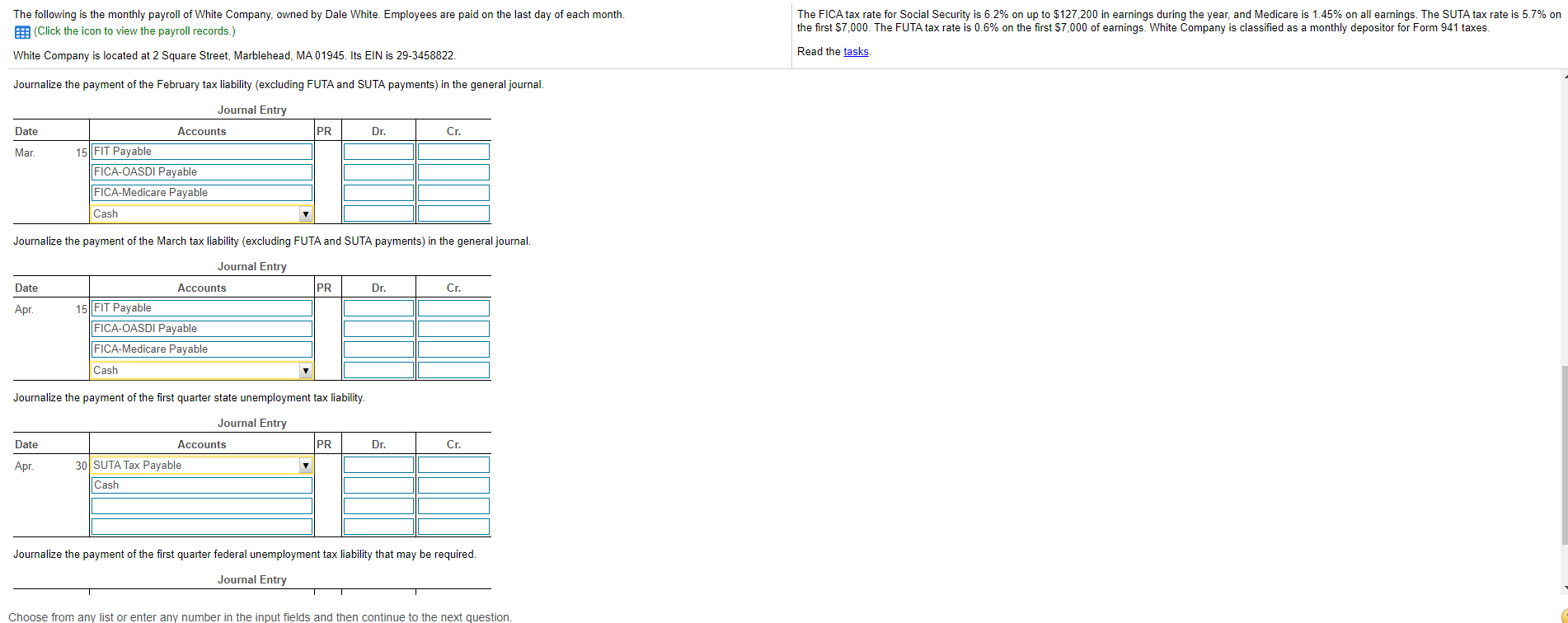

The following is the monthly payroll of White

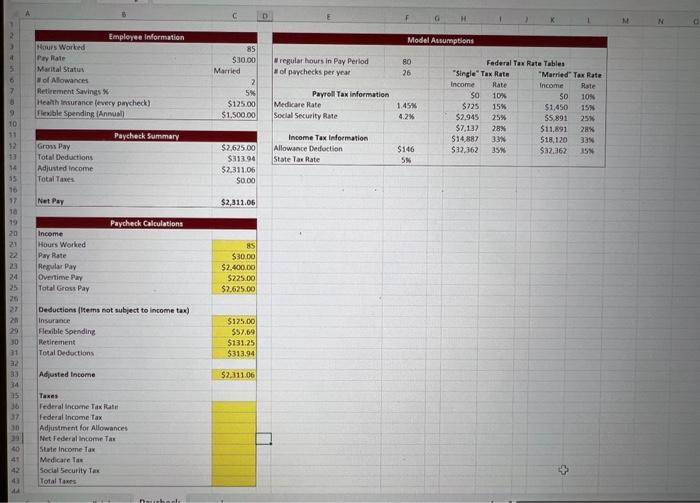

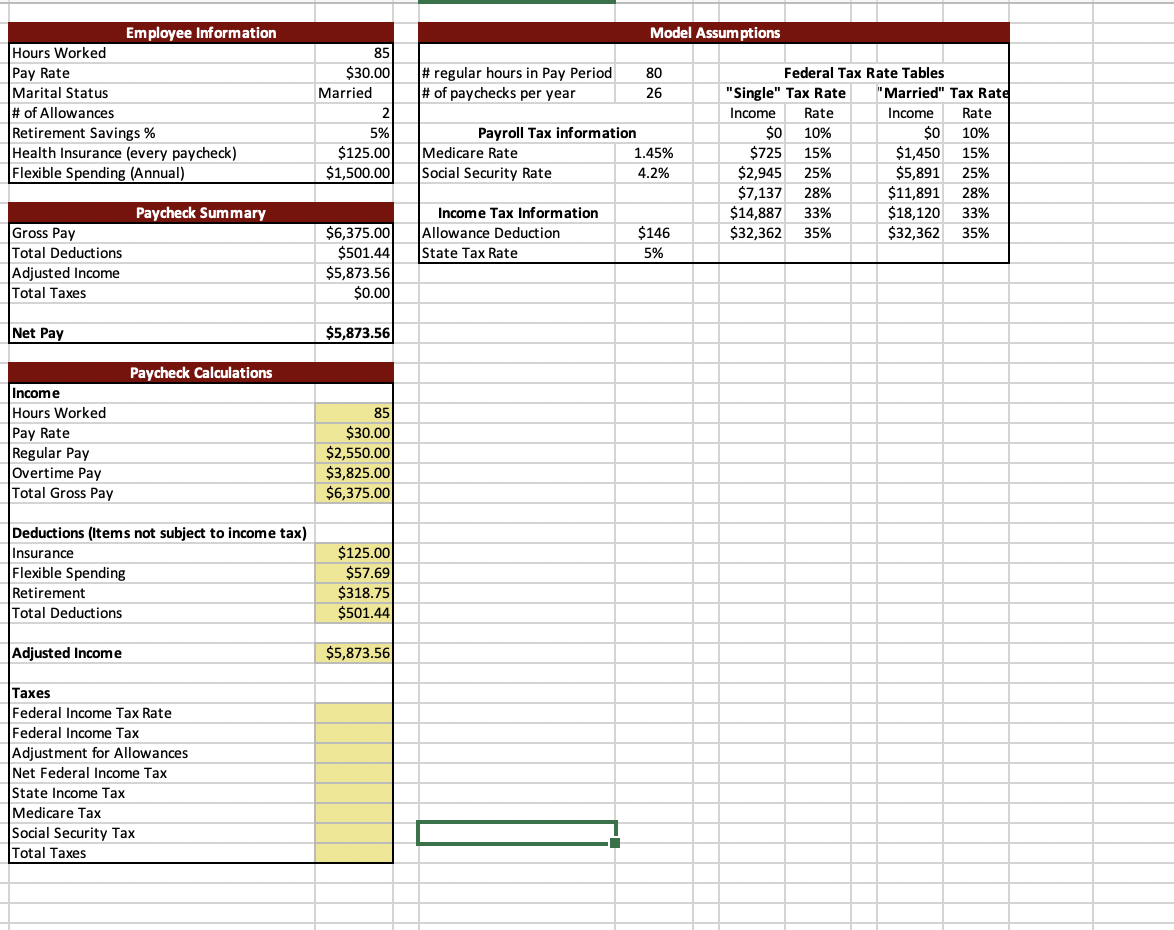

Employee Infor Model Assumptions Hours Worked Pay

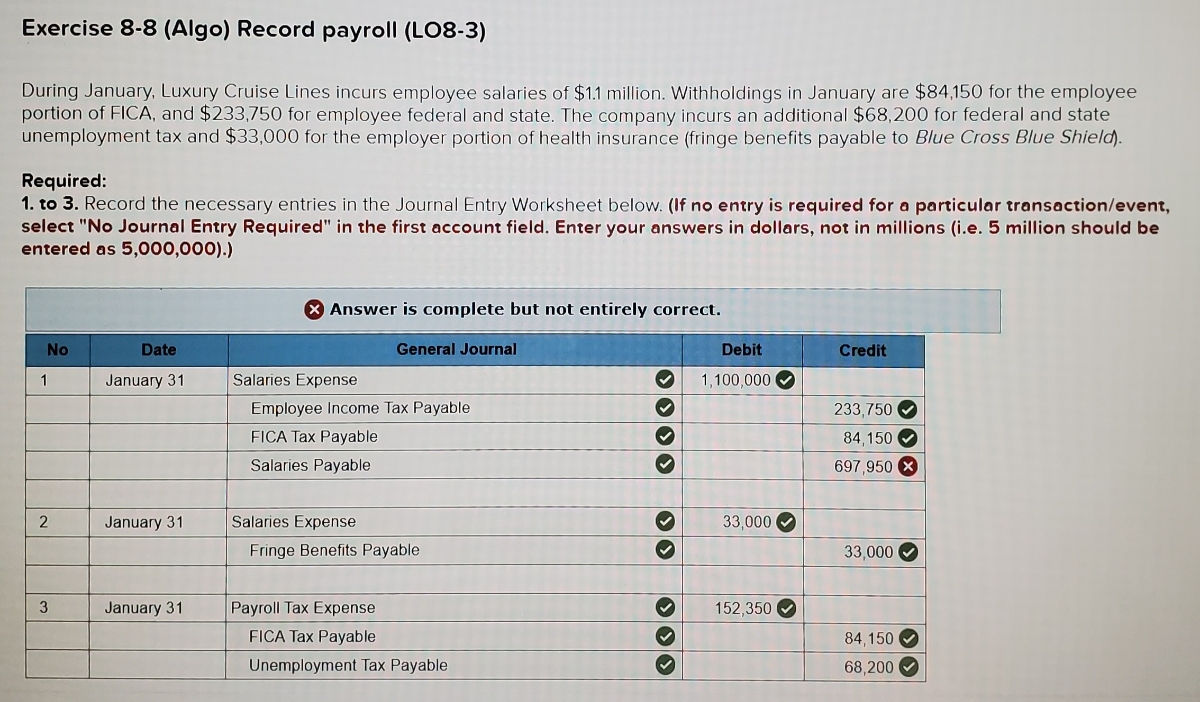

Answered: Exercise 8-8 (Algo) Record payroll…

Natalia gutierrez of Payroll Simulation - Payroll Simulation Employee 1 Patrick Smith works for a weekly paycheck. He is single and claims no

Natalia gutierrez of Payroll Simulation - Payroll Simulation Employee 1 Patrick Smith works for a weekly paycheck. He is single and claims no

1.12 Calculate the tax adjustment for allowances. An

Solved (1.1) Enter the hours worked and the pay rate for the

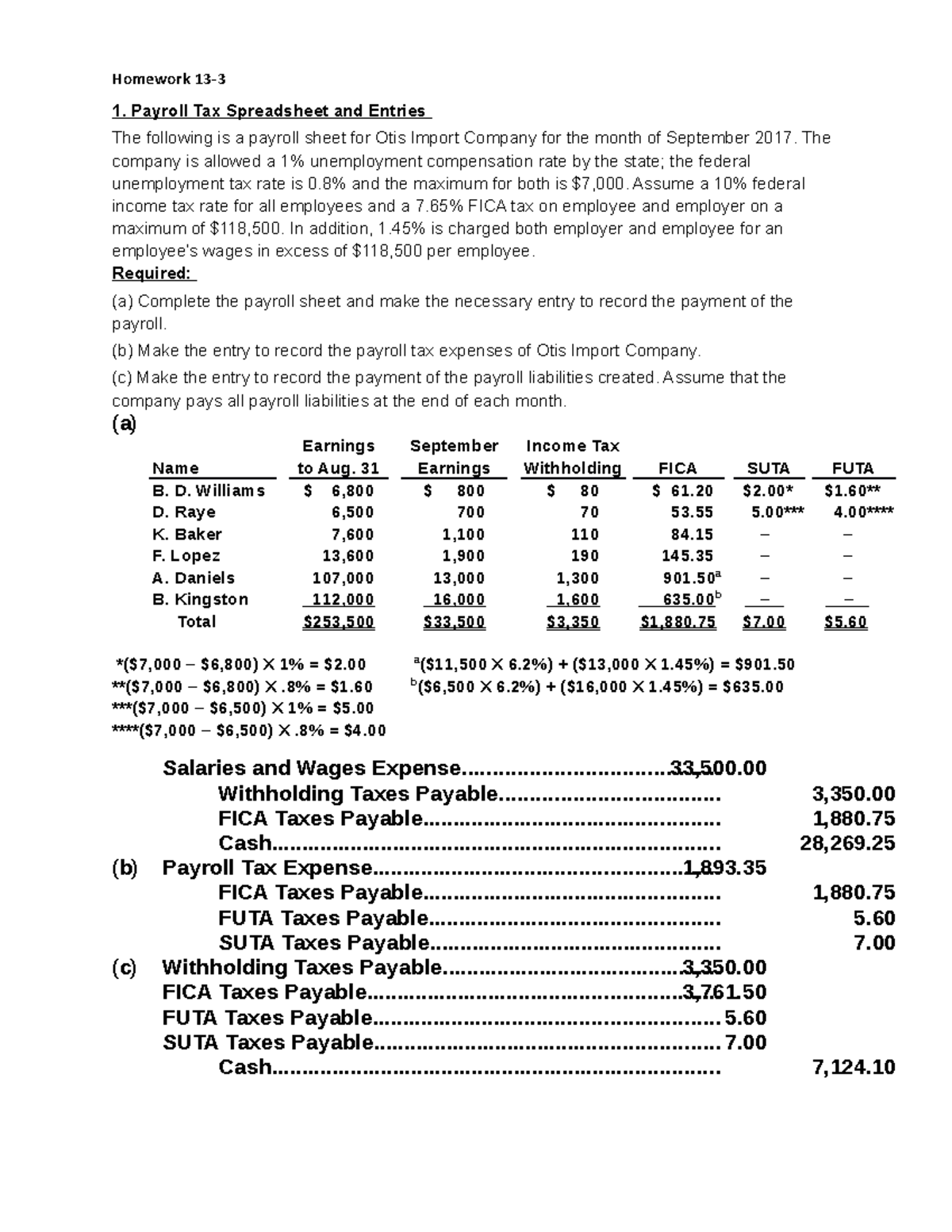

Payroll and Bonus Problem 13 3 - Homework 13- Payroll Tax Spreadsheet and Entries The following is a - Studocu

Recomendado para você

-

Onboarding employees on Ropay12 abril 2025

Onboarding employees on Ropay12 abril 2025 -

Tekedia Capital Portfolio Startup, Ropay, a HR/Payroll Tech Company, is Hiring - Tekedia12 abril 2025

Tekedia Capital Portfolio Startup, Ropay, a HR/Payroll Tech Company, is Hiring - Tekedia12 abril 2025 -

Server crashes · Issue #5972 · ldtteam/minecolonies · GitHub12 abril 2025

-

ropay on X: Remember, HR is always watching👀 #memefriday. What's your funniest HR encounter? Share in the comments!👇🏽 / X12 abril 2025

ropay on X: Remember, HR is always watching👀 #memefriday. What's your funniest HR encounter? Share in the comments!👇🏽 / X12 abril 2025 -

THE BEST 10 Shoe Repair near El Terrero, Moroleón, Guanajuato, Mexico - Last Updated October 2023 - Yelp12 abril 2025

THE BEST 10 Shoe Repair near El Terrero, Moroleón, Guanajuato, Mexico - Last Updated October 2023 - Yelp12 abril 2025 -

Interactive Worksheets12 abril 2025

-

/cdn.vox-cdn.com/uploads/chorus_image/image/71864693/1246174671.0.jpg) FC Barcelona News: 14 January 2023; Preparations begin for El Clásico, Newcastle join Barça in race for Ruben Neves - Barca Blaugranes12 abril 2025

FC Barcelona News: 14 January 2023; Preparations begin for El Clásico, Newcastle join Barça in race for Ruben Neves - Barca Blaugranes12 abril 2025 -

Pedro Neto of Wolverhampton Wanderers is challenged by Valentin News Photo - Getty Images12 abril 2025

Pedro Neto of Wolverhampton Wanderers is challenged by Valentin News Photo - Getty Images12 abril 2025 -

Introducing roPay: streamline onboarding with ease. 👋, roPay posted on the topic12 abril 2025

-

roPay on LinkedIn: #payrollmanagement #ropaymobile #ropaypeople12 abril 2025

você pode gostar

-

Baralho Duplo 100% Plástico 104 Cartas Prova De Água Estojo Jogo12 abril 2025

Baralho Duplo 100% Plástico 104 Cartas Prova De Água Estojo Jogo12 abril 2025 -

Where to Find Farfetch'd in Pokemon Sword and Pokemon Shield - Hold To Reset12 abril 2025

Where to Find Farfetch'd in Pokemon Sword and Pokemon Shield - Hold To Reset12 abril 2025 -

Tortinhas de Maçã e Canela (McDonalds) - Pam*B12 abril 2025

Tortinhas de Maçã e Canela (McDonalds) - Pam*B12 abril 2025 -

Mangás Dragon Ball Z Conrad - Volumes 1 a 50 - Preço Unitário12 abril 2025

-

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2021/4/0/bQXtRkRv63kupAoBWcqw/como-usar-cupons-no-enjoei-3.jpg) Como usar cupons de desconto no Enjoei12 abril 2025

Como usar cupons de desconto no Enjoei12 abril 2025 -

Dance se souber tiktok {2023} - Tente não dançar ~ TikTok 202312 abril 2025

Dance se souber tiktok {2023} - Tente não dançar ~ TikTok 202312 abril 2025 -

Rise-of-Nations Rock Paper Shotgun12 abril 2025

Rise-of-Nations Rock Paper Shotgun12 abril 2025 -

Sigam lá: @Brinstar Dubs💕 #dublagem #dublagembr #supercellcreators #s12 abril 2025

-

Advertise on Free Mahjong Website - ADspot12 abril 2025

Advertise on Free Mahjong Website - ADspot12 abril 2025 -

Lil Floppa (Cube) - Download Free 3D model by 🇧🇷 SamelCookies12 abril 2025

Lil Floppa (Cube) - Download Free 3D model by 🇧🇷 SamelCookies12 abril 2025