Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Last updated 11 abril 2025

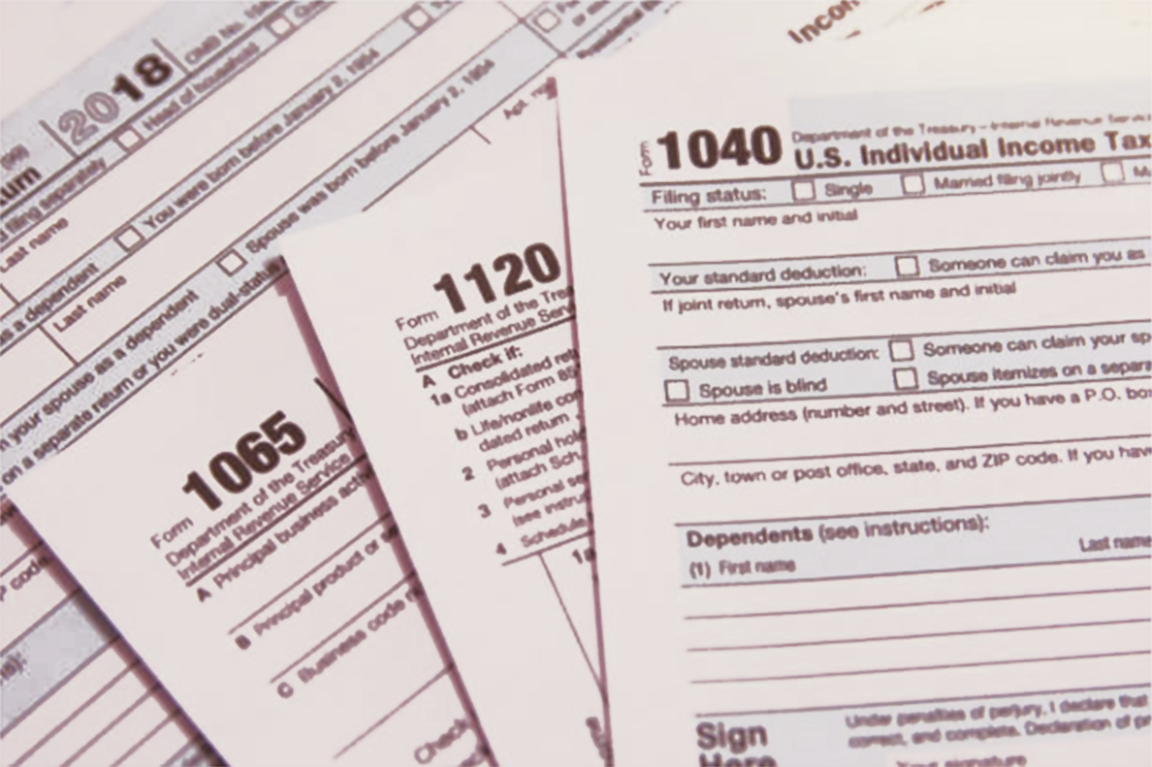

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

Paris Declaration: a Global Call for Investing in the Futures of

Ensuring Fair Assessment in Land Value Tax Systems - FasterCapital

Tax Efficiency and Tax Equity

Tackling the tax code: Efficient and equitable ways to raise

Taxation Reforms: Shaping the Future of the Revenue Regulation

Tackling the tax code: Efficient and equitable ways to raise

Taxation: Deficit Spending and Taxation: Examining the Trade offs

Tackling the Tax Code: Efficient and Equitable Ways to Raise

Income tax: Exploring the Benefits of a Proportional Tax System

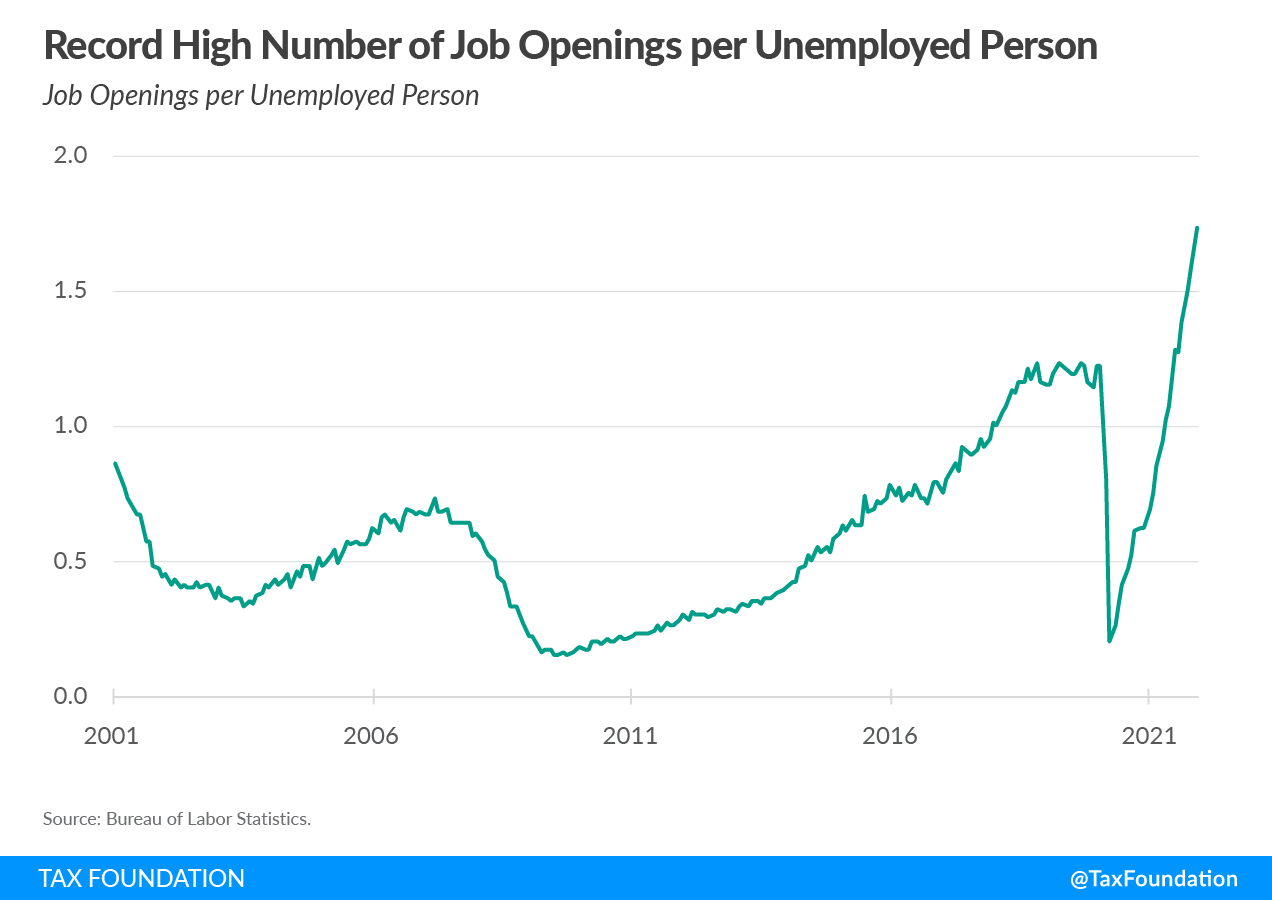

10 Tax Reforms for Economic Growth and Opportunity

How do taxes affect income inequality?

Tax equalization: Balancing Global Taxation with Foreign Tax

Recomendado para você

-

Macroeconomics CH1 Notes - MACROECONOMICS CHAPTER 1: Limits, alternatives, and choices Economics is - Studocu11 abril 2025

Macroeconomics CH1 Notes - MACROECONOMICS CHAPTER 1: Limits, alternatives, and choices Economics is - Studocu11 abril 2025 -

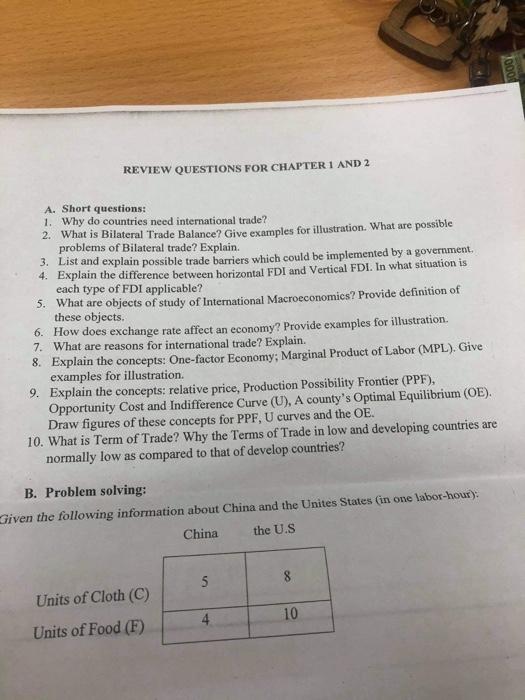

1000 REVIEW QUESTIONS FOR CHAPTER 1 AND 2 A. Short11 abril 2025

-

Economics11 abril 2025

-

Chapter Five – Joint Probability Distributions and Random Samples11 abril 2025

Chapter Five – Joint Probability Distributions and Random Samples11 abril 2025 -

Marginal 1 - Read Marginal Chapter 111 abril 2025

Marginal 1 - Read Marginal Chapter 111 abril 2025 -

Chapter 1 (3 sections) Introduction to Economics Flashcards11 abril 2025

Chapter 1 (3 sections) Introduction to Economics Flashcards11 abril 2025 -

1. Soils & Plant Nutrients NC State Extension Publications11 abril 2025

1. Soils & Plant Nutrients NC State Extension Publications11 abril 2025 -

Business Applications of Linear Functions11 abril 2025

Business Applications of Linear Functions11 abril 2025 -

Work Requirements and Work Supports for Recipients of Means-Tested Benefits11 abril 2025

Work Requirements and Work Supports for Recipients of Means-Tested Benefits11 abril 2025 -

Chapter 9: Marginal and absorption costing11 abril 2025

Chapter 9: Marginal and absorption costing11 abril 2025

você pode gostar

-

Boneca Bebê Reborn De Silicone Toddler - Dondoquinha Reborn - Bebê11 abril 2025

Boneca Bebê Reborn De Silicone Toddler - Dondoquinha Reborn - Bebê11 abril 2025 -

1.28: Sum of Squares - Mathematics LibreTexts11 abril 2025

1.28: Sum of Squares - Mathematics LibreTexts11 abril 2025 -

Vestido Noiva Princesa Casamento Linda Cauda Bordada + Véu11 abril 2025

Vestido Noiva Princesa Casamento Linda Cauda Bordada + Véu11 abril 2025 -

Comunidade Steam :: Lies of P11 abril 2025

-

Fotos De Walaa Mugaibel Em Roblox Shirt Template Em 2021 23011 abril 2025

Fotos De Walaa Mugaibel Em Roblox Shirt Template Em 2021 23011 abril 2025 -

ASSISTA AGORA JUJUTSU KAISEN 0 FILME COMPLETO LEGENDADO PT-BR11 abril 2025

ASSISTA AGORA JUJUTSU KAISEN 0 FILME COMPLETO LEGENDADO PT-BR11 abril 2025 -

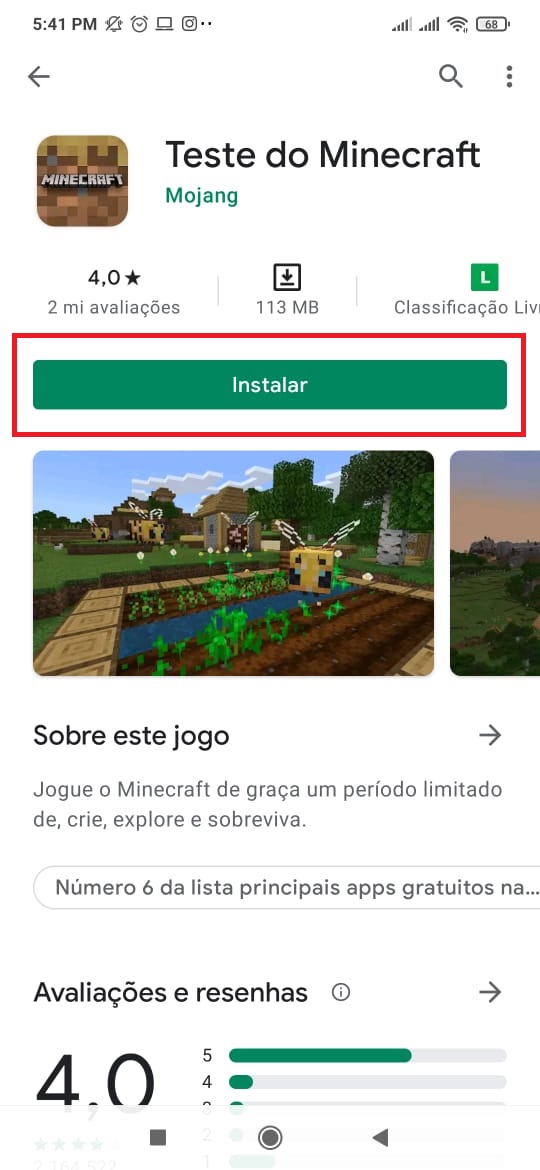

Como baixar Minecraft de graça no celular Android11 abril 2025

Como baixar Minecraft de graça no celular Android11 abril 2025 -

Rainbow Friends Plush,Animais Bonitos Recheados,Suaves E11 abril 2025

Rainbow Friends Plush,Animais Bonitos Recheados,Suaves E11 abril 2025 -

Mi Jalisco Mexican Restaurant11 abril 2025

-

Every Real-Life Footballer & Soccer Pundit In Ted Lasso11 abril 2025

Every Real-Life Footballer & Soccer Pundit In Ted Lasso11 abril 2025