How derivative traders can make the most of increased volatility

Por um escritor misterioso

Last updated 10 abril 2025

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

Trading Options Greeks: How Time, Volatility, and Other Pricing

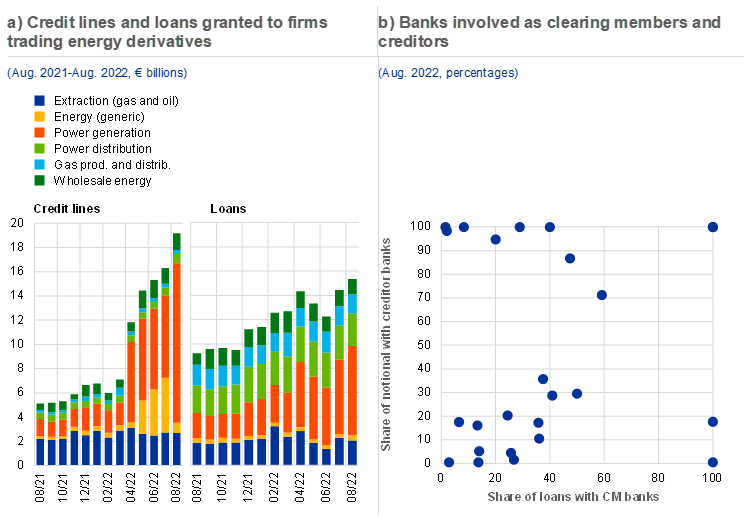

Financial stability risks from energy derivatives markets

What is Derivative Trading? Strategies & Tips

Which one is your volatility — Constant, Local or Stochastic?

Options Trading Guide: How to Hedge with Crypto Options

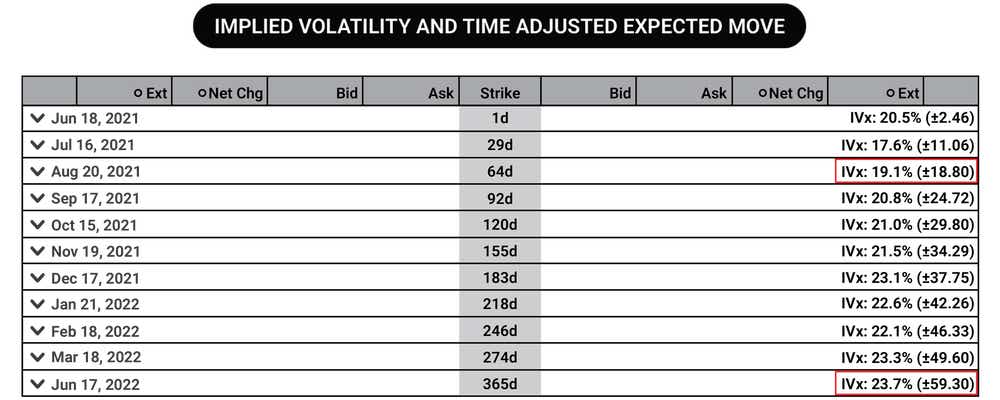

Implied vs. Historical Volatility: Options Vega & Theta Explained

Currency Volatility: What is it & How to Trade It?

Implied Volatility (IV) In Options Trading Explained

Daytrading.com

Calculus In The Stock Market

Volatility (finance) - Wikipedia

Recomendado para você

-

UNNERVE - Definition, pronunciation, grammar, meaning - Practice10 abril 2025

UNNERVE - Definition, pronunciation, grammar, meaning - Practice10 abril 2025 -

Unnerve - definition of unnerve by The Free Dictionary10 abril 2025

Unnerve - definition of unnerve by The Free Dictionary10 abril 2025 -

Jack Welch on Candor – It just unnerves people… the biggest change10 abril 2025

Jack Welch on Candor – It just unnerves people… the biggest change10 abril 2025 -

EXCA - Prime Fund10 abril 2025

EXCA - Prime Fund10 abril 2025 -

The Rise of AI in Cinema: A Thrilling Yet Cautionary Tale10 abril 2025

The Rise of AI in Cinema: A Thrilling Yet Cautionary Tale10 abril 2025 -

Unnerve, Urzas Saga (UZ) Price History10 abril 2025

Unnerve, Urzas Saga (UZ) Price History10 abril 2025 -

Should everyone be afraid of Elon Musk buying Twitter?10 abril 2025

Should everyone be afraid of Elon Musk buying Twitter?10 abril 2025 -

Why millennial embrace of socialism unnerves baby boomers10 abril 2025

Why millennial embrace of socialism unnerves baby boomers10 abril 2025 -

The Best Horror of the Year Volume 110 abril 2025

The Best Horror of the Year Volume 110 abril 2025 -

Pin by JocelynLiu🤓 on logo-shot (chamber / oed)10 abril 2025

Pin by JocelynLiu🤓 on logo-shot (chamber / oed)10 abril 2025

você pode gostar

-

Pokemon: 10 Ways The Emerald Manga Is Different From The Games10 abril 2025

Pokemon: 10 Ways The Emerald Manga Is Different From The Games10 abril 2025 -

Read Manga Tensei Shitara Slime Datta Ken - Chapter 11210 abril 2025

Read Manga Tensei Shitara Slime Datta Ken - Chapter 11210 abril 2025 -

6 jogos exclusivos que você vai jogar no PS4 em 2018 - Listas - BOL10 abril 2025

6 jogos exclusivos que você vai jogar no PS4 em 2018 - Listas - BOL10 abril 2025 -

SONY PlayStation 2 PS2 Zoids Struggle & Infinity Fuser set from Japan10 abril 2025

SONY PlayStation 2 PS2 Zoids Struggle & Infinity Fuser set from Japan10 abril 2025 -

GameMania10 abril 2025

-

Edens Zero Season 2 Anime To Release In 2023 - Animehunch10 abril 2025

Edens Zero Season 2 Anime To Release In 2023 - Animehunch10 abril 2025 -

All Star Tower Defense (astd) - summer skin Gojo10 abril 2025

-

app de jogo sem internet|Pesquisa do TikTok10 abril 2025

-

KND: A Turma do Bairro (Série), Sinopse, Trailers e Curiosidades10 abril 2025

KND: A Turma do Bairro (Série), Sinopse, Trailers e Curiosidades10 abril 2025 -

dimensions of full size bed What Are the Dimensions of Full10 abril 2025

dimensions of full size bed What Are the Dimensions of Full10 abril 2025